An investor’s dream is to earn high returns with the lowest risk possible. A wide range of investment assets exist, each with its risks. So, how does an investor achieve his goal? One of the best ways to do so is to make a diversification strategy. This is the allocation of investment capital into different assets, where the gain from one asset offsets a loss from another, thereby reducing losses to a minimum. The process is called managing risks within a portfolio.

However, diversification in investing needs to be done with care and research, or it may do more harm than good. Here, we will discuss the investment portfolio diversification strategy in detail and what mistakes to avoid when diversifying.

Diversification strategy: What is it?

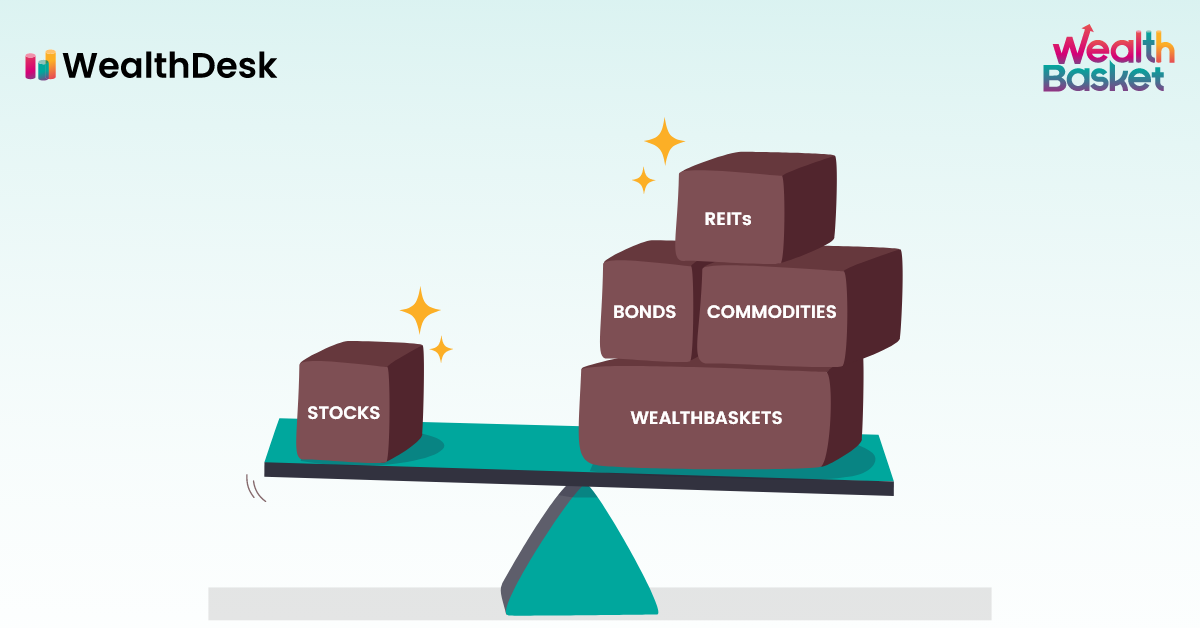

Investment in the stock market is a risky proposition, and to reduce this risk, investors choose to diversify. The idea is to reduce the overall volatility of the portfolio by mixing different assets with varying risks. The investor invests in multiple stocks, sectors, and companies rather than investing in one stock, company, or sector. The investor may choose similar sectors or pursue unrelated diversification, meaning separate companies and sectors. Mostly, the investors are comfortable investing in related companies and stocks. The following are some benefits an investor can get from diversification:

- Reduces the overall risk of the portfolio

- Investment opportunities in multiple sectors as opposed to one

- Safeguards against market volatility

- Exposure to international stocks and global markets

Can you go wrong with diversification?

Yes, diversification in investing comes with its own set of challenges. And, like every other investment strategy, an investor needs to be careful to avoid losses. Here are some situations where diversification can go wrong for an investor:

- When investors fail to take into account the risks

As a result of the pandemic, investing has become a popular way to earn additional income. Investors, however, must not forget that returns also come with risks. To begin investing, every investor must understand their financial goals and risk appetite. This will guide them to select the right stocks in their portfolio. To put it another way, they ought to be able to prove their reasons for diversification.

- When investors fail to conduct adequate research

Research is an essential part of any investment. Before investing, a successful investor understands the company history, the stock performance, the market reputation, and more. Investors will be able to gain insight into the company’s risks and whether they can accept them.

- When investors fail to devise an asset allocation strategy

A diversification strategy involves investing in a variety of assets. However, it is only successful if the percentage of investment is allocated in the proper ratio to different assets. The question, then, is what the ideal portfolio diversification percentages are? The answer varies according to the investor’s risk appetite.

The portfolio diversification percentages for aggressive investors will be higher in equity than in debt. Investors who want to protect their principal amount should invest in dynamic asset allocation funds, which includes an optimal mix of debt and equity instruments based on the market movements.

- When investors make the mistake of over-diversifying

It is a famous saying that excess of anything is bad. This also applies to diversification. Excessive diversification can harm returns. Due to investors’ focus on multiple investments, they are unable to review them periodically with that caution. Over-diversification can also lead to duplicate investments or to keeping assets that are no longer useful.

- When investors have no idea when to exit a particular stock

Research is crucial before investing, and it is also vital after investing. It allows investors to eliminate unviable investments from the investment portfolio. The investor’s goal should be to align the investment portfolio with market conditions and economic trends. As a result, investors should be very cautious with a buy, hold or sell strategy.

- When investors give in to temptations

Investors often make this mistake. New trends appear every few days. However, no matter how attractive they appear, they are not stable investments. The nature of their volatility makes them unsuitable for all investors. However, peer pressure and greed lead many investors to invest, giving in to such trends, even though they do not have the same risk appetite. In the end, they cannot handle the losses. Most of the time, investors do not have the backup savings to invest in such volatile funds.

- When investors lack patience

Every investor wants to achieve rapid returns. However, a successful investor understands the value of patience when investing. Nobody can forecast the market movements. Some investments take time to grow and produce returns. It is therefore essential to be disciplined when developing hold and exit strategies. Many stocks can give quick returns, but not without the expense of high risk.

The above mentioned are the cases that investors should take care of while diversifying their portfolios. However, if you are a beginner, choosing the right portfolio can be a challenge. In such cases, you can make use of an investment technology platform such as WealthDesk.

WealthDesk’s primary goal is to provide investors access to an array of research-driven portfolios curated by SEBI-registered professionals and built upon different themes, sectors, and more. Besides, it also allows customers with pre-existing broking accounts to invest in the curated portfolio. Invest in a WealthBasket today with WealthDesk.

Final thoughts

By now, you should have a fair idea of how to devise an investment portfolio diversification strategy and avoid common but grave mistakes. Diversification remains an attractive investment strategy despite the fear of these mistakes. The cost of not diversifying is much greater than the cost of diversifying. In a nutshell, careful diversification is better than keeping funds idle in savings accounts.

FAQs

Yes, age is an essential factor. Investing in stable stocks is preferable as responsibility increases with age. Near retirement, the portfolio needs to be revalued again, including more debt stocks.

False diversification can be defined as what appears to be diversification but is not. It involves investing in similar investments with similar goals. Therefore, they will operate in the same manner under a particular market condition.

In general, experts believe that diversification has a lot more pros than cons. In addition, it is always better to invest in multiple assets rather than just one. Therefore, no-diversification is not a good strategy.

The answer to this question is no. Diversification can’t reduce all risks. It does not affect systematic risks. The term “systematic risk” refers to unplanned risks or risks that can’t be anticipated. Thus, they affect the economy as a whole. A diversification strategy can only be applied to asset-based risks and unsystematic risks.