Are asset allocation and diversification related to each other? To understand this, we need first to understand what asset allocation is?

Asset allocation is a strategy that helps balance return versus risk by adjusting the asset in a portfolio. Asset allocation is done keeping in mind income flow, investment time and goals.

An asset allocation calculator can help determine the best-diversified portfolio for you. For Dynamic asset allocation, the final investor will need your age, income flow, and goal for the investment before creating the best possible asset allocation plan for you.

Diversification in investing is an investment strategy that helps mix various investments in an investment portfolio.

Consider two investors. Investor A has only one stock in his portfolio, and investor B has five. Since investor A owns only one stock in his portfolio, they are at risk of facing loses when there’s a price change. But investor B won’t be affected as much since he has four other stocks in his portfolio. These are the benefits of diversification.

By definition and function, asset allocation and diversification sound the same. These are the reasons why many investors use these terms interchangeably.

Types of asset allocation

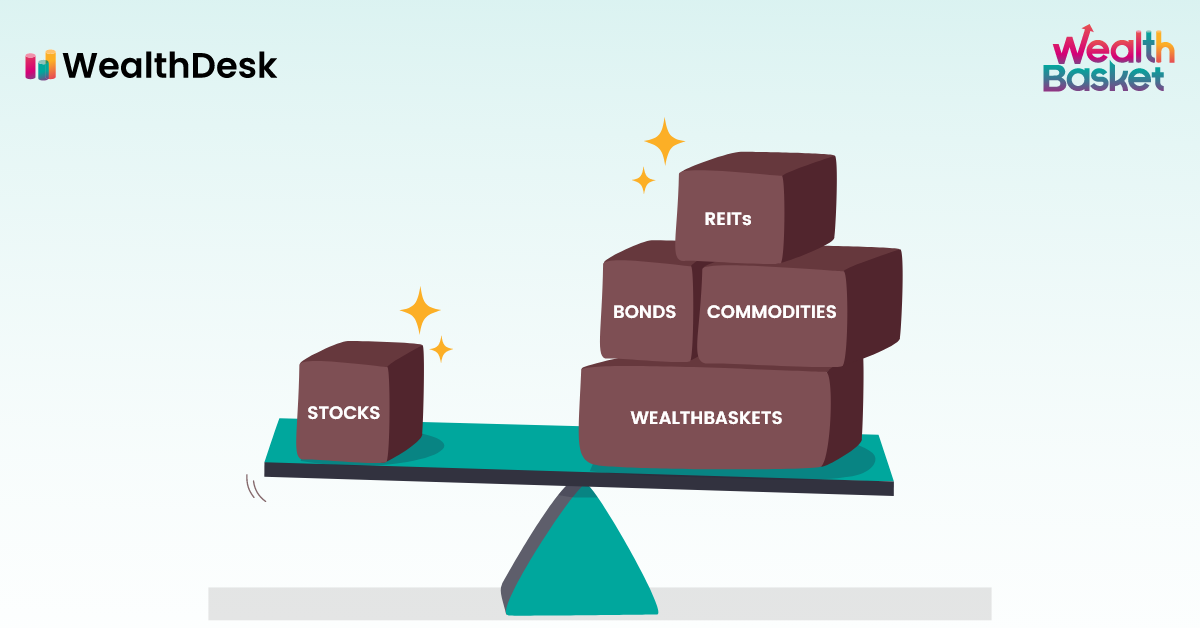

An investor can store his asset in four asset classes. These are fixed-income assets, equity, cash, and real estate. Allocation of assets in percentage in these classes is termed asset allocation. Here is a clear view of these classes:

-

Fixed income class:

Fixed-income investment class is one of India’s oldest investment forms. This investment includes government bonds, securities, corporate bonds, and securities. In these investments, the investors are like debt holders given an interest till maturity.

-

Cash:

The main reason to invest in cash and cash equivalents is the liquidity period. Cash equivalents like treasury bills, commercial papers, etc., can be liquidated in a year.

-

Real estate:

The investors invest their money in apartments, flats, lands that can give huge returns in the future. It is a long-term investment. It cannot be liquidated easily.

-

Equity asset:

Investing in various shares and bonds of different companies is called an equity share asset. The investor can have an investment portfolio of shares from different companies to increase the value of the investment.

Importance of asset allocation in investing

- Risk diversification

You should diversify your investment under various assets for an optimal asset allocation. By expanding your investment portfolio, you will be able to reduce risk and also multiply your returns. For example, in 2008, there was a huge market crash. People who invested in the financial market suffered losses, but on the other hand, the gold commodity was valued high. Thus, investors who had both these in their portfolios could survive the market losses. Portfolio diversification reduces risk and increases the chances of higher revenue.

- Low volatility

All the investments are in bonds shares with risk and rewards factors linked with them. The investment volatility is also reduced by asset allocation and diversification. Volatility is the dispersion of return on a security. The higher the volatility, the higher the risk.

- Stable returns

If you have the best asset allocation, you can get stable returns from time to time. Asset allocation helps reduce the risk of the investment and increase the revenue.

- Asset allocation maintains strict discipline

An optimal asset allocation helps in maintaining discipline. It ensures that the investor is not under-invested or over-invested in a particular sector. It also helps ensure that the investor is not greedy and taking more risks.

The connection between diversification and asset allocation

Asset allocation is done based on various factors such as age, income flow, the need for investment. Diversification is a way of asset allocation. The diversification strategy helps allocate funds in different investment areas to reduce risk and increase the reward.

For example, if an investor wants to invest only in stocks for his retirement or a family wants to save money for a down payment by investing in cash and cash equivalents, this will be termed asset allocation strategy and not diversification. Here the needs are specified. They need to invest for a specific reason. Diversification may not be helpful. Choosing an allocation model does not always mean diversification. Diversification will only happen when the investor decides to invest in various forms of market assets.

Conclusion

Diversification strategy is the subset of asset allocation. Asset allocation helps determine the best possible strategy for investment in marketable securities. The interested investor can invest in cash, equity, real estate, and a fixed income class asset to generate revenue.

Diversification of assets happens when an investor decides to invest a small percentage in different market securities to expand investment. So, start your journey of investing and creating a high-return portfolio with the help of the WealthDesk.

FAQs

Asset allocation is an investment strategy that helps balance reward and risk in an investment portfolio by investing in different assets. A financial investor uses an asset allocation calculator and chalks down the best allocation plan for you according to your needs and goals.

An investor can invest in three asset classes for higher rewards. These three asset classes are equity, cash, and fixed income asset classes.

The main reason for asset allocation is to maximise returns and minimise volatility.

• Invest in various assets.

Diversify your investments.

• Invest in bonds, shares, and cash

according to your needs and requirements.

•

Always build your portfolio. You may face

some losses in the beginning, but keep

building your portfolio always.

•

Understand the concept of holding and

selling.

Saving is always a safer option. There is no risk associated with savings. However, there is no growth in savings. By investing, you have a chance to double your money and increase your revenue.