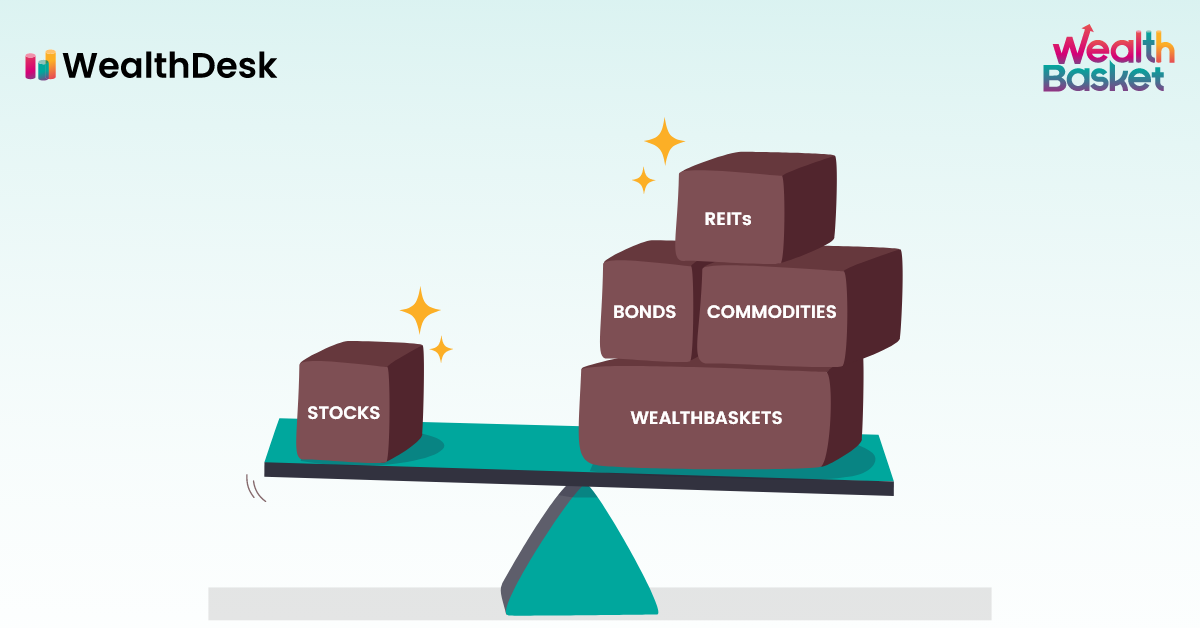

In the vast world of finance, one principle stands tall: diversification. It is the cornerstone of successful portfolio management, reminding us not to place all our financial hopes in a single venture. Instead, we can minimize risk and optimize returns by spreading our investments across various assets.

Let’s explore five indispensable strategies for diversifying your portfolio and securing a prosperous financial future in this article

Ways to Diversify Your Portfolio in 2023

Asset Class Diversification:

This is the most basic form of diversification and involves spreading investments among the three main asset classes: stocks, bonds, and cash. This method can provide a balance between risk and return since these asset classes often perform differently under various market conditions.

Cons: Over-diversifying may result in a portfolio that doesn’t have enough risk exposure to generate substantial returns. Also, choosing the right asset class to invest in can be challenging and requires a solid understanding of the financial markets.

Way to do it: You must use different platforms that give you access to bond and stock markets. Some stock brokers also provide the facility to invest in bonds.

Geographical Diversification:

Investing in different geographic regions or countries can help mitigate the risk associated with economic downturns or political instability in any one region. It provides exposure to different economies and growth rates.

Cons: It involves additional risks

related to currency fluctuations, geopolitical risks,

and it may also be difficult to thoroughly research

foreign investments.

Way to do it: By investing through mutual funds and

ETFs

which have exposure to foreign markets.

Sector Diversification:

Investing across various sectors (e.g., technology, healthcare, finance, utilities) helps to protect against downturns that can hit one particular sector. As different sectors perform differently under various market conditions, this can help smooth out returns.

Cons: Some sectors are more volatile than others, and the risk can be higher. Additionally, understanding and staying current with several industries can be time-consuming.

Way to do it: To invest in different sectors you can simply use your broking account and buy shares. Additionally, you can directly invest in WealthBaskets or Mutual funds that are sector focused.

Investment Style Diversification:

This involves diversifying among different investment styles such as value, growth, income, quant, etc. Different styles often excel under different market conditions, so this type of diversification can help balance performance.

Cons: Each investment style comes with

its own set of risks. Understanding and choosing the

right investment style requires knowledge and

experience.

Way to do it: You can invest via WealthBaskets, which follow

different investment styles to diversify in such a way.

Some new age mutual funds can also provide avenues to

invest in different styles.

Diversification Across Time (Dollar-Cost Averaging):

This strategy involves making regular investments of equal amounts over time, regardless of share price, thereby reducing the risk of investing a large amount in a single investment at the wrong time. This approach can remove emotional biases from the investment process.

Cons: If the market is in a consistent upward trend, dollar-cost averaging may lead to lower returns than investing a lump sum. Additionally, it does not guarantee profit or protect against loss in declining markets.

Way to do it: You can choose

SIP(Systematic Investment Plan) of WealthBaskets or

Mutual funds to diversify your portfolio in this

manner.

Final Thoughts

In the dynamic world of investing, diversification stands as a timeless principle, empowering us to navigate uncertainty and seize opportunities. As you embark on your journey to diversify your portfolio in 2023, remember that knowledge and discipline are your greatest allies. By embracing the power of diversification, you lay the foundation for a resilient and prosperous financial future.

FAQs

Portfolio diversification is the practice of spreading your investments across various assets to minimize risk and potentially increase returns.

The three main asset classes for diversification are stocks, bonds, and cash.

Geographical diversification involves investing in different regions or countries to mitigate risks associated with economic downturns or political instability in a single region.

You can invest in different sectors through your broker account or by buying sector-focused WealthBaskets or Mutual funds.

Investment style diversification involves spreading your investments among different styles such as value, growth, income, quant, etc.

Dollar-cost averaging is a strategy where you invest equal amounts regularly over time, reducing the risk of investing a large amount in a single investment at the wrong time.

You can implement dollar-cost averaging by choosing the SIP (Systematic Investment Plan) for WealthBaskets or Mutual funds.

No, diversification does not guarantee profit. It is a strategy to manage risk and potentially increase returns over time.

Over-diversification can lead to lower risk exposure, which might result in smaller returns. It can also be challenging to manage a highly diversified portfolio.

You can start diversifying your portfolio by spreading your investments across different asset classes, geographic regions, sectors, investment styles, and investing regularly over time.