If you are trying to learn how you should invest in your 30s or how your investment portfolio should look like at 50, chances are you are looking for an age-based asset allocation strategy. Here we explore what asset allocation is, why is it important, and what is age-based asset allocation.

What is asset allocation?

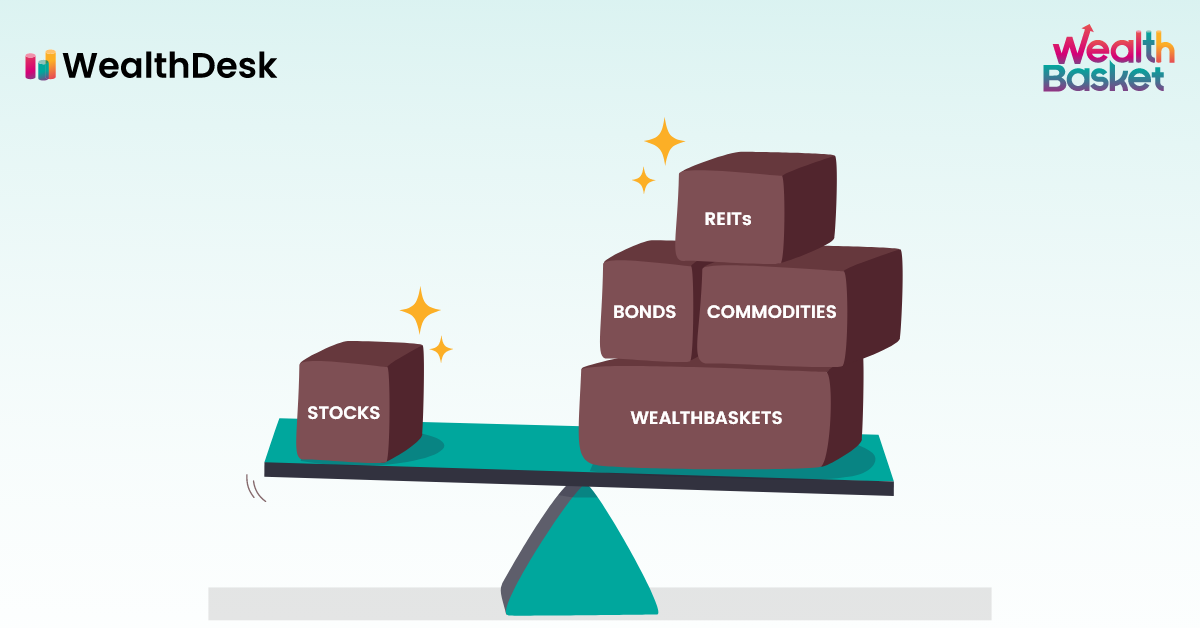

Asset allocation involves dedicating portions of your portfolio to different asset classes. The aim is to build a portfolio with exposure to multiple asset classes so that the portfolio’s risks and returns suit you.

By asset classes, we mean stocks, bonds, commodities and real estate. Asset allocation can be based on age, risk profile (risk tolerance and capacity), or an investment strategy.

Why is asset allocation important?

- Reduces risk

Asset allocation is a great way to diversify your portfolio. You can spread your money across various asset classes. Even within these asset classes, you may choose to diversify further by holding multiple assets of the same type. This level of diversification reduces your exposure to any individual asset or asset class by a lot.

-

Optimizes returns

Asset allocation allows you to build a portfolio with returns per your financial needs. The assets you invest in depends on how much returns you need and how frequently you need them.

-

Manages your liquidity needs

By dedicating portions of your portfolio to liquid assets, you can be sure of how much money you can pull out, should the need arise.

-

Simpler tax planning

Taxation policies may differ across asset classes. By keeping track of the asset classes you invest in, you can calculate the taxes from your investments in an organized manner.

Discover stocks that suit certain filter criteria and dive into details to check their WealthBaskets.

Asset allocation by age

As a person gets older, they have fewer years left to earn their salary or profits. At the same time, the responsibilities of a person also keep adding on with age. So, investors will become less interested in high-risk-high-return investments as time goes by. This is the basic premise of asset allocation by age.

If you choose to follow age-based asset allocation, your portfolio will shift funds from riskier assets to safer investments. When you’re young and have time to recover from losses, your portfolio will have larger portions of assets that have growth potential. A portfolio with a higher concentration of safe assets would suit you better at a later age.

Rule of thumb for age-based asset allocation

A rule of thumb for age-based asset allocation states that the percentage of your portfolio invested in equity shall be 100 minus your age.

Percentage of the portfolio dedicated to equity = 100 – Age

Percentage of the portfolio dedicated to safer assets = Age

| Age | Equity allocation | Allocation to fixed-income assets |

| 21 | 79 | 21 |

| 22 | 78 | 22 |

| 23 | 77 | 23 |

| 24 | 76 | 24 |

| 25 | 75 | 25 |

| 26 | 74 | 26 |

| … | … | … |

| 50 | 50 | 50 |

| … | … | … |

| 80 | 20 | 80 |

So, we see that, with age-based asset allocation, people in their 20s would end up with a growth-oriented portfolio. In contrast, the investment portfolio for a 50-year-old would be an equal-weighted portfolio. People close to 80 would have a conservative retirement-focused portfolio.

It should be noted that the age-based asset allocation strategy shown above considers a very limited number of factors. You may need to be adjusted according to your risk profile, income and future goals. There are various elements you could use for modifying these types of strategies.

Firstly, fixed-income assets are not limited to just fixed deposits. With a Retail Direct Gilt Account, you could invest in government securities with interest payments that suit you.

Secondly, you could employ various types of strategies while investing in equities. For example, growth investing, value investing, Systematic Investment Plans (SIPs), etc. Also, you can diversify your portfolio using Exchange-Traded Funds (ETFs).

Thirdly, even though asset allocation strategies generally tend to have one rebalancing every year, you could commit to rebalancing whenever the asset allocation shifts too much from the desired goal.

Final Thoughts

The age-based asset allocation strategy captures the fact that we get risk-averse with age gradually. Younger people who can recover from losses may take more risks than individuals close to retirement. However, each individual has different risk tolerance, income, responsibilities, goals and investing styles they agree with. So, age-based asset allocation strategies would have to be modified to suit an individual fully. Age-based asset allocation strategy is a good place to start, but you need not limit yourself to it.

At WealthDesk, you can find curated portfolios called WealthBaskets. Every WealthBasket has a theme and follows a particular strategy. Among all WealthBaskets, you can find portfolios with low, medium and high risk and portfolios with a short or long-term focus. Every asset in a WealthBasket is transferred to your Demat account.

FAQs

Young people have more time to recover from losses. Older people will have a higher number of responsibilities and less amount of time to recover from losses. So, age-based asset allocation proposes having a higher concentration of equity when you’re young and shifting funds to fixed-income assets as you get older.

Age-based investing theories suggest that 25-year-olds can experiment and take risks as they will have time to recover. However, there are multiple factors you need to consider, such as your career growth prospects, family plans, living expenses, etc.

30 is by no means too old to start investing. It is best to start as early as possible, but it’s never too late to start.

The rule of 100 in investing is an age-based asset allocation rule. Subtract your age from 100, and you’ll get the percentage of your portfolio you should keep in equity.