Diversification is the strategy of dividing your funds across different asset classes to minimise your vulnerability to any particular type of investment. This method is designed to assist you in lowering your overall portfolio uncertainty. Understanding the benefits of diversification will help you manage your familiarity with risk against your investment period, which is one of the essential goals of trading.

What Is Diversification?

Distributing investments along a wide range of assets to minimise investment risk is termed diversification. It is a part of asset allocation, which refers to how much of an investment is allocated to different assets or clusters of comparable holdings.

For example, if you invested in fruits and vegetables — pears, avocados, cauliflower, and lettuce — your asset classes would be fruits and vegetables.

What is Diversification in Investing?

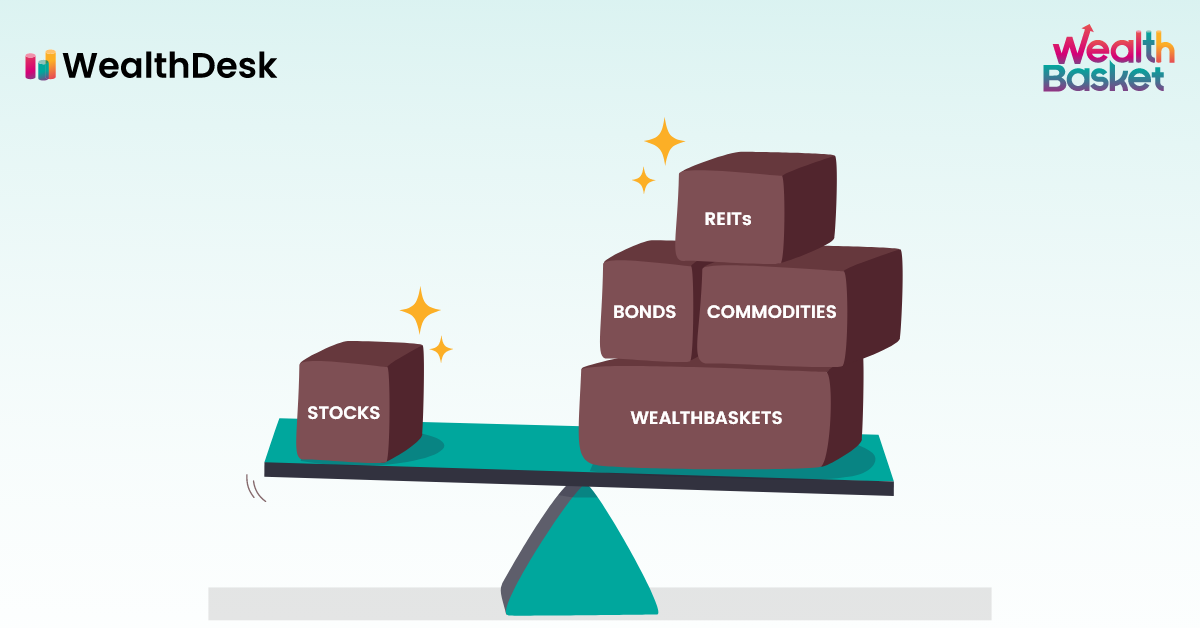

In investing, diversification is used to reduce your overall risk by distributing your wealth among different investments. You safeguard your investments from economic uncertainty by not putting all your goods in one bucket. There are numerous options to help you diversify your financial accounts.

Why is Diversification Important?

Diversification is important since it distributes risk along with a variety of commodities within the same portfolio. A diversified investment strategy is important because it decreases the danger of a company’s trend alteration in one asset, significantly influencing an investment portfolio.

To establish a strong range, look for financial assets such as stocks, bonds, cash, and others that haven’t traditionally moved in almost the same manner or at the same intensity. Be wary of overconcentration in a specific fund among your shareholdings.

For instance, you may not need a single stock to account for more than 5% of your total investment portfolio.

According to Fidelity, diversification across equities by market capitalisation (smaller, moderate, and giant corporations), sectors, and regions is also a good idea. Because not all companies, sectors, or areas have done well at the same period and to the same extent, you could be able to lower investment risk by diversifying your investments throughout the financial markets.

You might even want to think about a combination of approaches, such as growth and profitability. Diversification’s purpose isn’t simply to enhance performance; it won’t necessarily mean wins or protection from liabilities.

On the other hand, diversification can boost earnings for any level of investment you may want to pursue. For example, take maturities, credit quality, and tenure, which indicate susceptibility to interest-rate changes while making bond acquisitions.

Diversification of Asset Classes

After diversifying across different asset classes, investors may want to look into diversification within an asset class.

If, for example, an investor has decided to hold gold, IT sector stocks and automobile sector stocks. Instead of just holding one IT sector stock and one automobile sector stock, investors can further diversify and reduce their dependency by investing across different sectors like IT and automobiles.

Of course, higher diversification has higher costs and may result in too little concentration which results in low results. One may need to carefully weigh their options. An effective way of diversifying within an asset class would be holding sectoral index ETFs. These ETFs allow investors to get exposure to various stocks across a sector.

How to Build a Diversified Portfolio?

Let us start with certain instances of diversity. Many investors prefer to concentrate on equities and spread their investment risk in various companies rather than just one. They may use a mix of established, lucrative businesses and start-ups. A fledgling company’s prospective returns can be much higher than those offered by a market-leading blue-chip stock if it succeeds.

However, if things don’t turn out as expected, a company with a stable share price and reliable dividends might lessen the economic effect.

Diversifying your investment fund can be done in many formats. Users can diversify their portfolios by investing in a single asset class, such as stocks. You could, for example, invest in the leading corporations in a variety of (and unrelated) industries.

Diversification’s primary focus is to enhance efficiency while lowering earnings volatility. A good portfolio spreads risks among various investments whose performance is unrelated to the profitability of the overall portfolio’s remaining resources.

You can also diversify your investment by investing in commodities, such as stocks, bonds, and real estate. Users can also divide based on territorial considerations like state, region, or country. Diversifying suggests “don’t put all your eggs in one basket.”

Clients may lower the risk associated with one type of equities, but market hazards influence practically every sector, so diversification across asset classes is crucial. Diversifying can aid risk management and decrease the turbulence of an asset’s currency fluctuations. Nevertheless, consider that risk can never be entirely avoided, no matter how well-diversified your strategy is.

Capital diversification entails investing in a variety of payment securities. An individual can possess stocks, fixed-income debt products like bonds, commodities like gold, and cash in this account. Amongst the benefits of variation is knowing that a percentage of your funds may be quickly accessible if you need it. In addition, a mix of short- and long-term holdings, as well as cash reserves, keeps capital liquid and accessible in the case of a rainy day.

The idea is to strike a balance between both profits and losses. That way, you’ll be able to meet your investment objectives while somehow enjoying a decent night’s sleep.

What are the Benefits of Diversification in Investing

The benefits of diversification in your investments are:

- Putting all your eggs in one basket might backfire, particularly if long-term progress is impacted. Investment variety reduces the risk of skipping out on huge rises in a single equity market.

- Fixed-income securities might outperform stocks a year, but stocks may outperform fixed-income assets the very next year. A well-balanced strategy may help you manage all your concerns.

- New experiences await you. If a dealer is fascinated by an opportunity to make money but does not want to risk all his money, a diversified portfolio allows him to minimise the risk.

Disadvantages of Diversification in Investing

- Investing in a diverse group of investments frequently entails more costs, which cut into the returns.

- It’s not simple to construct a flawlessly balanced and diversified portfolio, which can take ages.

- Though it has the power to inhibit benefits, traders may lose out on big profits in the near run since their investment is engaged with low securities.

Conclusion

Diversification in investing has several benefits.

Although diversifying has several pros and cons, the

conclusion is to diversify your portfolio and not take a

chance by risking all your money on a single commodity.

Portfolio diversification is a way to secure your money

and also helps you explore the marketplace.

Need help in building a diversified portfolio? – Invest in diversified portfolios called WealthBaskets.

FAQs

Diversification means distributing your assets. If you concentrate all your money on a single commodity, you may lose it altogether. So, to be on the safe side, it is suggested to diversify your portfolio to reduce the risk factor.

Although diversification is essential for safe trade, it has certain disadvantages too. Diversifying your assets among many stocks makes it hard to manage. Things are confusing while you play with several investments at the same time. Also, at times, the total amount exceeds the budget when you distribute it among several estates.

Diversification refers to dividing the investments so as not to concentrate the risk factor upon a single commodity. Increasing variety decreases volatility. For, e.g., if you invested in a single stock that perhaps does not perform well, all your money is at risk. Therefore, it’s always recommended to diversify, i.e., to invest in multiple stocks rather than just one.

Diversification is a term used in investing, which suggests investing in multiple commodities. This also helps lower the risk factor while investing. Therefore investors widely believe in diversifying their portfolios.

Diversification saves an investor from risk, but it also has other takeaways. It helps a beginner to explore and experiment with the market. If the investor faces loss in a certain asset, another asset might profit and neutralise the risk.