Any discussion on stock markets always revolves around two concepts: risk and return. In both instances, your financial goals as an investor are considered. You need different investment strategies based on their risk analysis for maximum returns. One of the best strategies is risk diversification.

Before we examine the effect of diversification on portfolio risk, let’s first understand portfolio risk and return.

What are portfolio risks and returns?

For a discussion on portfolio risk and portfolio return, you must be clear about what is risk and what is return in the stock market.

What is ‘risk’?

Risk is known as an inherent uncertainty and potential loss in an investment. Many risk factors can contribute to this uncertainty. They can include country risk, political risk, market risk, inflationary risk, etc. It is therefore important to conduct a proper risk analysis before investing.

What is ‘return’?

A return is a measure of the future performance of an investment. A positive return indicates a profit, while a negative return indicates a loss.

What are ‘portfolio risks’ and ‘portfolio returns’?

The portfolio risk and return measure the risk and return of all stocks an investor holds at a particular time. Investors can opt for a high-risk, high-return portfolio or a low-risk, low-return portfolio. Everything depends on an investor’s risk tolerance.

How to reduce portfolio risks?

To reduce the overall portfolio risk, an investor often holds a high-risk stock and a low-risk stock when constructing a portfolio. This process is also called diversification. Let’s take a closer look at how diversification reduces the portfolio’s risk.

How are diversification and portfolio risks related?

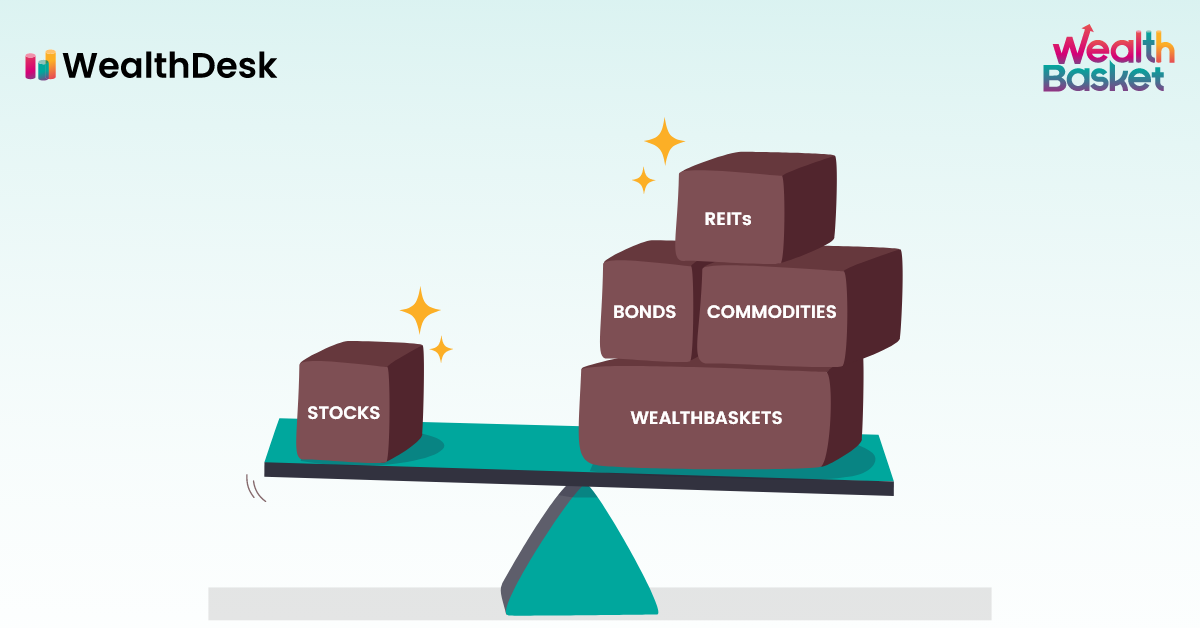

Diversification involves including different assets like real estate and technology with varying rates of risk and returns within a portfolio. A non-diversification risk is when the fate of an investor’s return is completely dependent on the performance of one sector.

Firstly, let us examine the advantages and disadvantages of diversification.

Advantages of diversification

Some of the advantages of diversification:

- It protects investors against a sudden market drop in a single sector or economic fluctuations.

- As part of diversification, investors may tie their funds to short-term financial instruments. This way, they can maintain liquidity and have funds available for a rainy day.

- With time, spending patterns may expand, while it might get constrained in others. In these times, diversification can help create a balance.

Although diversification may sound easy, it needs to be a well-thought-out process. When done right, it can do wonders for your investment. However, it can also be costly and disastrous with improper management.

Disadvantages of diversification

Here are some disadvantages of diversification:

- The purpose of diversification is to decrease portfolio risk. Hence, you cannot expect to gain high returns as you will get in profit-oriented securities.

- Like every investment, research and risk analysis are essential for diversification. For instance, before investing in an upcoming industry, perform a comprehensive risk analysis and gather information. Your portfolio may not benefit from investing in every new trendy sector.

- Lastly, diversifying into a wide variety of sectors is also not healthy. It will limit your ability to react to market changes.

What is the ideal amount of diversification in a portfolio?

Experts recommend around 20–25 stocks for optimal portfolio diversification and the best risk vs return trade-off. Veteran investor Warren Buffet, however, says otherwise. According to him, diversification is for people who lack knowledge about investing.

You may have heard the proverb that anything in excess is harmful. The same is true for over-diversification. It creates confusion, which leads to shifting the focus away from top-performing funds, consequently hampering overall returns.

How much is too much diversification?

Diversification tends to lower overall returns and reduce portfolio risk simultaneously. Interestingly, over-diversification tends to reduce portfolio return yet does not reduce portfolio risk. Additionally, it increases investment costs.

Here is what an over-diversified portfolio looks like:

- Owning several funds from different AMCs with the same underlying stocks that perform similarly.

- Investing in many individual stocks of a sector instead of a stock index. You will waste time and resources since a stock index will automatically include that sector.

- Often, the investors will invest in attractive sectors or in the trend without having any clue what they are. Many investments tend to understate their risks to appear attractive. For instance, non-publicly traded investments are risky and require specialized knowledge and expertise before investing.

Final thoughts

Successful investors invest according to their time and resources. The best way to avoid over-diversification is to understand your holdings and sell a fund with similar performance. Consult a financial advisor for any questions or concerns about your investment risk and return.

Additionally, use platforms like WealthDesk to invest in portfolios called WealthBaskets that are curated by topmost SEBI-registered advisors and research analysts in the country.

FAQs

According to financial advisors, a portfolio investing in 20–30 stocks from different sectors is sufficiently diversified. However, this may vary depending on your risk appetite.

• Over-diversification leads to the

following :

• Magnified

risks

• Low, stunted

returns

• Increased

transaction costs and taxes

•

More resource allocation

•

More confusion

• Augments due

diligence (audit)

Diversification aims to maximize returns. However, It may not result in a straightforward increase or decrease in returns. It decreases volatility and chances of fraud by investing in various asset classes that react differently to market risk.

With an over-diversified mutual fund, even great success in a single stock does not impact its overall progress and rate of return. Besides, too many investments make it difficult for you to keep track.

The veteran investor believes diversification is done by those who do not know about investing. According to him, it is solely a “protection against ignorance.” He has allocated 40% of his portfolio to a single stock in the past.