Many individuals tend to concentrate their savings in asset classes that have the potential to provide a high return on investments. This strategy can be a double-edged sword.

While a concentrated portfolio can deliver inflation-beating returns, it can also significantly increase an individual’s risk exposure. Furthermore, market volatility can create a sense of perpetual uncertainty about the safety of capital.

Therefore, it is always better to diversify your investments by spreading the risk among various asset classes. Delve deeper to know what is a diversification strategy and how you can build a well-diversified investment portfolio by following different types of diversification strategy according to your financial goals and investment mindset.

What is Diversification Strategy

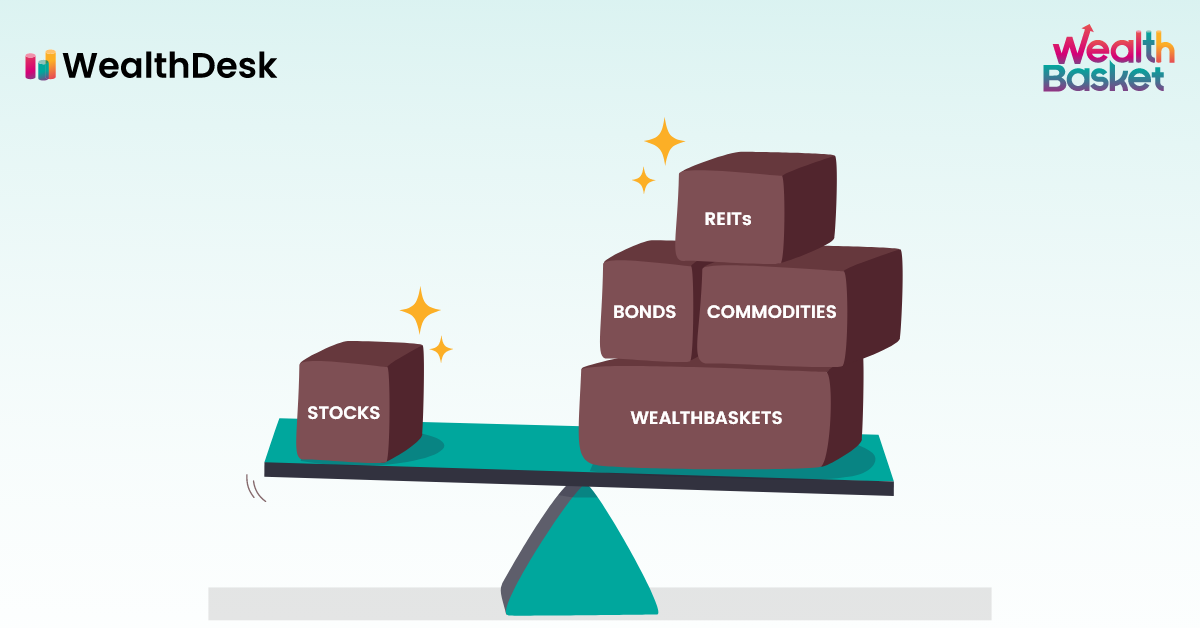

Portfolio diversification, in investment terms, simply means spreading your investments across different financial instruments such as stocks, bonds, real estates, bank term deposits, mutual funds, etc., to keep your risk exposure low without compromising on returns.

This objective can be achieved by following a diversification strategy, where the weightage of different asset classes in your portfolio is regularly assessed and adjusted according to prevailing market conditions and your risk appetite.

Importance of Portfolio Diversification

The following points highlight the importance of portfolio diversification, especially when you need to walk a tightrope between safety and growth while keeping an eye on inflation.

- Lowers The Risk of Market Volatility on Investments

As you will be investing across various sectors and financial instruments, your investment portfolio will be unaffected by one or two poorly performed sectors.

For example, it is unlikely that the pharmacy, banking and chemical sectors perform poorly at the same time. Therefore, an investment portfolio diversification strategy that evenly distributes your wealth across all these sectors can help you mitigate the risk and stay afloat while a sector underperforms.

- Option of Flexible Investing

Diversification provides you with the flexibility to increase or decrease exposure to different financial instruments by adjusting the weightage of allocation among different asset classes.

For example, a hybrid mutual fund can provide you with balanced exposure in equities and debts as per the market volatility.

- Peace of Mind

A diversified portfolio gives you much-needed peace of mind. You no longer have to worry about the short-term volatilities in the market or the socio-economic factors of the country.

How to Diversify Your Investments

The following tips can help in creating the best portfolio diversification strategy for your investments.

- Distribute the Wealth

While investing in stocks can be fruitful, you are always one step away from disaster if you put all your investments in a few stocks. The statement holds true for gold, real estate and other such investments as well.

On the contrary, you can effectively hedge your investments from economic slow-downs or sudden changes in fundamental attributes of a sector by following a diversification growth strategy by investing in a basket of wealth that has a sound mix of good stocks, or different asset classes.

2. Invest in Mutual Funds

Mutual funds can be the best way to diversify your investments. Mutual funds invest your money in the stock market as per your preferences.

You can choose a mutual fund that invests in stocks of a

specific sector like chemical, pharma, banking etc.

Alternatively, you can choose a fund that invests across

different financial instruments like equities, debts,

government bonds, etc.

Mutual funds can be of two types

- Actively Managed Funds

These funds are managed by experts known as fund managers. The fund manager invests your amount as per the underlying theme of the fund of your choice.

- Passively Managed Funds

These funds are automatically managed through computer software and pre-defined investment algorithms. As no fund manager is employed, the human intervention is minimal in such funds. These funds are designed to replicate the returns generated from the underlying index that they follow.

For example, a gold ETF aims to follow the prevailing gold prices in the country.

3. Pay Attention to Commissions

Mutual funds charge a fee to manage your portfolio. It helps to know beforehand how much commission is charged by your fund house.

- Keep Updating Your Portfolio

Once your portfolio outline is ready, keep building up your portfolio by regularly investing. Systematic investment plans or SIPs can be an excellent way to consistently build your portfolio.

- Keep track of the markets

You don’t have to delve deep into the technicalities. You just have to know how the markets are performing collectively. Alternatively, you can choose a good fund to park your investments and let a certified financial expert do the job on your behalf.

When it comes to investing, we do not believe in the strategy of one-size-fits-all. With WealthBasket, retail investors get to choose WealthBasket portfolios as per their investment choices, preferences and risk-taking capabilities to achieve long-term financial goals.

Conclusion

Exercise Caution over Reckless investing

It is easy to get lured into taking high risks for getting spectacular returns on investments. However, the pain of losing your hard-earned money in the wake of unforeseen circumstances can be an unpleasant experience.

Diversifying your investments provides you with the benefit of good returns while simultaneously cushioning your money against unwanted surprises stemming from market uncertainties. Additionally, you will inculcate a habit of disciplined investing for life.

FAQs

The power of compounding works wonderfully in wealth

creation. However, you need to follow a

diversification growth strategy for the long term.

The easiest way is to keep investing over a long

period and stay invested across various market

cycles. The longer you stay invested, the longer

will be the compounding effect.

It is not advisable to put all your eggs in one

basket. You are probably at risk by limiting your

investments in a few stocks. Stock markets are known

to make regular highs and lows depending upon

various factors. You may be reaping the benefits of

a boisterous market but in a downturn, you may be

exposed to risking all your investments over one

poorly performing company or sector.

Instead,

you should consider dividing your investments by

diversifying your funds across many stocks to hedge

against a potential downturn.

Any kind of investment in stock markets is subjected to market risks. However, unlike bank deposits that assure stable but low returns, equities and mutual funds, when invested for a long term, can generate potentially higher returns that can help beat inflation.

Reputed fund houses, especially the new-age

financial technology firms, provide a plethora of

options to retail investors. Whether you want to

invest in Flexi-cap funds, MNC funds, or

sector-specific funds, there can always be a fund

that perfectly suits your needs.

You can

also take advice from certified experts to assess

your financial needs and invest accordingly.