Commodities, sectors and regions – Exchange Traded Funds (ETFs) have tapped almost every segment as they become more popular among investors. This low-cost instrument is considered an alternative to actively managed mutual funds. The ETF portfolio is a basket of securities and stocks with some features of stocks (real-time, volatility) and some mutual funds (fund managers).

This blog explains how to build a most diversified ETF portfolio and various ETF portfolios.

What is an ETF Portfolio?

An ETF is a portfolio or a basket of various securities and shares that tracks an index (market index, country index or sector index). For example, market ETFs track market indexes such as SENSEX ETF, BSE 500 ETF, etc.

The benefit of investing in ETFs is getting a well-diversified portfolio of securities such as shares, mutual funds, bonds, commodities, etc. At a low cost, the expense ratio for ETFs can be as low as 0.20% per annum.

While ETFs are themselves a portfolio, track various indexes such as country index, market index, or sector index, you can also create your portfolio of more than one ETF, called an ETF portfolio.

Let’s understand different types of ETF portfolios.

Types of ETF Portfolios

Since ETFs replicate the indexes, the type of ETF investment is called a passive investment. Now, when you invest in 1 ETF, for example, sector ETF, it will track the stocks of a particular sector or an industry price index. Similarly, gold ETF will only track the physical gold prices.

Thus, a single ETF will not allow you to diversify your investment, which is how the concept of ETF model portfolios emerged. ETF model portfolio is a diversified portfolio that consists of various sector ETFs, commodity ETFs or international (country) ETFs.

So, let’s first look at the types of ETF portfolios before moving on to the steps involved in diversifying the ETF portfolio.

Asset Allocation ETF Portfolio

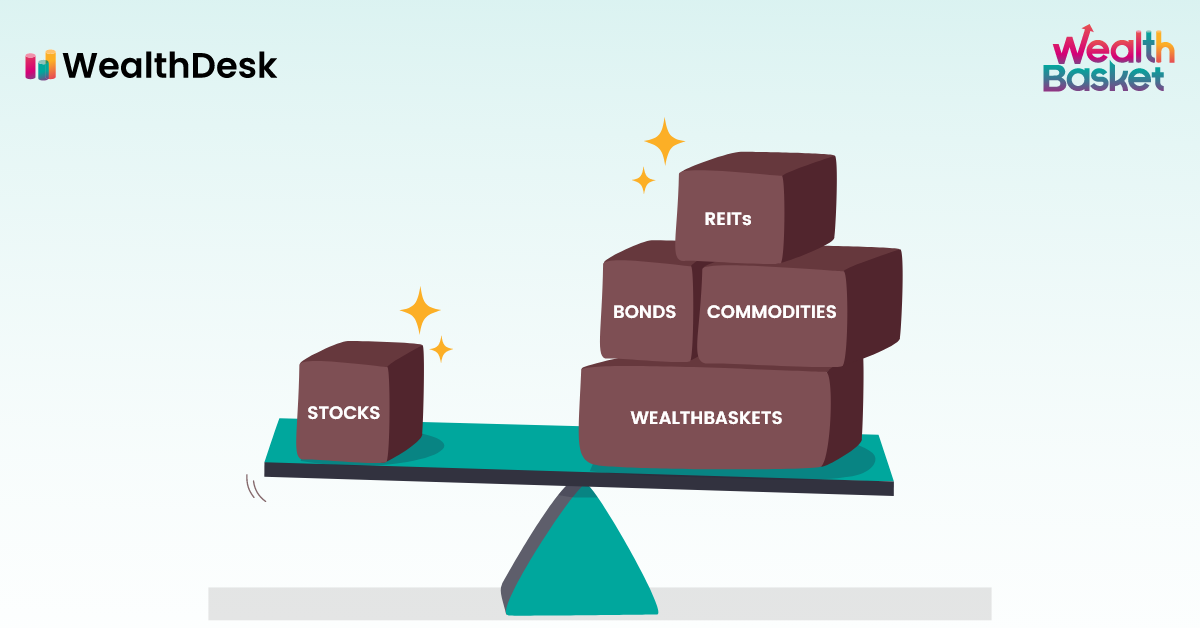

Asset allocation ETF portfolio is a diversified portfolio that focuses on various asset classes such as equity, fixed income, and commodity to pick more than one ETF in a portfolio. The asset allocation ratio is dependent on your risk-taking ability and your investment goals.

Once you have the desired asset allocation in mind, you can pick sector ETFs, commodity ETFs or even real estate ETFs to build your asset allocation ETF portfolio.

Balanced ETF Portfolio

The balanced ETF portfolio diversifies the portfolio equally among various asset classes. For example, if you want an asset allocation in only equity and debt instruments, the balanced ETF portfolio will consist of 50% equity and 50% debt.

Conservative ETF Portfolio

As the name suggests, a conservative ETF portfolio picks the majority of low-risk, fixed-income ETFs and has little exposure to the sector or equity ETFs. Some best conservative ETF portfolios include bond funds listed on the stock exchange whose performance can be tracked.

Growth ETF Portfolio

The growth ETF portfolio invests mainly in equity ETFs and real estate ETFs as shares and property are considered the growth assets whose value increase over a longer term. However, these growth assets also have high risk and high potential loss if such assets are underperforming.

Complete ETF Portfolio

Often called an all-in-one ETF portfolio, the complete ETF portfolio focuses on diversifying the ETF portfolio as much as it can. It picks all types of ETFs in one basket and brings the risk level to the minimum as it has at least one ETF from the sector, market and commodity ETFs. A good ETF portfolio is well-diversified and cost-effective at the same time.

How to Build a Diversified ETF Portfolio?

So, that brings us to our critical question of how to diversify an ETF portfolio which is a portfolio replicating an entire index. Below are the steps through which you can build a diversified ETF portfolio.

Plan Your Financial Goals

Setting financial goals is key to any investment strategy to plan your financial and investment objectives. You may consider the following while planning your financial goals:

- Risk Appetite

- Expected Returns

- Time-horizon

- Tax Treatment

- Amount of Investment

Determine the Right Asset Allocation

Determining the proper asset allocation again depends on your financial goals. For example, for some investors, the asset allocation of 60:30:10 (60% in equity, 30% in debt and 10% in gold) works well, while for others, 80:20 (80% debt and 20% equity) performs better.

Create a Basket of ETFs You Desire to Invest in

Now that your asset allocation is decided, you need to create your portfolio of ETFs by picking the suitable ETFs of each asset class you choose to invest in.

Find Tracking Errors and Rebalance if Needed

The ETFs do not precisely duplicate the indexes, and hence there is a difference between ETF returns and index returns. The difference is called a tracking error, and the more minor the tracking errors, the better the ETF will be. Find the tracking errors and rebalance them by buying ETFs with fewer tracking errors and selling ETFs that have more tracking errors.

The Bottom Line

A good ETF portfolio is a well-diversified ETF portfolio that includes various asset classes. However, it entirely depends on your risk appetite and financial goals. An ETF portfolio gets higher returns for some asset allocation, while a balanced ETF portfolio may do wonders for others. You can also pick baskets of ETFs already created by industry experts. At WealthDesk, our SEBI-approved investment professionals have made WealthBaskets that consist of stocks or ETFs reflecting an investment strategy or theme.

FAQs

For a well-diversified ETF portfolio, you will need a minimum of 5 ETFs that will cover various asset classes.

Yes, the ETFs track various indexes which consist of various asset classes such as sector ETF will track a particular sector’s index which will consist of shares of different companies in that sector. Hence, the passive investment strategy works well for diversification.

The key to diversification is picking various asset classes along with multiple sectors. For a good diversified ETF portfolio, you need ETFs of multiple sectors, markets, and commodities as well as of different asset classes also.