If there’s one thing you can predict about the stock market is that it will be volatile. Unfortunately, market volatility is widespread and can occur due to several reasons like domestic or foreign economic policy, increase in interest rates, or inflation. This volatility is what often scares people from investing in the equity market. That is why hardly 3.7% of Indians invest in the stock market compared to 56% of Americans (Source: Business Standard and Gallup.com). But stock market investments are usually the ones that give you the highest returns. So, instead of choosing not to invest in the market at all, you should diversify your portfolio to safeguard yourself from market volatility. Additionally, staying invested during volatile markets has its benefits. But before we look into that, let us understand portfolio diversification.

What is Portfolio Diversification?

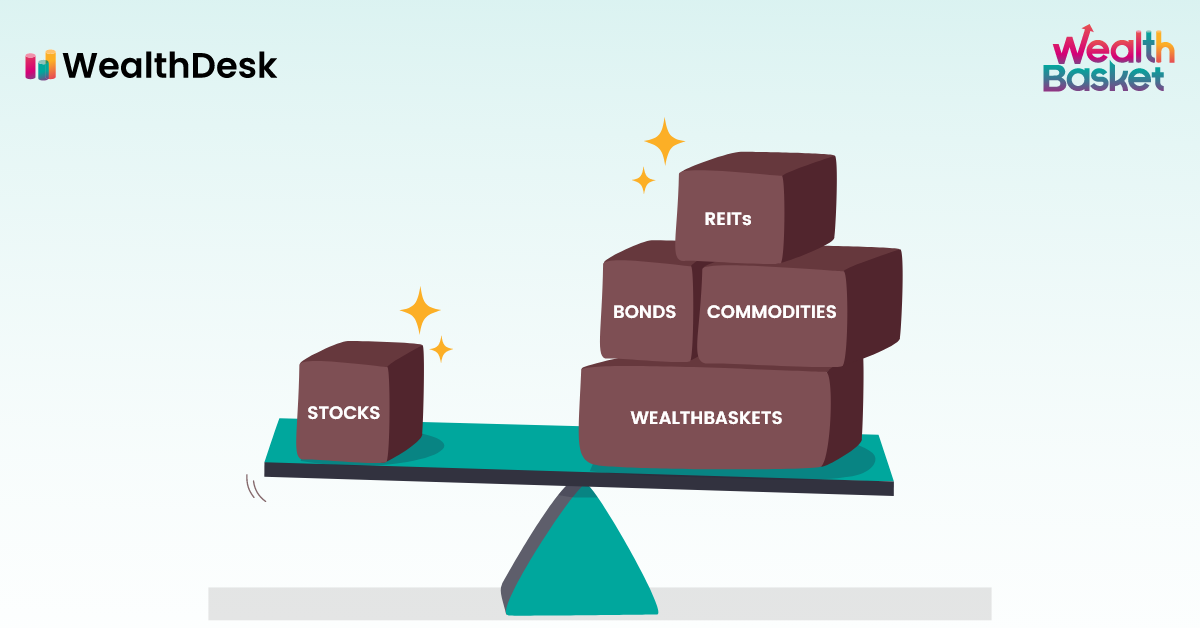

Portfolio diversification means investing your money in different assets or securities. For example, you should never invest in just bonds or stocks, as this will not help you meet your financial goals and open you to market risk. For instance, if you have only invested in stocks and the market crashes, there are chances that you could lose out on the entire sum you invested. But if you invest your money in ETFs, stocks, bonds, fixed deposits, SIPs, and some other investments as well, even if one of these investments performs poorly, you will still get returns from the other investments and be on track to fulfill your goals.

How to Diversify Your Portfolio?

The most crucial part of portfolio diversification is the process of asset allocation. First, you must carefully decide which assets you want to invest in and the percentage of the money you want to invest in each asset class.

You should also pay attention to equity market diversification. Just investing in stocks is not enough. You should ensure that you invest in stocks of different companies belonging to various sectors. In this way, if one company or one sector faces market volatility, you could still get returns from the shares of the other companies.

Asset Portfolio Diversification Strategies

There are many different types of asset allocation strategies that you can adopt to make sure your asset portfolio is diversified and safe from market volatility. Here are a few of them:-

- Strategic Asset Allocation – This diversified investment strategy involves deciding a base mix of assets based on the returns expected from them and then sticking to the decision. It is essentially a “buy-and-hold” strategy and doesn’t require much active management.

- Tactical Asset Allocation – Like strategic asset allocation, this strategy also begins with determining a base mix of assets. However, it involves keeping an eye on the market and taking advantage of any current market conditions. However, this is not a long-term strategy, and usually, after the short-term gains have been achieved, investors restore their portfolio to the original asset mix.

- Dynamic Asset Allocation – This is an active asset allocation strategy that requires you to keep a very close eye on the market and keep changing your portfolio according to market conditions. In this strategy, you sell assets that are not performing well and buy more of the best-performing assets based on market conditions. It is a diversification growth strategy that allows you to increase your returns. This strategy, in particular, can help you counter the effects of market volatility on your portfolio, but it requires constant monitoring.

How to Manage Portfolio Diversification

It is often difficult to understand how much you should invest in each asset class and which asset allocation strategy you should follow. In terms of market volatility, such decisions can either cost you a lot of money or help you make a lot of money. But if you feel you don’t have the required knowledge to make these decisions, you can always consult a professional portfolio manager. Now, you can also do it from your home through an online portal like WealthDesk.

WealthDesk helps retail investors build their portfolios with assistance from SEBI-registered professionals. These experts will also help you monitor your portfolio and rebalance it as and when you need it.

Conclusion

Though it may seem complicated, asset portfolio diversification is an essential step in your financial journey. It can help protect you from losing out on your valuable money and also allow you to meet your financial goals on time.

FAQs

It will help if you allocate assets in your portfolio according to your risk appetite. For example, if you don’t have a lot of responsibilities and can take huge risks, then high-risk investments like stocks should make up the greater part of your portfolio. But if you are someone who doesn’t want to take a lot of risks, then bonds, fixed deposits, real estate, and other safe investments should make up a more significant portion of your portfolio to give you guaranteed returns.

There is no one-size-fits-all asset allocation strategy that works out for everyone. The best asset allocation strategy for you depends not only on the amount of risk you can take but also on your knowledge of the market and the time you have to monitor your portfolio. For instance, for someone without much market knowledge, strategic asset allocation could be the best strategy. But for someone keenly interested in the stock market, following a dynamic asset allocation strategy makes more sense as it will protect them from market volatility.

The three main asset classes included in a diversified portfolio are stocks, bonds, and cash. However, most portfolios also include other investments like gold and real estate. While diversifying your portfolio, one thing to keep in mind is to invest in assets that can be sold easily and quickly, so you can get quick cash in times of need.

Portfolio Diversification can protect you from the

following types of investment risks:

–

Market Risk

– Business Risk

–

Inflationary Risk

– Liquidity Risk