The two major components of any investment are risk and return. For investors, the goal is to maximize their return with the lowest level of risk possible. Hence, you must carefully analyze both before investing. Now, risk and return vary according to the asset type. This is where portfolio diversification comes into play. This investment tool is used to achieve symmetry between the return and risk factor by making strategic asset allocation and, taking into consideration, the market conditions. However, it requires extensive research and knowledge. Before we discuss some tips that can help you diversify your portfolio, let’s explore the power of diversification.

What are the advantages of portfolio diversification?

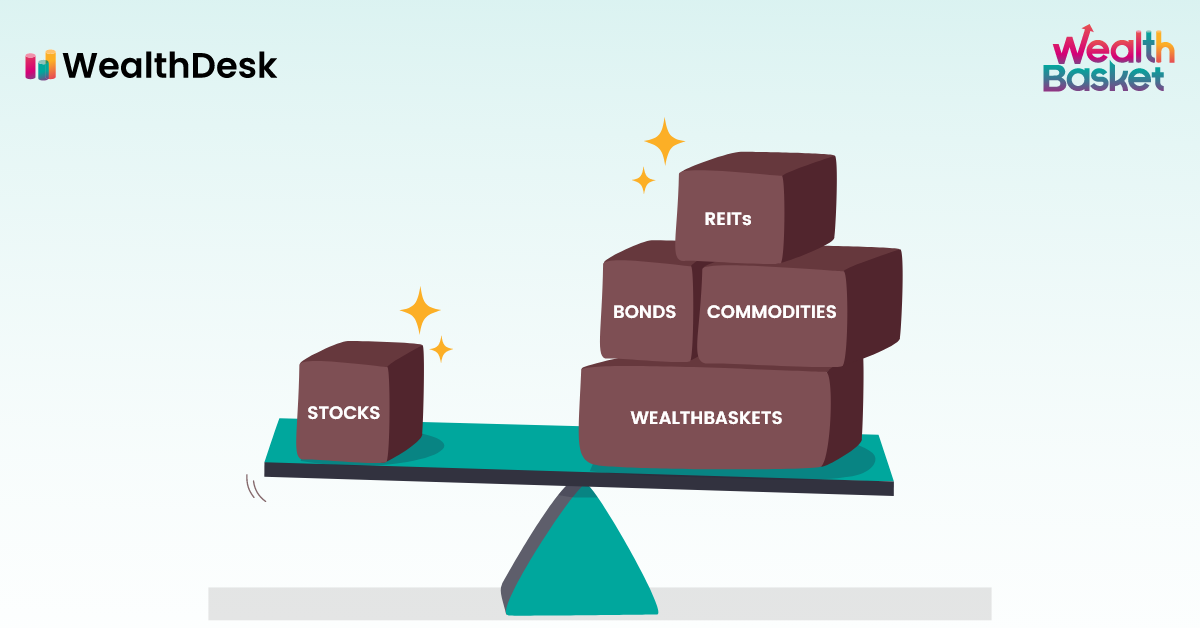

The purpose of diversification is to spread the investment in different asset types to minimize the overall portfolio risk. These asset classes include equity, debt, hybrid funds, and others. Diversification is possible within the same sector as well as across sectors. Here are some of the benefits of portfolio diversification:

- By diversifying their portfolios, investors are not putting all their eggs in one basket. This reduces their risk of losses.

- In a diversified portfolio, investors are less likely to experience market volatility. This reduces their need to monitor their portfolios constantly.

- An investor’s risk appetite plays a major role in their investment decisions. Beginners, non-risk takers, and retired investors always wish to earn stable returns with minimal risk. Therefore, diversifying portfolios becomes a viable option for such investors.

- It gives investors the option to invest in different sectors and assets. Investors can choose to invest their money in a trending new sector while investing the rest of their money in safe assets to balance the risk.

Some tips to properly diversify your portfolio

Volatility in the stock market is an inherent risk faced by all investors. Fortunately, this type of risk is avoidable through proper diversification. Following are some tips on avoiding the stock market risk and maximizing your returns.

- Understand your risk appetite

Depending on the investor, risk appetite can range from high to low. An investor’s risk appetite varies according to several factors, including their income, age, lifestyle, and dependents. Although young investors can choose to pursue aggressive investments, it is more prudent for those nearing retirement to take a conservative approach.

- Make an active asset allocation strategy

Portfolio diversification can be effective, but only if the investor chooses the right asset mix. Compared to bonds and debt, equity investments can provide high returns, but they also carry greater risks. Thus, strategic asset allocation is the key to a successful portfolio. To allocate your assets in a well-diversified portfolio, the investor must carefully examine their finances.

- Avoid over-diversification

Everything in excess is bad, as we all know. Diversification is no different. The benefits of portfolio diversification are numerous; however, over diversification can reduce overall returns. Investing in too many assets can make it difficult to monitor, as well as to know when to exit when necessary. Therefore, it increases the risk of having inefficient or similar stocks in a portfolio.

- Research before investing

Successful investors conduct proper research and gain knowledge about the stock or company before investing. This may include company history, past performance, market reputation, future objectives, etc. If a company has a longstanding track record, its returns are more likely to be stable.

- Know when to exit

In the same way that research is crucial before investing, it is crucial to do the same post-investment. In this way, the investor will know whether to hold or sell a specific stock. Thus, it gives insight into the potential of the stock.

Moreover, market conditions are constantly changing. Thus, a stock that may perform well in one market condition might not perform as well in another.

- Learn about global markets

Investing doesn’t have to be confined to domestic markets. Today, investors have the opportunity to invest worldwide, including upcoming new trends with the potential for high returns in the future. Thus, they can gain a first-mover advantage and maximize their returns.

- Review the portfolio periodically

A person’s financial needs change as they go through life. Individuals with single status have different financial objectives from those with families. Hence, it is important to analyze whether the current portfolio meets the current financial needs. If not, the portfolio should be rebalanced. In this way, the investor can achieve their life goals in a disciplined and informed manner.

- Avoid temptations

Every so often, we hear about investments where someone has earned great returns within a short period. Like cryptocurrencies these days. However, no matter how tempting the profits might be, it is important to understand that these volatile instruments fall as rapidly as they rise. Moreover, some popular instruments, while appearing glittery from the outside, can be fraudulent.

- Invest in instruments with different liquidity terms

When investing, it is important to consider the possibility of needing emergency funds if an unfortunate event occurs. Investing in a money market instrument with a maturity of around 3 months can be an example of the same. In addition, they carry low risk.

As a result, investments should be spread out so that some of them can deliver timely payouts to investors.

- Explore alternative investments

- A good portfolio mix should be neither too conservative nor too aggressive. In addition, investors can now invest apart from traditional instruments like stocks, cash, and bonds. Some non-traditional investments options include derivatives, investments in private companies, and hedge funds for investment. As an alternative to stocks, investors can also invest in insurance and real estate.

Final thoughts

Following the above article, you should have a good understanding of how to maximize your returns with the power of diversification. To create a well-diversified portfolio, thorough research and financial planning are necessary.

WealthDesk offers you low-cost but high-quality diversified portfolios called WealthBaskets. WealthDesk advisors create curated portfolios and monitor them on regular basis and give rebalancing updates. So, you can rest assured that your investments will be well taken care of.