Risks and returns are two of the major concerns of every investor. Some investors are ready to take higher risks if they see higher potential gains. In contrast, some investors fear high risk. There is no one-fit-all investment strategy.

However, various investment strategies exist for the investor to choose the suitable one. They can be divided into concentration and diversification strategies.

This article will help you understand concentration strategy, concentration risk, a diversification strategy and types of diversification strategy.

What Is Concentration Strategy?

A concentration strategy is an investment strategy used by investors who prefer a lower degree of diversification in their portfolio and want to focus on particular asset classes, sectors, or stocks. When the investors are optimistic about a particular asset class, sector, theme, or few stocks, they may go for a concentrated portfolio.

For instance, if your investment portfolio only consists of five stocks from the infrastructure sector, you are said to have adopted a concentration strategy.

Investors willing to take higher risks to generate market-beating returns may create a concentrated portfolio. Concentration strategy gives birth to concentration risk.

What Is Concentration Risk?

Assume that you have evaluated the auto sector and realised some of the stocks from that sector performed well over the last ten years and generated higher returns than the benchmark index. Therefore, you decide to have a majority of holdings, for example, 70% of your overall investment, in these auto sector stocks. Your aim here is to outperform the benchmark index.

But, what if the auto sector’s performance slopes downward in the next two years? Seems scary? That chance of adverse outcomes from having a concentrated portfolio is termed concentration risk.

What Is Diversification Strategy?

Diversification is an investment strategy in which investors choose to spread the risk by investing across various stocks, sectors, or asset classes. The performance of a well-diversified portfolio does not depend on any one asset class, sector, or stock.

For instance, if your investment portfolio consists of stocks, fixed-income securities, and real estate, your portfolio has multi-asset class diversification. If your investment portfolio includes 15-20 stocks from different industries, such as banking, FMCG, pharma, auto, IT, etc., your portfolio gives you multi-sector diversification.

Types Of Diversification Strategies

Diversification strategies can be categorised based on how they diversify your portfolio.

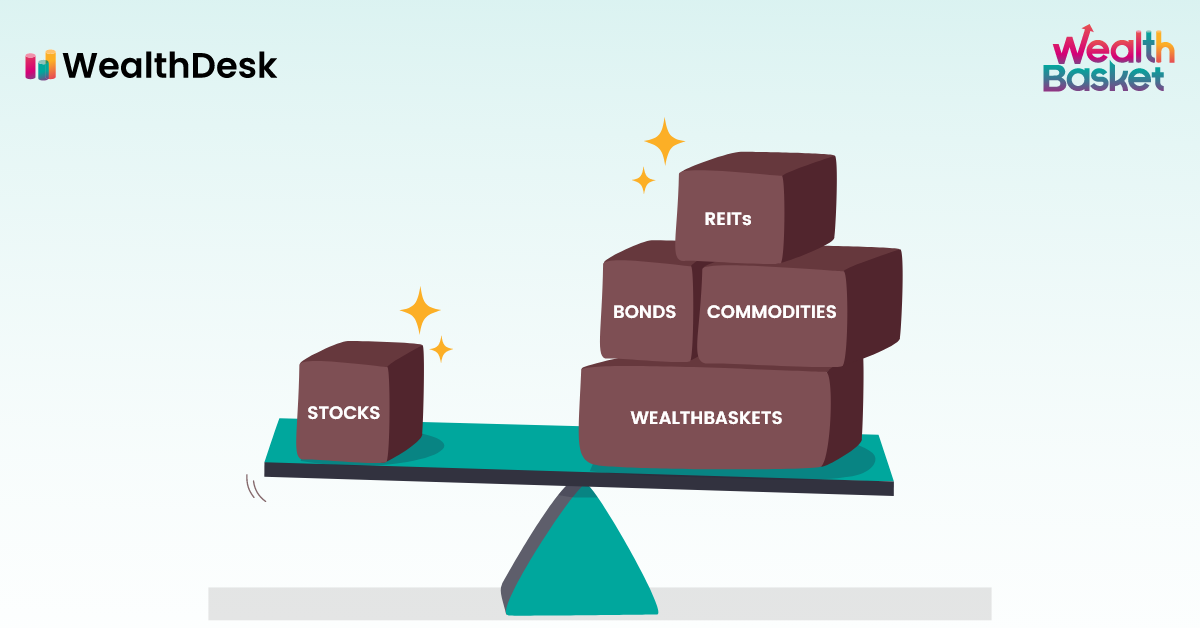

- Asset Classes: You may include multiple asset classes, such as equity, fixed-income securities, real estate, commodities, etc., to diversify your portfolio.

- Industries: You can also choose to invest in stocks across sectors and industries that are less correlated, such as FMCG, IT, Realty, etc.

- Individual Stocks: You may hold various stocks in your diversified portfolio that behave differently in different situations or market phases.

- Geographical Dimensions: You may diversify your portfolio by investing globally in addition to your home country. For instance, an Indian investor may invest in Indian and U.S. stocks.

Concentration Vs Diversification

If you are still confused about choosing between concentration and diversification investment strategies, here are the benefits and problems of both.

| Concentration strategy | Diversification strategy | ||

| Benefits | Problems | Benefits | Problems |

| You have fewer securities or stocks in a concentrated portfolio, making portfolio management more convenient and efficient. | The concentration strategy involves the concentration of wealth over a minimal number of securities. You may have to bear a massive loss if your choices come out wrong and those securities of your portfolio perform poorly. | One of the benefits of a diversification strategy is that when some securities or stocks in the portfolio perform poorly and some perform well, the overall negative impact would be lower. | A diversification strategy may limit the potential gain and result in a mediocre performance. |

| If you choose the right securities, the potential gains would be higher, and your portfolio may even outperform the benchmark index returns. | Fewer asset classes, sectors, or stocks may also mean fewer potential places to succeed. | A diversified portfolio is preferable to investors with a lower risk appetite or who cannot afford huge losses. | Managing and tracking your portfolio’s stocks/securities may become more challenging. |

Final Thoughts

Concentration and diversification are two seemingly opposite investment strategies. While concentration strategy includes increasing potential gains by sticking to a few asset classes or securities, diversification strategy believes in spreading risk across various securities.

Which is better among concentration vs diversification strategies depends on your investment goals. If you are willing to take a higher risk to gain potentially higher returns, a concentration strategy may help. However, a diversification strategy may work better if your focus is lower risk.

At WealthDesk, we help you have a well-diversified portfolio by enabling you to invest in WealthBaskets. WealthBaskets are the combinations of stocks and ETFs managed by SEBI registered professionals and reflect an idea, theme, or investment strategy.

FAQs

Whether a concentration or a diversification strategy is preferable depends upon your investment objective. Investors ready to take a high risk to generate market-beating returns may adopt the concentration strategy over the diversification strategy.

There is no full-proof assurance that the concentrated portfolios will outperform every time. If the factors affecting portfolio performance work in favour and the concentrated stocks or sectors are sound, the chances of the portfolio outperforming the market index are higher.

The degree of concentration of your portfolio highly depends on your investment objective. You may opt for a highly concentrated portfolio if you have a higher risk tolerance level and higher return expectations. On the contrary, if you are ready to settle with lower returns for lower risk, you may opt for a diversified portfolio.

Risk-averse or risk-neutral investors often find a diversified portfolio better to avoid or reduce concentration risk. A significant benefit of a diversified portfolio is that the performance of the portfolio does not depend on a single asset class, sector, or stock.

There is no thumb rule for how many stocks should be there in a concentrated portfolio. Usually, investors building concentrated portfolios prefer to have less than ten stocks.