Every asset we invest in has its own risks and rewards. Holding only high-risk-high-return assets or low-risk-low-return assets limits the potential of a portfolio. An investor should also look into strategies that help balance the risk-to-reward ratio.

This article discusses various types of strategies for asset allocation.

What is Asset Allocation?

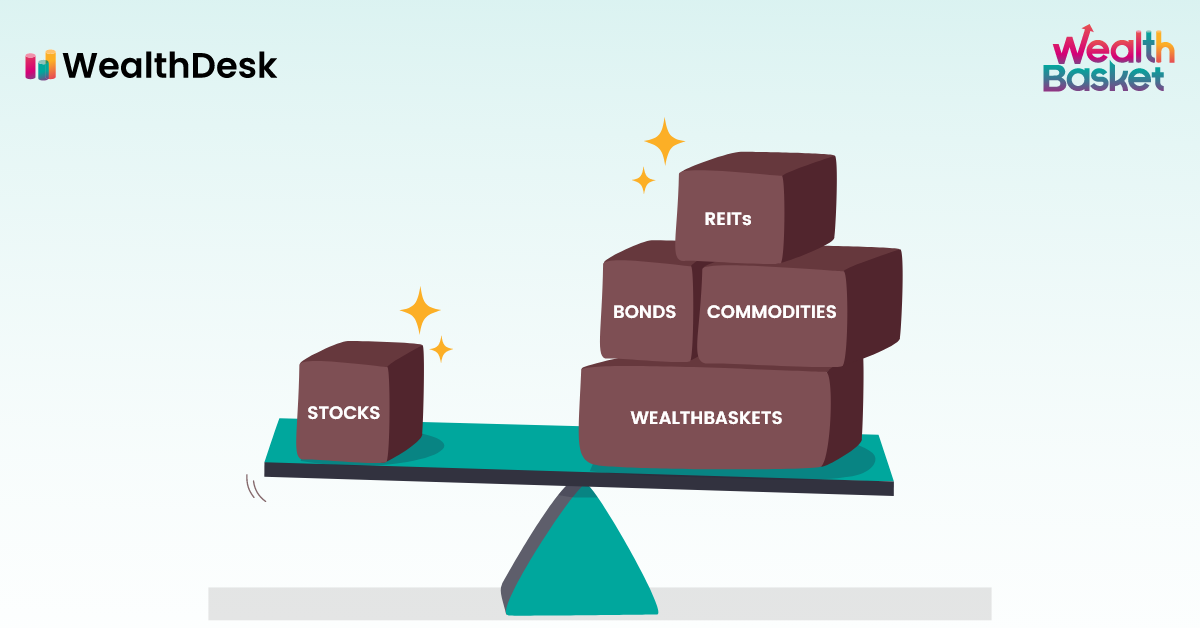

Asset allocation investment strategies aim to balance the risks and rewards by dividing a portfolio among asset classes like stocks, government securities, private bonds and real estate, etc. There are 2 types of goals of asset allocation:

- To earn the same returns (as before asset allocation) at a lower risk

- To earn a better return at the same risk

In theory, if the risk of an asset is higher, it will have a higher return. If the risk is lower, then it will have a lower return. By dividing the portfolio among various assets with various risk-to-return ratios, an investor can curate their portfolio to meet various financial goals.

3 Types of Asset Allocation Strategies

There are three major types of asset allocation strategies in India:

- Strategic Asset Allocation

- Tactical Asset Allocation

- Dynamic Asset Allocation

What Is Strategic Asset Allocation?

Strategic asset allocation (SAA) strategies have a long-term focus. They are based on the investor’s income, age and risk profile. These strategies are generally passive and can be described as buy-and-hold strategies.

In this method, investors evaluate an asset’s expected risks and returns. Based on these risk-to-reward expectations, the allocation of each asset is decided according to the investor’s financial conditions. The allocation among each asset class is changed periodically.

SAA strategies can be broadly classified into 2 sub-categories:

Age-based asset allocation

These are simple asset allocation strategies that are probably the most well-known asset allocation strategies currently practised in India. The Age Rule fixes asset allocation among equity stocks and other assets here.

Equity investment = (100 – Age of investor) %

Due to the simplistic nature of these strategies, they have various limitations. They do not consider the varying market conditions and investors’ risk profiles.

Risk Profile-Based Asset Allocation

Risk profile-based asset allocation strategies consider the investor’s risk profile to determine asset allocations.

All the investors can be classified into 5 categories:

- Conservative

- Moderately Conservative

- Balanced

- Moderately Aggressive

- Aggressive

Conservative investors would have the lowest risk tolerance and prefer a low volatility portfolio. On the other end of the spectrum, aggressive investors would choose high volatility portfolios that can give high returns.

Therefore, conservatives would hold more low-risk-low-return assets. On the other hand, aggressive investors would hold more high-risk-high-return assets.

What Is Tactical Asset Allocation?

Tactical asset allocation (TAA) has a comparatively short term focus and aims to take advantage of market conditions. TAA strategies are moderately active asset allocation strategies. Investors who feel limited by SAA strategies may opt for TAA strategies.

When determining the asset mix, TAA strategies take the investor’s long-term goals and market conditions into account. For example, an SAA strategy may recommend keeping 75% equity and 25% government securities mix. However, you may notice that equities have higher returns after a certain period and are expected to outperform in the near term. In this case, you may tactically increase your equity allocation to 80% or 85% until you feel returns from equity are back to previous levels.

Momentum based strategies are a common type of TAA strategy. The asset allocation is determined by how much buying momentum an asset experiences. Suppose an asset is undervalued or has growth potential and starts appreciating. In that case, this strategy will increase its allocation in the portfolio.

What Is Dynamic Asset Allocation?

Dynamic asset allocation (DAA) is a strategy that frequently adjusts the mix of asset classes according to market conditions. DAA is comparatively more active than SAA and TAA. DAA involves reducing the percentage of money in the worst-performing asset classes while adding to asset classes that are performing best.

Counter-cyclical strategies, a.k.a. contra strategies, are a common type of DAA strategy. These strategies aim to buy low and sell high. When an asset looks undervalued, its allocation is increased in these strategies. Investors can use various metrics like the price to earnings ratio (P/E Ratio), price to book value ratio (P/B Ratio), Dividend Yield, etc.

Final Thoughts

Investment strategies have evolved beyond holding just one asset. Instead, an investor can find various asset allocation strategies and choose one that best suits their needs and goals. Nowadays, an investor can easily follow a global asset allocation strategy through ETFs.

On WealthDesk, investors can find portfolios that follow various strategies like growth, momentum, etc. These portfolios, called WealthBaskets, are curated by SEBI-registered professionals. There’s a WealthBasket for different themes and financial needs.

FAQs

An age-based asset allocation strategy would recommend keeping 75% of your money in stocks. However, age-based asset allocation ignores many factors like income and risk profile. So, it might be better to look at other strategies as well.

Strategic asset allocation (SAA) has a long-term focus, while tactical asset allocation (TAA) has a short term focus. SAA is based on an investor’s risk tolerance, time horizon, and investment objectives. TAA shifts the percentage of assets held in various categories to take advantage of market conditions.

The tactical asset allocation (TAA) strategy, an active management strategy, has higher risk exposure. So, TAA may suit better to investors with higher risk tolerance. Younger investors with some income stability may prefer TAA more than old investors with only a few years to retire.