“Diversification is a Protection Against the Ignorance.” – Warren Buffett (Legendary long term investor, CEO of Berkshire Hathaway)

Even the world’s most successful investor advises diversifying portfolio as he firmly believes that it can save you from losing all your money into just one or two types of securities. A portfolio consisting of various securities may look unmanageable, but it protects you from heavy losses in tough times.

As a young investor in India, by now, you must have developed your interest in cryptos, stocks and gaming (just joking!). You might have started investing recently and may have created a portfolio of your own. If that is true, read on to understand how portfolio diversification reduces the risk associated with market volatility.

This blog will be a young investors’ guide explaining how to diversify your portfolio and its importance.

Understanding Portfolio Diversification

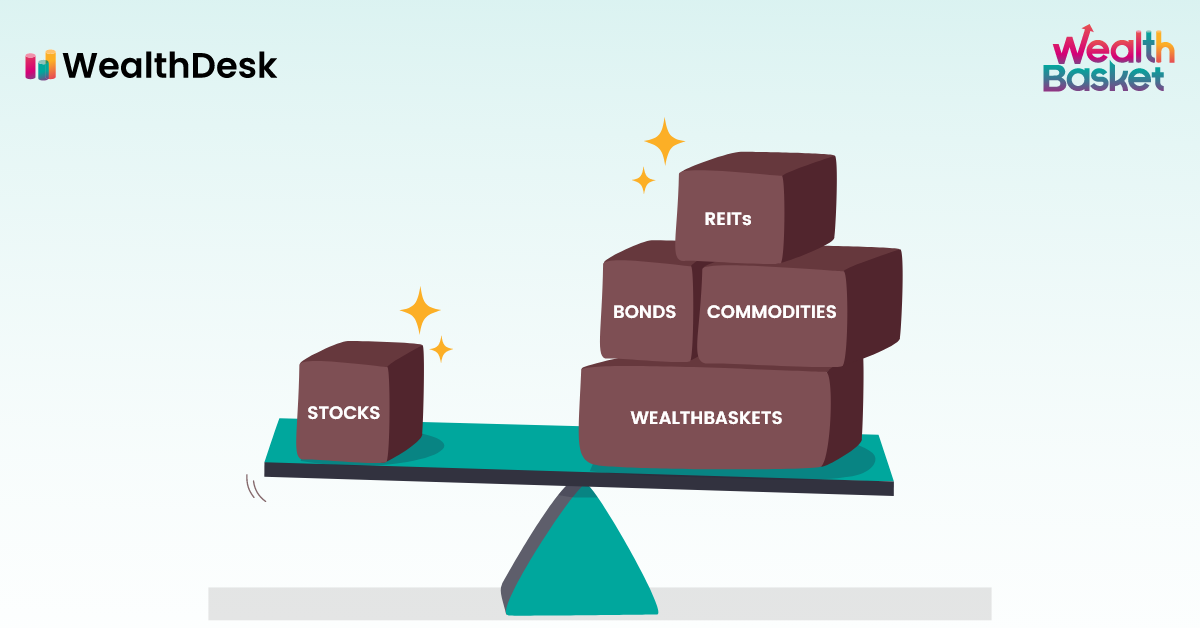

A portfolio diversification includes investing your money across various securities, sectors and other financial instruments. For example, when you invest in stocks, mutual funds, bonds, FDs, and gold, you have diversified your portfolio into equity, debt, and fixed-income instruments.

Diversification also refers to investing only in shares of different sectors which means you have diversified your risk of investing in only one industry. However, portfolio diversification creates a portfolio of securities of varying risk levels. Investing in stocks for young investors could be risky, but they can make their money grow for the long-term with the proper diversification strategy.

So, let’s jump on to another section of the young investors’ guide on portfolio diversification.

How to Diversify the Portfolio?

Portfolio diversification can be as simple as investing in different securities and sectors. However, it is not that simple; you need the right strategy to diversify your portfolio to fetch you better returns. So, let’s get started.

Set the Desired Asset-Mix

To begin with, you need to understand your risk appetite and your financial goals to understand which securities are you willing to explore. It gives you an idea of what asset mix you need to have. For example, if you are ready to take more risks, you may set an asset mix of investing 60% of your savings into equity, 30% debt and 10% gold. Equity is considered as an asset with higher risk, in comparison to debt and gold.

Invest in Stocks Across Different Sectors

Once you have decided on your asset mix, pick a variety of sectors for your equity investment. Let’s continue the same asset mix example where you want to invest 60% of your savings into equity stocks. This 60% should be invested across various sectors such as financial, technology, healthcare, FMCG, etc.

Rebalance Your Portfolio

Once you have invested your money, you need to rebalance your portfolio regularly; it means, if your desired asset mix (60:30:20 in our example) changes due to market fluctuations, you need to bring back again your original asset mix by selling overvalued securities or buying undervalued securities.

Evaluate Your Costs

You can not just keep investing without understanding how much it costs you. There are several charges, for example, Demat account charge, annual maintenance costs, the expense ratio for mutual funds, subscription fees, security transaction tax, brokerage fees, etc. You must check your risk-adjusted returns to understand how much money you get after deducting the costs incurred for it.

Use SIP and STP

Systematic Investment Plan (SIP) and Systematic Transfer Plan (STP) are two crucial modes of investing your money at a fixed amount. SIP allows you to invest in mutual funds or shares at a predetermined date and amount.

Whereas, under STP, you can regularly transfer a fixed amount of your existing investment into another investment on a specified date.

But, Why can’t you stay invested in just one security? Well, let us tell you why.

Importance of Portfolio Diversification

The below points will answer your question, and you will be overwhelmed to see the results once you start diversifying your portfolio.

Increases Risk-adjusted Returns

When you diversify your portfolio, it will help you generate better risk-adjusted returns. This is because your portfolio will perform safer as it is invested across various sectors. So, if the healthcare sector does not perform well, you will have other sectors to save you.

Minimises Risks

Portfolio diversification reduces risk as you have diversified it enough to share the risks of various securities at different levels. When you study the top investors’ portfolios, you will be amazed to see how well diversified their portfolios are.

Stable Market Cycles

Be it either a bearish or bullish market, your portfolio will balance the sudden shocks. When specific sectors do not perform, the price drop of those shares will not affect your portfolio as the shares of other sectors in your portfolio will be performing better. That is how you will have stable market cycles as you invest across industries and securities.

Growth Opportunities Across Sectors

Since you would have covered all critical sectors, you will get enormous growth opportunities across different sectors. Stocks, bonds, funds, gold, you are invested everywhere, and that is what is the key to making your money grow.

Final Words

Investing is nothing without diversification. As young investors in India, if you diversify your portfolio, you will have better returns by the time you turn 35. Remember the stock market success mantra from this young investors’ guide – Portfolio diversification reduces risk, and you are all set to grow your money at an accelerated pace. What if I told you I know a place where you will get already diversified portfolios, and you just need to pick one and simply invest in them.

At WealthDesk, we offer WealthBaskets to help you invest in stocks and ETFs across different sectors carefully curated by SEBI-approved professionals.

FAQs

Usually, a 60:40 ratio is the most common asset allocation across investors whereas, for young investors, more equity exposure is recommended, i.e. more than 60% investment in stocks.

When you invest in a stable company’s stocks offering regular dividends, you will have higher dividend income by the age of 40.

You can start investing in mutual funds and exploring the stock market by investing in equity shares.