Doesn’t matter if the candle goes up or down, the stock market always corrects itself. Some industries outperformed others in 2021 due to the pandemic, while others underperformed. Investors are wondering as to which sector is best for long-term investment as the new year approaches.

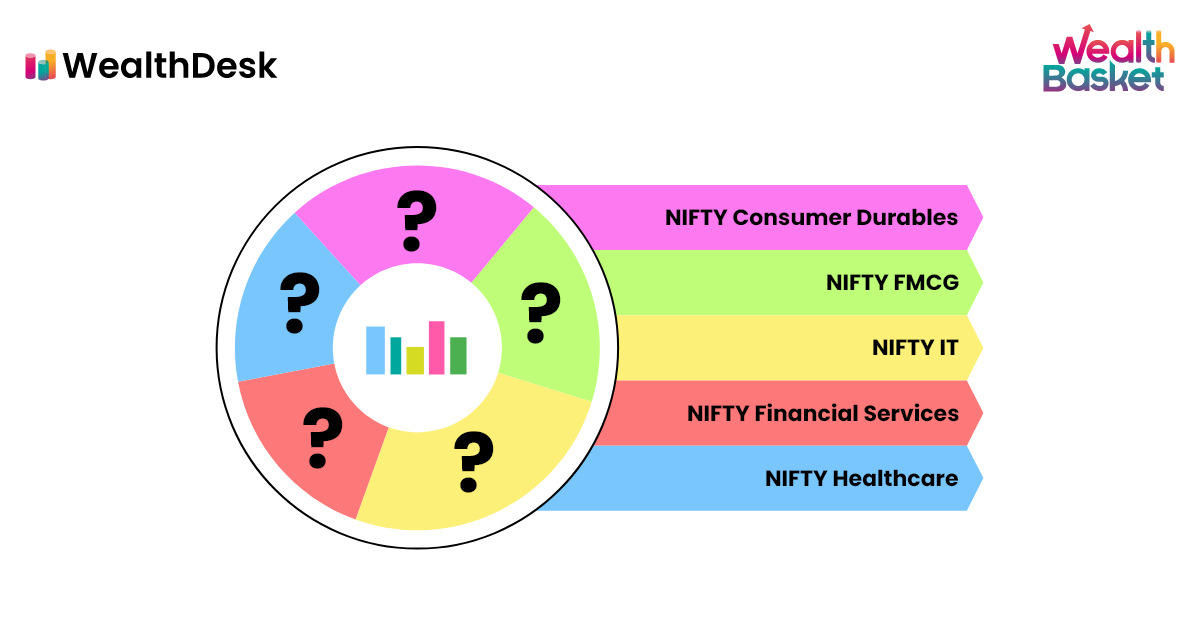

As a result, investors should identify hot sectors to invest in with a high growth potential, a significant market share, and a stable profit margin. Let’s analyze which sector is best for long-term investment.

Telecom Sector

During the global pandemic, one of the essential services and sectors was telecommunications. The trends have highlighted that the telecom sector is most probably one of the best sectors to invest in the share market as well. It has been a critical facilitator in assisting government and healthcare authorities in timely communication, tracking advancements, adopting work from home, and keeping the economy afloat.

Existing consumers’ demand for bandwidth is predicted to increase; telecom will likely continue to be one of the best sectors to invest in the Indian stock market.

FMCG Sector

Consumers panicked in 2020 due to the nationwide lockdown and supply chain issues, especially regarding essential items. The effects of the second wave remain, so consumers may begin to overstock essentials and consumer staples.

Consumer spending on essentials may increase due to uncertainty about the pandemic, boosting FMCG sales. Some of the hot sectors to invest in right now are HUL, Nestle, Dabur, Emami, ITC, and other FMCG firms.

Healthcare Sector

In 2020, the pharmaceuticals industry was one of the best sectors to invest in the Indian stock market, providing considerable profits to investors. There are firm hopes that the sector will remain in focus as one of the top sectors in India in 2021, as demand for life-saving pharmaceuticals and immunity-boosting supplements continues to rise, and people are more focused than ever on purchasing healthcare products.

Lupin, Sun Pharma, Glenmark Pharma, Aurobindo Pharma, and others are prominent participants in this business and are one of healthcare’s best-performing sectors in the stock market.

Technology Sector

The tech industry is at the forefront of innovation and one of the best performing sectors in the stock market. It is also the catalyst for the explosion of data and information. For decades, technology has shaped the economy. Due to continuous research, this tendency appears to continue for a long time.

As compared to manufacturing enterprises, IT companies are growing at a considerably quicker rate. It makes the IT industry one of the top sectors in India. As a result, IT stocks might be considered one of the best sectors to invest in the share market.

Housing Finance Sectors

India is a developing nation. Currently, housing finance looks like one of the best sectors to invest In the Indian stock market. Often categorized as NBFCs, housing finance businesses will play a critical role in India’s growth story. It is, without question, one of the best performing sectors in the stock market. Unlike India’s giant public sector banks, housing financing companies have been performing successfully for some years and will continue to do so.

When compared to PSU banks, they have low NPAs (non-performing assets). Some of the top sectors in India to invest in are Indiabulls Housing Finance, GRUH Finance, HDFC, LIC Housing Finance, and DHFL.

Automobile Sectors

By 2030, it’s safe to claim that the entire world will power electric automobiles. As a result, if you are looking for long-term investment opportunities in India, you may not want to miss out on these future sectors to invest in India.

To summarise, the following are a few companies that could be the best long term stocks in India:

- Among the battery manufacturers are Amara Raja, Exide Industries, and Eveready.

- Metals companies include Hindalco, Vedanta, NALCO (National Aluminium Corp), Graphite India, and Hindustan Copper.

- Automobile manufacturers include M&M, Tata Motors, Maruti Suzuki, TVS Motors, Hero Motocorp, and Bajaj Auto.

Specialty Steel

Domestic steel companies have concentrated on both import substitution and export promotion over the years. It is an excellent long-term sector pick in India. The expansion of the PLI (production-linked incentive) plan to include specialty steel offers this sector a boost.

A cash allocation of Rs 6,322 crore for this scheme over five years has been issued. Coated products, high-strength steel, steel rails, and alloy steel bars and rods are all included in this PLI scheme.

This strategy would help domestic enterprises improve their manufacturing capacities and produce new products in the future sectors to invest in India, promoting import substitution and increasing exports.

An investment guide helps you make better investment decisions, and WealthDesk is here to save the day. With rigorous research, WealthDesk provides a Thematic WealthBasket curated and managed by SEBI-registered professionals based on an investment strategy or idea. This helps in selecting stocks and ETFs that are accordingly weighted following the index. You can now maintain a low-cost, diversified portfolio with a set of professionally created and continuously monitored WealthBaskets suitable for your requirements.

Conclusion

Long-term investments in the best performing sectors in the stock market can help you generate significant wealth and ensure your future security. Many large-cap companies, including Infosys, WIPRO, HUL, and others, have lavishly rewarded their loyal shareholders.

FAQs

According to TradeBrains, the best sectors for long

term investment in the new normal are:

Information

Technology

FMCG

Pharmaceuticals

According to TradeBrains, the best sectors for long

term investment for the next five years are:

Retail

Information

Technology

Telecom

You can use the rule of 72. All you need to do is divide 72 by the number of years you wish to double your money in. This will give you the exact interest rate that will allow you to achieve your target.