You are often told not to put all your eggs in one basket when investing. If anything untoward happened to the basket of stocks, you wouldn’t have to lose all your eggs. That’s the underlying principle of a diversified portfolio.

Diversification is a risk management strategy that may include asset allocation and hedging your bets. If one asset class doesn’t perform, another could make up for it.

However, there are advantages as well as disadvantages to diversification, just like for anything else in the world. In this article, we will look at these to make a more educated decision when you invest.

How do you diversify your investment portfolio?

The ideal strategy for diversified investments is to adopt an asset allocation based on your risk profile. Your risk appetite sets the tone and tenor of your investment.

If you can stomach riskier investments, you can invest a larger percentage in higher risk, higher reward assets. On the other hand, if you are more risk-averse, you need to diversify your portfolio to insulate your investments better.

The key to an insulated investment for a risk-averse investor is to look for different assets that have historically shown other performance trends (probably not in the same direction or to the same degree).

What are the different investment asset classes for investment?

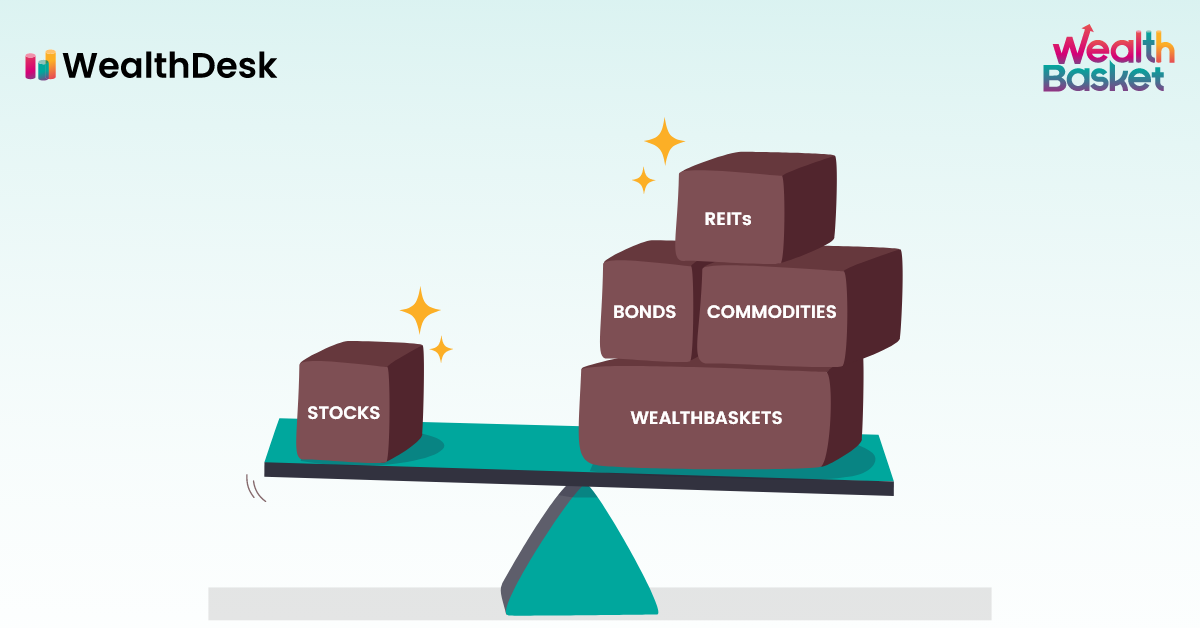

To diversify your portfolio, you can choose from various asset classes. Equities, which usually perform better than most assets, can be further broken down into large, mid and small-cap stocks. Within equities, you can diversify your portfolio further (For example: based on sectors, the scale of operations, etc.).

Other asset classes include fixed income instruments, such as fixed deposits, government bonds, and debentures for a steady income. They are less risky, but their returns are generally lower than returns in equities. Gold, gold ETFs, and real estate are other asset classes you can explore.

Pros and Cons of Portfolio Diversification

Advantages (Pros) of Portfolio Diversification:

- Risk Management

- Align With Your Financial Goals

- Growth Opportunity

Risk Management: When you invest in different asset classes, you mitigate the risk you undertake. For example, suppose your portfolio diversification percentage breakdown was 50% in equities, 10% in gold, 25% in debt funds, and 15% in government bonds.

If the value of your stocks falls, you only stand to make a loss on 50% of your investment to that extent (assuming other assets remain constant). Furthermore, rarely do all investment asset classes don’t perform well simultaneously. Thus, diversifying your portfolio optimises your returns and protects your downside in case markets are volatile.

Align With Your Financial Goals: Diversifying your portfolio helps you invest in different investment instruments for different time horizons. Your investment asset allocation will be based upon when you need to redeem your investments for a goal to come to fruition.

For example, a long-term goal such as paying for your child’s college fees allows you to invest in equities, where you can take on higher risk for higher returns.

On the other hand, paying for your child’s nursery school fees is an immediate goal, for which you can invest in fixed income instruments, which are low risk with an assured income at maturity.

Growth Opportunity: Investing in different asset classes exposes you to growth opportunities in various sectors. For example, having a percentage of your investment in the pharma sector could earn higher returns when certain pharma companies came out with vaccines against Covid-19.

You can benefit from growth opportunities in stocks that fall into various categories based on market capitalisation, such as mid-caps or small-cap companies.

Disadvantages (Cons) of Portfolio Diversification:

- More Investment Means More Mistakes Can Be Made

- Different Rules For Different Assets

- Tax Implications

- Cost of Investment

- Capping Growth

More Investment Means More Mistakes Can Be Made: It is rare to get the best asset allocation for your diversified portfolio. When you try too hard to get the right mix of investments, you tend to risk selecting the wrong investments, which, in turn, could dilute your returns.

Different Rules For Different Assets: Each asset class has a different structure and works differently. If you over-diversify, you risk investing without genuinely understanding the asset and its workings. This could lead to complications and wrongful investments.

Tax Implications: Just like the asset classes work differently, they are taxed differently. Without proper tax planning, you tend to risk additional tax compliance or higher consulting costs with a tax planner.

Cost of Investment: Each asset class has different fees and charges. This needs to be considered when diversifying your portfolio, as the fees could add up and dilute the value of your investments.

Capping Growth: While diversifying reduces the risk while optimising the returns, you stand a chance to lose out on opportunities to earn higher returns when certain assets perform well.

Advantages and Disadvantages of Portfolio Diversification

| Advantages | Disadvantages |

| 1. Risk management2. Align with your goals3. Growth opportunity | 1. Increases chances of mistakes2. Rules differ for each asset3. Tax implications & cost of investment4. Caps growth |

Conclusion

In conclusion, holding a diversified portfolio is potentially more beneficial than holding just one asset. By diversifying your portfolio, you can counter the risk of losing all your money from one bad investment. Also, the losses made from one investment may be made up for by other investments. However, it is equally essential to be cautious not to over-diversify when diversifying.

Carry out a thorough check, ensure the asset allocation is aligned with your financial goals, be aware of the cost of investing, and be mindful of the asset allocation’s tax implication while building your diversified portfolio. This strategy ensures a good combination of equity, debt, fixed income, and liquid investments.

To overcome the challenges of diversifying your investments, you can invest through WealthDesk, a platform for retail investors to invest in portfolios curated by SEBI registered professionals.

Discover stocks that suit certain filter criteria and dive into details to check their WealthBaskets.

Be it a top-down asset allocation, where the macro-economic factors are considered, or you want to build your portfolio with assets that seem attractive and accurate for your needs, investing in WealthBaskets through WealthDesk empowers you to make the right investment decisions.

FAQs

Diversification of a portfolio means that the portfolio holds multiple types of investment assets. A diversified portfolio comprises cash, stocks, bonds, fixed income instruments, mutual funds, property, gold, etc.

A well-diversified portfolio is defined as one that minimises the risk while optimising the returns. This is done by investing in various asset classes to minimise the weight of each asset class within the portfolio.

Diversification of a portfolio refers to investing in various asset classes within a single portfolio. It allows investors to earn higher returns while minimising the risk of investing.

Diversifying a portfolio does help investors to mitigate the risk and reduce the volatility of one’s portfolio performance. With the market and economic factors affecting all asset classes, allocating investments across different asset classes is essential.

If your portfolio has a combination of shares, bonds, cash, and other investment instruments, it is diversified.