Many people think of investing as just allocating capital and keeping track of their investment in the stock market. While that is important, one should undertake many other vital steps on their investment journey. And one of the most essential steps is portfolio diversification.

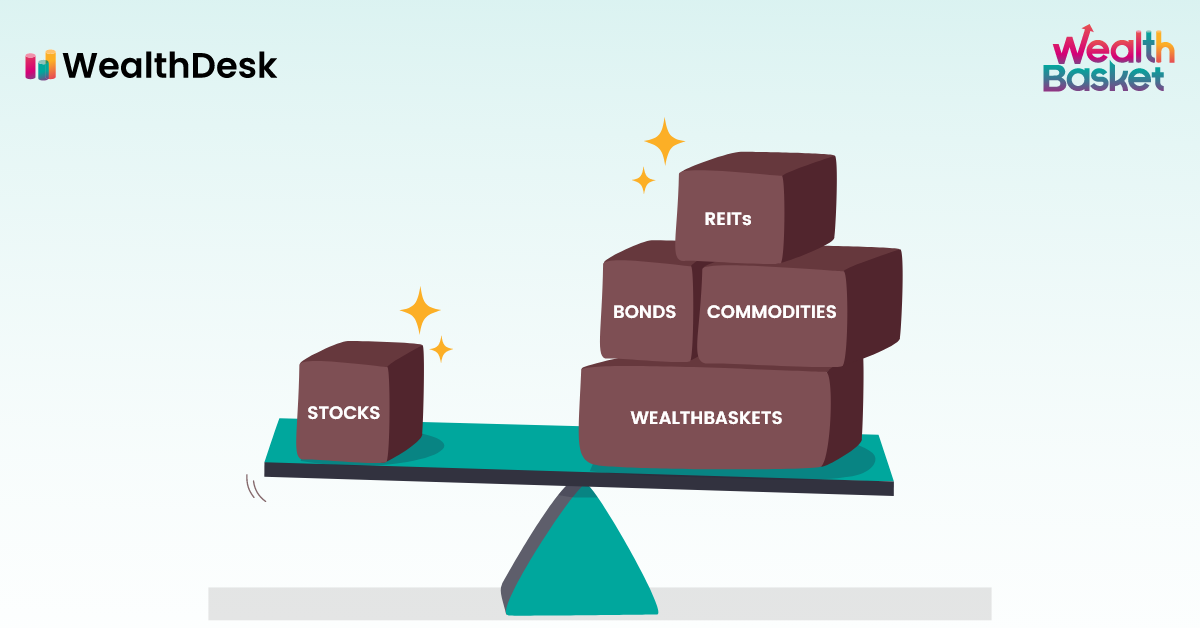

Portfolio diversification means spreading your investments across different assets and asset classes. There are several reasons for diversification but before we explore them, let us look at the steps to diversify your portfolio.

Steps for Portfolio Diversification

To diversify your portfolio, you first need to identify your financial goals, the time you have to accomplish these goals, and your risk appetite. These three factors, along with a few others like age and income, will help you understand which assets you should invest in and how much you should invest. However, your work isn’t done yet, even after successfully allocating assets in your portfolio. You need to keep a close watch on your investments, keep track of their performance, and rebalance your portfolio accordingly. Otherwise, you will not be able to track bad investments and will not meet your goals in time.

Importance of Portfolio Diversification

1. Protects You From Investing Risks

Investing involves a lot of risks. However, it is still necessary to secure your future and beat inflation. To protect yourself from some of these investing risks, you should practice portfolio diversification. By spreading your investments, you protect yourself from volatility in any one sector.

For example, if you have a lot of exposure to stocks, like in the pie chart below, your total losses will be very high if your stock investments fail.

But, if you have moderately high exposure to stocks like in the pie chart below, your total losses will be lesser as compared.

2. Helps you Tap Different Sectors

When you diversify your stock investments, you invest in several different sectors. You never know when one of these sectors will start performing exceptionally well and give you high returns. For example, during the COVID-19 pandemic, the stocks of many drug manufacturing companies shot up. If you had already invested in these companies to diversify, you would have made huge profits.

3. Gives You Higher and Consistent Overall Returns

Historically, the stock market is very volatile. So, just investing in stocks can not give you consistent returns on your investment. Moreover, investing in safe assets like fixed deposits gives you meagre investment returns. But if you invest in different asset classes, you can ensure you get significant and consistent returns.

4. Provides Liquidity

People often stick to safe investment options like fixed deposits or public provident funds. While these investments are safe, they have lock-in periods. So if you try to cash in on these during an emergency, you will have to pay a fine. One main advantage of portfolio diversification is that you can invest in a few liquid investments along with these safe investments, which will allow you to get cash quickly whenever you need it.

Complications of Portfolio Diversification

While there are many advantages of diversification, it is simply not everyone’s cup of tea. If not done correctly, it could also cost you money. This is why a large amount of the Indian population sticks to putting their money in fixed deposits or employer-provided retirement funds. But these investments are not always enough to beat inflation and build a retirement fund.

So, consult a professional if you want to diversify your portfolio but don’t want to spend a lot of time and effort doing it. This has now become easier than ever before. You can just go online and select a website that provides financial consultancy services. WealthDesk is one such platform that helps you with portfolio diversification by allowing you to choose a mix of equities and ETFs.

Conclusion

Portfolio diversification is essential as it helps you counter one of the biggest disadvantages of investing: the risk factor. By diversifying your portfolio, you can also be at peace, knowing that at least some of your investments will give you returns if the market is not entirely favourable. Further, if you decide to use the services of a professional, investing may become even simpler and offer better returns.

Discover stocks that suit certain filter criteria and dive into details to check their WealthBaskets.

FAQs

Over diversification can lead to over-complication. If you have exposure to too many assets, managing all of them can be hectic. Also, diversification can lower returns as all parts of your portfolio may not give high returns.

If your financial goals require high returns, you might need high exposure to assets with higher expected returns, and if you are a conservative person, you might need a portfolio that has lower expected risk. A well-diversified portfolio will get you closest to both requirements.

A portfolio can be considered well-diversified if it gives the investors exposure to different assets and asset classes, and the portfolio suits the investor’s risk profile and financial needs.

Diversification refers to spreading your money across various investments in different asset classes so that the exposure from any single investment or asset class is lowered.