Earning wealth is not enough. Making it grow by making investments is essential. Surprisingly, even some high-net-worth individuals (HNIs) are confused about portfolio diversification. You may have made good investments, but you need to understand the parameters leading to diversification. A diversified investment can help you keep your peace even during an economic downturn.

If you want to benefit more from your investments, you must be aware of diversification methods. By way of diversification, you can spread your investment to limit exposure to one type of asset. Through this practice, you can reduce the volatility of your portfolio over time.

What does it mean to diversify your portfolio?

When you diversify your portfolio, you are lowering your exposure to the few assets you own. By holding multiple assets across different sectors and asset classes, an investor can limit the risk from a single asset, asset class or sector.

Suppose, a stock you were holding falls by 30%. If you were holding only that stock, you would lose 30% of your total investments. However, if you were holding other independent assets as well, you will lose only 30% of the investment in that particular stock.

Discover stocks that suit certain filter criteria and dive into details to check their WealthBaskets.

What is the importance of portfolio diversification?

The fundamental importance of portfolio diversification is to minimise risks related to investments. The investment explained here is a particularly unsystematic risk or specific risk.

Specific risk is concerned and related to any specific company or market segment. Diversified investment decreases this risk and protects your investments from getting affected the same way as market uncertainty.

For example: during the COVID-19 pandemic, people are making most of their investments in the pharmaceutical sector. However, it is unwise to make your investment only in one sector. You can diversify your investment in real estate too.

Why do you need diversified investment?

The reasons for having a diversified investment are:

- Reduces the risk of loss

- Increases your ability to stay in the market and helps to survive market downturns

- Improves your risk tolerance

- Protects you from suffering heavy loss

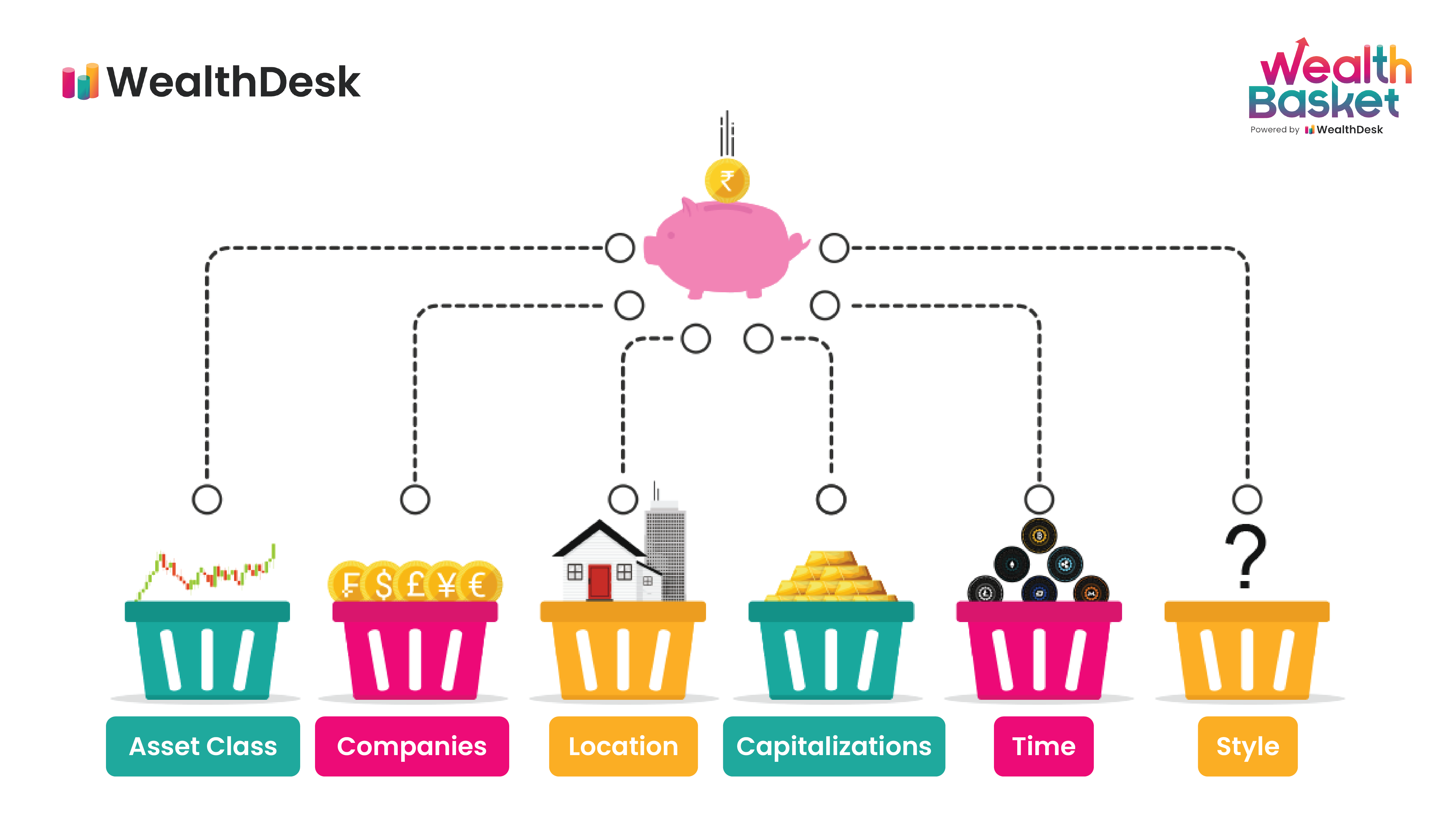

What are the 6 types of diversification?

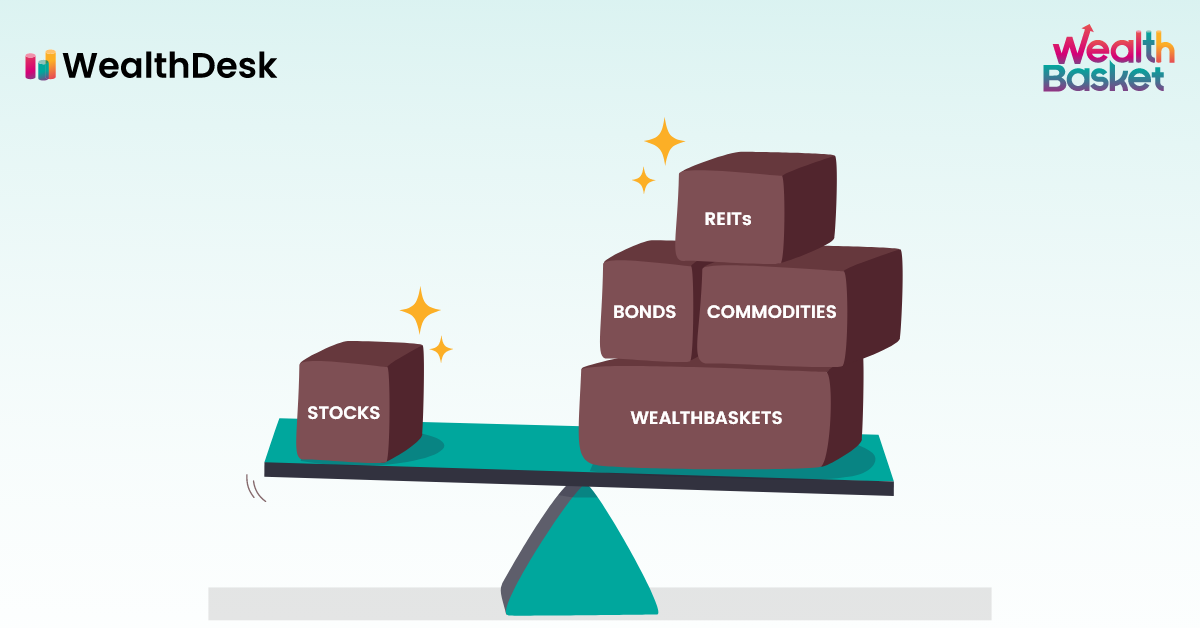

Portfolio diversification does not mean investing in different mutual funds. It is asset allocation, dividing investments into different sectors or industries. You must have a well-planned diversification strategy before making investments.

If you are wondering how you can diversify your portfolio in India, taking a look at the following types of diversification will help you:

1. Diversify across different asset class

You must diversify your investment in different asset classes such as mutual funds, stocks, debt products, real estate, gold or silver. In addition, you must plan a diversification growth strategy if you cannot handle the risk of one asset class.

2. Diversify across different instruments or companies

Investing your money in a single asset class but different types of companies is like diversifying your assets in varied instruments. An example of this type of investment is making fixed deposits but in different banks. The portfolio diversification percentages should be the same here.

3. Diversify your investments in global

Portfolio diversification of investments can be done based on geography. For example, you can invest in US or Indian stock markets. Investments can also be made in real estate in India. In location-wise investments, you can also benefit from currency fluctuations.

4. Diversify across different companies or capitalisations

Whenever you invest in mutual funds, you can make diversified investments in big companies or small companies or small funds etc. The risk vs returns will be different as you invest in different companies.

5. Diversify choosing a different time span

You can choose to make investments across time too. Either it can be long term investments or short term investments. In the case of FDs, you can have a five-year deposit or for just six months. This type of investment can affect your liquidity.

6. Diversify across style

This type of diversification is made across styles. You can have a diversification growth strategy that will help you get a fixed income. The risk aptitude also depends on the level of risk you are willing to face. This can depend on your cultural or financial background. For example: If you are financially stable, you can afford to take more risks to get a higher return on investments.

Takeaway

The primary reason for diversification is to get an opportunity to earn more and to reduce the risk of a portfolio. Hence, it is better to start early to have more time to reach your goals. However, diversification of investment does not assure you profit at all times.

However, it is still possible to lose money. Therefore, even after following the process, it is not possible to eliminate all risks.

However, a proper diversification strategy will lower the risks of losses to a minimum. Therefore, try to prepare a diversification growth strategy to earn good returns without worrying about losses.

With WealthBaskets, you can achieve diversification easily and at lower costs. The WealthBaskets consist of ETFs and stocks selected by leading SEBI registered advisors. The investors also get updates whenever there is a rebalance suggestion to maintain risk and return objectives.

FAQs

You can build a diverse portfolio in the

below-mentioned ways:

• Spread

your wealth in different sectors and fields.

•

Consider bond funds or indexes.

•

Know when you must exit.

•

Keep an eye on commissions.

•

Keep building your portfolio.

The primary components of a strong portfolio are effective diversification that should be beyond asset allocation, active management, cost efficiency and tax efficiency.

By portfolio diversification, it means picking a range of assets to minimize all your risks and maximizing your potential returns. A good investment portfolio usually includes potential growing stocks, investments like index funds, bonds as well as bank accounts.

To build a strong stock investment portfolio, you

need to follow the below-mentioned steps:

•

Decide the amount of help you need.

•

Select an account that will work towards your

goals.

• Based on your risk

tolerance choose your investments.

•

Determine the best asset allocation for you.

•

Rebalance all your investment portfolio as per your

needs.