What is Inflation?

Inflation means the gradual increase in the rate of prices over time. It causes the purchasing power of the currency to reduce over time. For instance, if Rs. 20 would get you 2 kgs of tomatoes in 2010, it will only get you 1 kg of tomatoes a couple of years later. So, the value of Rs. 20 gradually declines.

Causes of Inflation

Inflation could result from multiple factors. Here are a few causes of inflation:

- Disbalance in demand and supply: Certain goods and services sometimes experience high demand. This could be due to an increase in need or a new trend. If the manufacturing companies cannot keep up with these demands, supply decreases. This decrease in supply further increases the value of the limited items available in the market, making them costlier. This is called demand-pull inflation.

- Increase in wages or material prices: An increase in the salaries of workers or the cost of essential materials could also cause the prices of commodities to shoot up. This is called cost-push inflation.

- Excess supply of money: During times of crisis, the government often reduces banks’ interest rates to allow people to borrow money more freely. However, suppose these low rates continue for a long time. In that case, it puts too much cash in people’s hands, increasing demand and leading to inflation.

Effects of Inflation

The effects of inflation could be widespread. For example, inflation can erode the value of a currency and increase borrowing costs. Cost-pull inflation could also increase operating costs for companies, forcing them to lay off people and thus increase unemployment. Inflation could also have a massive impact on your investments and portfolio. If you don’t adjust your portfolio according to the inflation rate, your returns on investment could decline in real terms.

Given below are a few ways in which you could beat inflation to secure your future.

How to Beat Inflation

Inflation poses a massive risk to your investments and savings. You could only counteract these risks by putting your money in assets that give you higher returns. One of the best inflation-beating investments is the stock market. According to research, equities outperform inflation around 90% of the time.

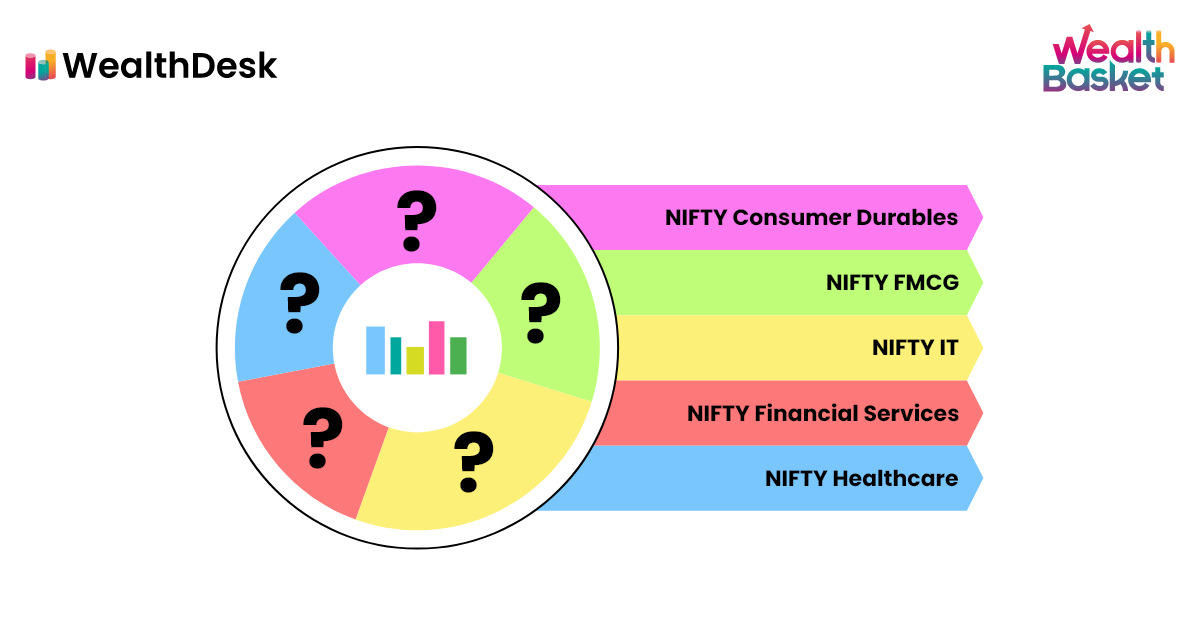

To learn how to optimize your stock portfolio for inflation, you must start by learning about the sectors that have outperformed inflation. You need to understand which sector will grow in the future in India and invest in that. According to Motilal Oswal, the top sectors in the stock market in 2021 are banking, infrastructure, IT or tech, pharmaceuticals, and chemicals.

Research also shows that financial firms and consumer good companies can be inflation-beating investments. This is because these two sectors have a high growth rate. They are also primarily not badly impacted by inflation, as they could pass on most of the increased costs to customers. This way, their profits aren’t affected. So, these could be the best stocks for inflation-beating returns.

Real estate and energy sector investments in Indian stock markets have also shown inflation-beating returns in the past. Equity REITs have outperformed inflation 67% of the time, while the energy sector has outperformed inflation 71%.

Conclusion

Investing in equities could help you beat inflation and grow your wealth considerably. However, it is also perilous. You need to know the top sectors in the stock market and invest accordingly. However, such sector-wise investment in India is complex. You have to evaluate all the stock market sectors and pick a few that will perform the best. You may not have the knowledge or the time to do this. In such a case, you should take the help of a professional. Nowadays, many websites can help you make such decisions. One such site is WealthDesk, which enables you to invest in diversified portfolios for both long-term and short-term. Financial experts registered with SEBI and associated with WealthDesk help you invest in stocks and ETFs that can allow you to meet your future financial goals. So, you no longer have to be scared of inflation.

FAQs

You should avoid investing in corporate or government bonds during times of inflation. The price and the rate of interest that these bonds provide fluctuate a lot in such times. So, they should be avoided. Investing in growth stocks or stocks of companies that provide high earnings is also risky in times of inflation.

Yes, historically, gold has been considered as a hedge against inflation. This is because the value of gold generally increases with time, unlike that of currency. So, it is regarded as a haven asset that you can sell whenever you need and get a good return on your investment.

There is no particular amount that you should be saving to beat inflation. Most experts suggest that you should invest 10-20% of your after tax salary. But during times of inflation, you should save a little more, around 25%. This will help you create a sufficient pool of funds that can secure your future.

A marginal increase in inflation is usually good for

stocks as most investors start investing more in the

stock market to get better returns. However, very

high inflation sustained over a long period can be

bad for stocks, especially value and growth stocks.

It is because long-term inflation erodes a

company’s profits, directly impacting your

investment in the company.