Broadly speaking, there are 12 sectors in India, including banking, automobiles, fast-moving consumer goods (FMCG), etc. But which sector should you invest in? It is unlikely that all sectors will grow at the same pace in a certain period. Some sectors might give higher returns, while others might fall in value.

If you invested in the best-performing sector from 2011-20 at the start of this investment period, you would have more than quintupled your initial investment amount.

This blog explores the best-performing sectors of 2011-20, how they have performed since, and whether past performance can be indicative of future results.

Top performing sectors in India for 2011-20

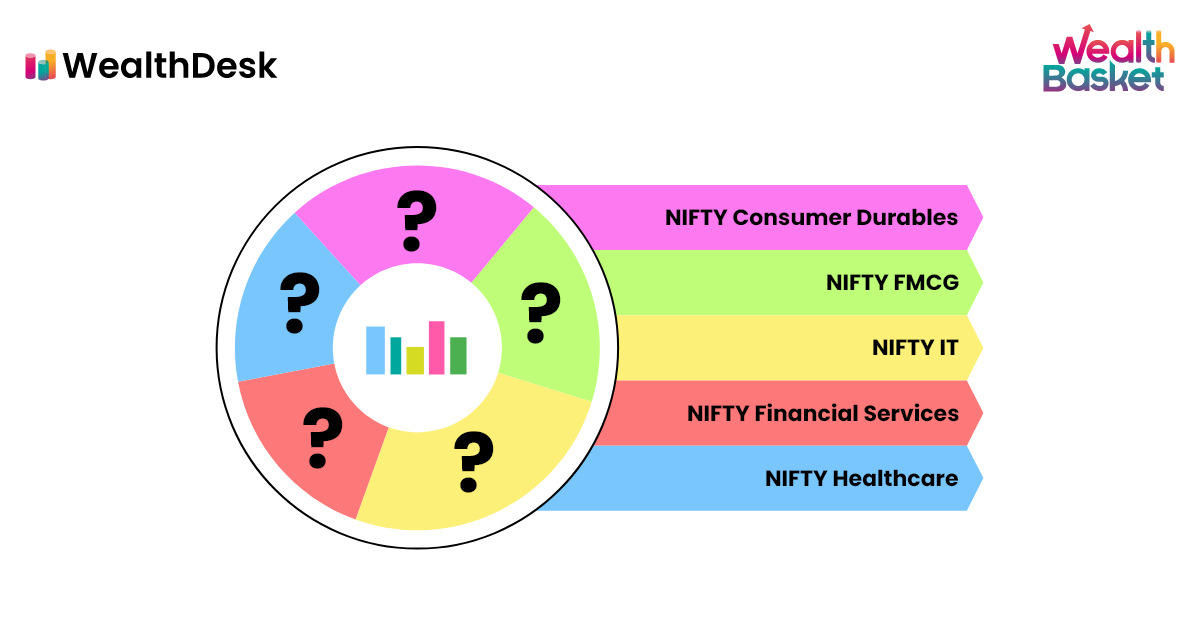

We will be considering the compounded annual growth rate (CAGR) for the following NIFTY sectoral indices:

- NIFTY Auto

- NIFTY Bank

- NIFTY Consumer Durables

- NIFTY Financial Services

- NIFTY FMCG

- NIFTY Healthcare

- NIFTY IT

- NIFTY Media

- NIFTY Pharma

- NIFTY Realty

Top 5 Sectors From 2011-20

Looking at the sector-wise performance of the Indian stock market for 2011-20, we can see that consumer durables and FMCG sectors were the best sectors to invest in.

After the housing bubble burst in 2008, the world entered a low-growth period we now know as the Great Recession. India was not unaffected by this and went through a period of low growth during 2011-20.

During such periods, job security and expectations of an increase in income are low. This is why there might be a low demand for real estate during periods of low growth. Thus, the CAGR for NIFTY Realty was negative for 2011-20.

But demand for fast-moving consumer goods (FMCGs) is typically not affected by economic conditions. FMCGs include food products such as meat, dairy products, toiletries (e.g. soap, shampoo, toothpaste, etc.), and personal care products, most of which are necessities.

On the other hand, consumer durables include TVs, fridges, ACs and washing machines. Consumers demand TVs for entertainment and fridges to store food. The demand for consumer durables is derived from other products. As consumption demand remained strong in 2011-20, consumer durables too benefitted from this.

Should you invest only in the best-performing sector of the last decade?

The short answer would be no. Which sector would be the best performing sector in the stock market depends on various factors that can be specific to sectors or the whole market in general, and these factors can change.

If we look at the best performing sectors, but this time from the start of 2021 to the end of August 2022, we can see that consumer durables could not retain its position as the best sector in India to invest in.

CAGR of top performing sectors from the start of 2021 to the end of August 2022

One of the reasons why the realty sector performed well since the start of 2021 was because it had been struggling due to the economic slowdown that affected the Indian economy since 2018, the introduction of RERA (Real Estate Regulatory Authority) and GST, and the demonetisation.

In 2020, equity valuations fell due to the COVID-19 pandemic and the lockdowns it caused. The realty sector was no exception, recording returns of just 5.12% in 2020. According to ANAROCK’s data, housing sales fell 47% on a YoY basis in 2020 across the top 7 cities: Delhi-NCR, Mumbai Metropolitan Region (MMR), Bengaluru, Hyderabad, Pune, Chennai and Kolkata.

Thus, the realty index benefitted from having a low base. In 2021, the situation became favourable for the realty sector as home loan interest rates were low due to RBI keeping the repo rate low, foreign direct investments (FDI) were high, and various state governments cut stamp duty for a limited period.

As a result, the NIFTY Realty Index grew 54.26% in 2021. Even though in 2022, the realty sector suffered setbacks due to high inflation, interest rate hikes and uncertainties bred by the Russia-Ukraine war, Nifty Realty Index remains the best performer from the start of 2021 to the end of August 2022.

Final Thoughts

We have seen that the best sector in India to invest in now might differ from the best performer in the last decade. A sector’s performance depends on various factors like the current phase of the economic cycle, sector-specific factors, and global economic conditions. All these factors can change; thus, the best-performing sector might differ for different periods.

If you want to concentrate your investments in a particular sector, consider WealthBaskets, combinations of stocks and ETFs managed by SEBI registered professionals. Each WealthBasket has a certain investment theme and strategy. At WealthDesk, you can find WealthBaskets that focus on specific sectors.

FAQs

In 2022, the Indian economy has been affected by interest rate hikes worldwide, high inflation, high crude oil prices and the repercussions of the Russia-Ukraine conflict. In such a situation where there is a lot of uncertainty, typically, necessity goods companies do better than others. In the first 7 months of 2022, the NIFTY FMCG index has grown by 13.06%.

According to government estimates, the financial, real estate and professional services sectors had the highest Gross Value Added (GVA) in 2022. However, the agricultural sector provides employment for the highest number of people.

According to government estimates, in FY 2022, the mining and quarrying sector experienced the highest growth in Gross Value Added (GVA) at 57.9%. In the same year, the construction sector showed growth in GVA of 30.7%.

Industries that produce goods and services necessary for a person to survive in today’s world will always be in demand. These industries include food, education, healthcare and pharmaceuticals.