Do you ever feel like understanding the bond market is like solving a jigsaw puzzle with missing pieces? If so, you’re not alone. Many individual investors struggle to fully grasp the shifting dynamics of the bond market, its long-term significance, and its essential role in a balanced portfolio.

In this blog, we will clarify all the doubts you might be having about bonds and make you understand the role of bonds in your portfolio.

What are bonds?

Bonds are fixed-income instruments that represent a loan made by an investor to a borrower (typically a corporation or government). The borrower promises to repay the principal amount of the loan at a later date, along with a series of interest payments along the way.

Let us understand this with a simple example,

Imagine you’re lending money to a friend. You give your friend ₹1000, and your friend promises to pay you back in one year.

To thank you for your help, your friend also agrees to give you an extra ₹50 every month until the year is up. At the end of the year, your friend gives you back the original ₹1000 you lent them.

In this example, you’re the investor, your friend is the borrower, the ₹1000 you gave your friend is the principal amount of the loan, the extra ₹50 your friend gives you each month is the interest, and the promise to pay you back in one year is the bond.

The total income you receive is fixed – you know you’ll get ₹50 per month, plus your original ₹1000 back at the end, hence the term “fixed-income instrument”.

Key Features of Bonds

Here are some key features or terms which you should know about bonds

Face Value/Par Value

The amount of money the bond issuer promises to pay back to the bondholder when the bond matures. This is also the amount on which the issuer pays interest.

Coupon Rate

This is the interest rate that the issuer agrees to pay the bondholder annually. It is usually expressed as a percentage of the face value.

Maturity Date

This is the date on which the bond issuer must repay the principal or face value back to the bondholder. Bonds can have short, medium, or long-term maturities, ranging from less than a year to more than 30 years.

Issuer

This is the entity that is borrowing the money and is obligated to pay back the principal and interest. Issuers can be corporations, municipalities, or governments.

Market Price

The price at which the bond is currently trading in the market. This can be more or less than the face value, depending on factors such as changes in interest rates, the creditworthiness of the issuer, and the length of time until maturity.

Yield

The return an investor realizes on a bond. When the market price changes, so does the yield. If the price of a bond goes up, its yield goes down, and vice versa.

Credit Quality

The ability of the issuer to repay the bond’s face value at maturity and make all coupon payments. Rating agencies assign ratings to the issuers to help investors assess this risk.

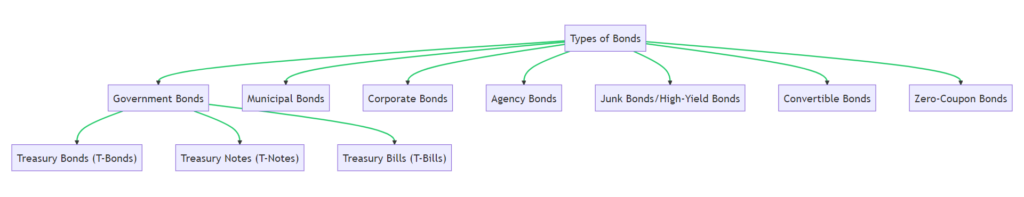

What are the different types of bonds?

There are several types of bonds, each with their own risk levels, structures, and advantages:

Government Bonds

Issued by national governments, these bonds are considered very safe since the full faith and credit of a country backs them. These include:

| Treasury Bonds (T-Bonds) | These are long-term securities with maturities of up to 30 years. |

| Treasury Notes (T-Notes) | These have shorter maturities, typically between 1 and 10 years. |

| Treasury Bills (T-Bills) | These have the shortest maturities, up to 1 year. |

Municipal Bonds

Issued by state, city, or county governments to finance public projects, such as infrastructure improvements. They are generally tax-exempt and offer lower yields than other bonds.

Corporate Bonds

These are issued by corporations to fund business operations, expansions, or acquisitions. They often pay higher interest than government bonds but also carry a higher risk of default.

Agency Bonds

These bonds are issued by government-sponsored enterprises (GSEs) and federal agencies. While they’re not fully guaranteed by the government, they’re considered very safe.

Junk Bonds/High-Yield Bonds

These are bonds issued by companies with lower credit ratings. They offer higher interest rates to compensate for the higher risk of default.

Convertible Bonds

These bonds can be converted into a predetermined number of the issuer’s common shares. They offer the potential for capital appreciation if the company’s stock price rises.

Zero-Coupon Bonds

These bonds do not pay regular interest. Instead, they’re issued at a discount to their face value and mature at that face value.

Why consider bonds for investment?

Investors frequently gravitate towards equities due to the lure of higher returns, but bonds – or fixed income securities – represent a critical piece of the investment jigsaw puzzle. When investing in bonds, one essentially lends money to the issuer, be it a government or a corporation, who, in turn, promises to repay the principal amount along with interest over a certain period.

Bonds might not offer the sky-high returns associated with equities, but they provide a layer of stability, cushioning the portfolio against severe market downturns. This is primarily because bond prices typically increase when interest rates fall, a common occurrence during economic recessions.

What are the benefits that bond investments offer?

Imagine you’re planning a road trip. You need a car that’s reliable, efficient, and can handle all sorts of terrain. That’s the role bonds play in your investment journey. They’re like that reliable car that drives you towards your financial goals, serving various purposes like:

Income Generation

Bonds, often known as fixed-income securities, offer a regular source of income through interest, known as coupon rates. This consistent income can be used to patiently plan for bigger financial goals.

Capital Preservation

Consider bonds as your ‘Mr. Dependable’. They’re the slow yet steady players, always there for you, ensuring your capital is safe and offers secure returns. Just like you would keep an umbrella handy for rainy days, bonds act as a safety net for your funds, providing you with assurance and reliability.

Inflation-proof Income

Remember your grandparents telling you how they could

manage an entire month with just ₹100. But can you do

the same today? Of course not, and that’s because

inflation

is at work, and bonds may help you fight it.

Inflation-protected bonds offer you returns adjusted to

the rate of inflation, ensuring your purchasing power

remains intact in the future.

(NOTE: Not all bond

offerings are inflation-protected)

Hedge against Economic Slowdown

Remember the seesaw games from your childhood? Sometimes you’re up, and sometimes you’re down. Bonds and stocks work similarly. Bonds help balance your portfolio, acting as a safety buffer when the stock market is going through a rough patch.

How to build a diversified portfolios with bonds?

You can follow this checklist in order to create a diversified bond portfolio for yourself which can stand the test of time.

Assess Your Risk and Goals:

Understand your risk tolerance and financial objectives to guide your bond investment decisions.

Include Different Types of Bonds

Include different types of bonds such as government, municipal, and corporate bonds to spread risk in your portfolio.

Vary Bond Maturities

Choose bonds with different maturity dates to manage interest rate risk.

Consider Bond Funds or ETFs

These provide instant diversification and are managed by professionals.

Rebalance Regularly

Keep your portfolio aligned with your goals by periodically adjusting your bond holdings.

Monitor the Market

Stay updated on economic and interest rate changes as they can influence bond values. Be prepared to adjust your portfolio accordingly.

Final Thoughts

In the grand theatre of financial investments, while equities may grab the limelight, bonds silently perform their critical role. They mitigate risk, provide a steady source of income, offer liquidity, and help maintain a balanced and diverse investment portfolio. By incorporating bonds, investors can better navigate the financial markets, weathering volatility storms and steering towards long-term growth.

FAQs

A bond is a type of fixed-income investment where an investor lends money to an entity (typically corporate or governmental) which borrows the funds for a defined period at a fixed interest rate.

Bonds play a crucial role in your portfolio by providing stable income, preserving capital, offering inflation-proof income, and acting as a hedge against economic slowdowns.

Bonds are generally less risky than stocks and provide predictable, regular income, making them a safe bet during economic downturns.

Inflation can erode the purchasing power of your bond’s returns, but there are inflation-protected bonds that adjust their returns according to the inflation rate, ensuring your purchasing power remains intact.

Bonds bring stability and resilience to your portfolio, helping to mitigate risks associated with other investments, like equities, which might be more susceptible to market volatility.

The allocation to bonds varies depending on an individual’s risk tolerance, investment goals, and time horizon. However, a common rule of thumb is to have a proportion of bonds that matches your age (i.e., if you’re 30, then 30% of your portfolio should be in bonds).

While holding cash might seem risk-free, it doesn’t keep pace with inflation. Bonds, on the other hand, provide better returns while offering a steady flow of income and capital preservation.

A coupon rate is the annual interest rate paid by the bond’s issuer to the bondholder. It is typically expressed as a percentage of the bond’s face value.

Inflation-protected bonds, or inflation-linked bonds, are types of bonds that adjust their returns to the rate of inflation, thus protectingInflation-protected bonds, or inflation-linked bonds, are types of bonds that adjust their returns to the rate of inflation, thus protecting your money’s purchasing power. your money’s purchasing power.

Capital preservation refers to an investment strategy where the primary goal is to protect the initial capital or the amount invested from potential loss, which is one of the significant benefits of investing in bonds.