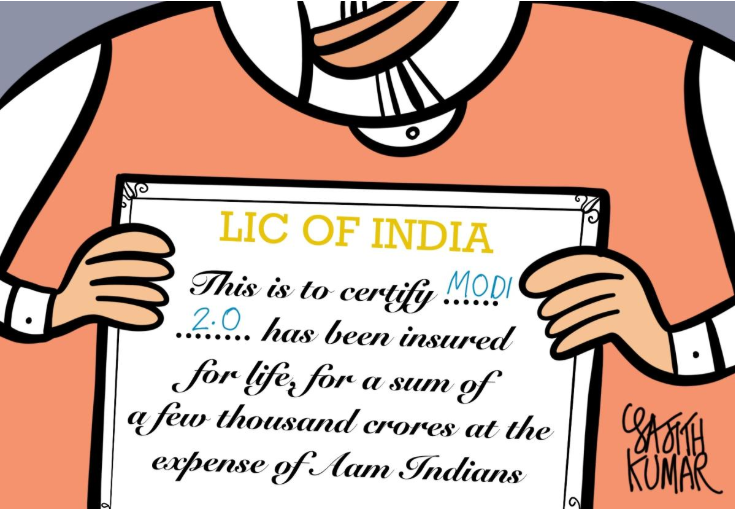

A Big Move: Taking LIC public with an IPO could prove to be one of the Modi govt’s better decisions

The Narendra Modi government’s decision to divest from the life insurance behemoth Life Insurance Corporation of India (LIC) through an Initial Public Offering (IPO) might have come as a desperate move at a time the government is staring at a gaping hole in its fiscal position — partially due to contraction in the direct tax mop-up and partially because of the government’s fiscal math having gone haywire. Consider the context: Even as the government reduced its revenue targets for this year by 3%, it still expects its annual mop-up to jump by 16.6% for the full year, which seems unlikely. And for the next fiscal, the government has toned down its expectations, projecting the total receipts to jump by only 12%. Still, the LIC move may prove to be one of the better decisions by this government.

The decision to divest from LIC is in line with the ‘maximum governance, minimum government’ and the “government has no business to be in business” mantras. Set up under the LIC Act of 1956, the insurance giant is a statutory corporation owned by the government and may need to be converted into an independent commercial company before getting it ready for a public issue.

There are many issues to be tackled along the way. LIC and the way its policies and investments are administered is largely a black box and investors and the insured have little or no access to information. The culture of ‘bonus’ on policies, for instance, is largely at the whims and fancies of the company (which grew up in the protectionist era).

Some 300 million LIC policyholders currently enjoy a sovereign guarantee on policy benefits. The issue of the continuance of that guarantee will have to be dealt with.

Read more at: https://www.deccanherald.com/specials/sunday-spotlight/lic-ipo-desperation-or-masterstroke-802968.html

But the world has changed. For 14 years, pensions have moved to a defined contribution universe, along with EPFO (Employees’ Provident Fund Organisation) diversifying away from government debt into equity markets.As such, the government, too, has little interest in holding onto stakes in large (or even smaller Public Sector Undertakings) and is itself heading to public (and foreign) markets — with aggressive divestment targets and a larger signal towards public market fundraising through instruments like Sovereign Bond ETFs (exchange-traded funds).

Implications for the government

Leaving aside the timing (this is again in the issuer’s hands and the government appears to be in no tearing hurry to file for the IPO), companies which have either a legal mandate or a significant competitive advantage, have been a small but important source of fundraising. The CPSE ETF is a well-entrenched investment instrument with well-oiled machinery. Such public holdings (along with Bharat Bond ETF — the jury is still out on this one) have a significant role in easing government finances by diluting equity and providing these firms with access to public debt markets to directly raise monies.

And once that cat is out of the bag, there is little that future governments can do to overtly influence the LIC’s functioning, except to re-nationalise it, which, for the foreseeable future, appears unlikely. In fact, post-IPO, LIC quite likely will see incremental dilution through direct share sale or through new ETFs and tranches of existing ones.

As the ETFs start to trade well, there will be a better price discovery. With better pricing and liquidity, the LIC, and PSUs in general, will be in a far better position to manage their balance sheets and, more importantly, function without the need for either government assistance or bailout. The government, therefore, would benefit both from the divestment itself as well from making the organisation self-sustaining which, in turn, would add value to residual government holding. There are larger issues around transparency for a government-owned organisation.

Corporate Governance:

Sooner or later, this will come to the fore as investors, customers and indeed vendors start to demand periodic updates. Today, especially for LIC customers, other than the pure term insurance buyers, there is no way of discovering what they stand to gain (or even a formula thereof) on maturity, for the annual/periodic/one-time premium payment. Furthermore, there aren’t clear options for shifting to more secure pools. Going public, with greater scrutiny on risk management (at the organisational level) and service, all stakeholders — the government (and shareholders), policyholders, vendors — stand to gain, and not just within the existing scheme of things.

Financial and Equity Markets have a peculiar problem. When the EPFO investment limits were hiked (to 15% of additional flows into Equity ETFs), and with India’s growing GDP, there has been a dearth of large sinks for investment. The result of that has been zooming headline indices with astronomical valuations, with the rest of the cap table languishing in the shallows. The addition of a large company releases some of this pressure and provides both institutional and individual investors with another avenue. Not just enhancing the diversity in existing indices, the debut of a significant firm will also spawn a series of passives, offering different slices of the stock market to suit their preferences and improving areas directly connected with LIC’s business of retirement planning, regular saving as well as developing core technologies for more efficient management. It will be ideal for passive investors or those looking at India allocations.

The implication for a well-managed publicly owned LIC is far greater than mere corporate accountability. Domestic public ownership also serves to open the company for stripping some functions and aligning itself with the global model of the asset as well as asset manager diversification. It opens the asset management business to institutional mandates which are all currently handled in-house.

Benefits will accrue near-shore in the overseas markets. With the advent of a large firm on the stock market, most of the indices, which are India-centric or with an India component, will reset to account for additional weight. Indirectly, those companies at the lower end of the indices which, by virtue of relative size, move to other indices, impact the flow in those as well. These will indirectly drive capital flows to India. Such or other direct/indirect foreign ownership of companies also results in compliance with other financial market regulators.

Govt, RBI and Money Markets:

While Indian interest rates remain high, and cutting rates is an option, inflation has put paid to that party. There now needs to be a balancing act for generating revenues to stave off the dreaded stagflation.Instead of multiple divestments (for example, CPSE tranches), which add a billion or two to the kitty, a larger offering serves to increase government spending without necessarily upsetting the interest/inflation balance.

While this and other initiatives by successive governments as well as DIPAM are great overall, they do face hurdles in terms of existing staffing contracts and agreements, etc. The process of valuing the company and setting the terms for its IPO will take at least four to five months. And even when this is done, the government will have to wait for the right market condition to put this behemoth on sale.

As if these processes weren’t enough, the government will have to counter the rhetoric of ‘family jewel being sold’, which has gripped the country after the LIC divestment was announced. It would also have to carefully negotiate will the employees of LIC, who are already on the streets opposing the divestment plan.

Doing away with tax exemptions, as has been done in the Union Budget, may also impact the sale but broadly these, like in any other sale, are merely problems to be solved if the nation is to realise the real value for publicly supported assets.But there is a catch: The Finance Ministry expects its mop-up from the investments to surge three times next year to Rs 2.1 lakh crore — mostly on the back of the LIC divestment plan. This is despite the fact that the government was forced to revise downwards its divestment targets for this year by 38% — primarily because of two big-ticket disinvestments (Air India and BPCL) not likely to take off soon. But the LIC sale plan is likely to take more than a year to materialise as there are legal hurdles to cross before testing the market.

Also, the announcement of the new tax regime, and a follow-up announcement of doing away with all kinds of exemptions completely in the future, might hit the valuation of LIC. A large chunk of these exemptions resulted in insurance policies being bought from the life insurance behemoth in a bid to get a tax break. With this, the forward estimates of the earnings of the company – a key metric used by investment bankers across the globe – will take a hit.

As a parallel step, the government may also wish to look

at offloading upto 75% of the stake not just from LIC

but all other such holdings.If done well, the LIC

divestment can easily fix several years of the budget

deficit while providing a significant jump in valuation

for each incremental divestment.

First published : https://www.deccanherald.com/specials/sunday-spotlight/lic-ipo-desperation-or-masterstroke-802968.html