Comparing stocks in the same sector is a sure-fire technique to assess the best sector to invest in. The procedure is simple: pick a financial ratio (P/E, D/E, or RoE). You could find the balance for the company that interests you.

Then you might make a list of all the companies in that investment sector that operate in the same space. It would help determine the chosen ratio for each company in the peer group. It’s critical to assess how the companies compare stocks in the same sector.

Why is it Important to Compare Stocks from the Same Sector?

If we compare 2 companies, it is easier to compare them if they are in the same sector. Different industries are subject to different seasons. By this, of course, we do not mean the weather. Each industry has periods of a year in which they usually experience more sales or gain more revenue.

To prepare for these periods of opportunity, companies spend more before and invest. This creates uniformity in the expenditure, production, sales and profit pattern within a year across an industry. However, not all industries move together. An umbrella company will have more sales in the monsoon season, while a swimming trunk company will have more sales in the summer.

Thus, the values of different sectors fluctuate and overtake each other throughout the year or business cycle.

Another reason for comparing stocks from the same sector is that the sizes of sectors differ as well. This is due to various reasons, such as government support by allowing more FDI or simply because of the sector’s scope.

The takeaway is to remember that companies from different sectors are present in different ecosystems. Thus, their stocks move differently.

Using Leverage & Profitability to Compare Stocks

Many professional equity analysts worldwide compare stocks in the same sector to do equities analysis. It’s a simple technique to see which stocks are overvalued and should be added to the portfolio.

While there are different methods for completing this analysis, comparing the company to other firms in the same industry is the favoured method for identifying to invest in high-quality stocks and analysing the best sectors to invest in India’s stock market. Let’s have a look at it.

These two broad-level variables might assist you in determining how to evaluate a company compared to its competitors.

Discover stocks that suit certain filter criteria and dive into details to check their WealthBaskets.

The company you want to invest in has a 20% Return on Equity (RoE), whereas the investment sector’s average is 15%. It indicates that the company has demonstrated a more remarkable ability to transform equity money into earnings.

There are several matrices to consider when determining how a company compares to its competitors. These include the Return on Equity (ROE), Return on Assets (ROA), Margins (gross, operational, and profit), and the D/E ratio, among others. You can make a comparative analysis using a similar procedure and a list of these numbers.

Expected Annual Earnings Growth is another significant factor to consider. While there are numerous methods for calculating this, we propose that investors follow 3/4 of research analysts and get an average value on the best sector to invest in. Always pay close attention to this characteristic because it significantly impacts its value. Investing in a firm with good fundamentals and a high predicted yearly earnings growth rate makes financial sense.

5 Tips on Comparing Stocks in the Same Sector

Conducting a fundamental assessment in the same sectors as the company is an integral part of stock analysis. It will enable you to evaluate the company’s strengths and make an informed investment decision.

Even though it takes some time and work, this is an excellent technique to uncover strong stocks that can endure the test of time and provide consistent returns despite market volatility.

- Price-to-Earning Ratio (P/E)

It’s critical to grasp the ratios before comparing stock markets in the same sectors. A high P/E ratio indicates that the stock is expensive compared to its earnings. A low P/E ratio, on the other hand, suggests that the company is undervalued and could be a good purchase. However, one must understand that an undervalued company may have fundamental issues, which may reflect the price accordingly.

- Price-to-Sales Ratio (P/S)

When the P/S ratio is high, it suggests that investors are willing to pay more per unit of sale. It, too, implies that the stock is expensive. A low P/S ratio, on the other hand, could indicate an affordable stock worth considering in that investment sector.

- Debt-to-Equity Ratio (D/E)

A high D/E ratio implies that the company has relied on debt to support a significant amount of its operations. It is a crucial ratio since it reveals if the company’s strong growth rates are attributable to efficient business decisions or high commitments. It gives you an insider look into the best sector to invest in. Debt offers financial leverage to a company.

- Other Metrics

Some of the other important matrices to compare a company/corporation are the return on investment (ROI), return on assets (ROA), margins (gross, operational, and profit), and the D/E ratio, among others. The Expected Annual Earnings Growth matrix is yet another critical metric. Investing in a firm with good foundations and a high predicted yearly earnings growth rate might be a lucrative bargain.

It’s critical to buy a firm with a better Return on Equity than the sector average. It makes financial sense from a profit standpoint. It shows that the company has demonstrated a more remarkable ability to convert its equity capital into earnings. However, one must consider ratios critical to the sector while comparing.

- Bonus Tip – Porter’s Five Forces

Porter’s Five Forces can assess a company’s competitiveness. It is critical because a company’s ability to manage its competitors is critical to its success. The threat of substitution, the risk of new entrants, the negotiating power of suppliers, the power of customers, and the general competitive landscape are all significant elements to consider.

The Bottom line

When researching a stock, it’s critical to conduct thorough research on the firm. Unless you judge a company’s competitors, looking at the bigger picture gets difficult. Choosing the appropriate stock determines whether you lose or gain money.

WealthDesk is a Platform provider for retail investors to invest in portfolios curated by SEBI Registered professionals. If you want to invest in stocks, choose from the various theme or sector-based WealthBaskets at WealthDesk, and invest in premium portfolios.

The fundamental objective is to bag stocks in the same sector leading the market. It is important to get as many details as possible for the company in question of comparison. Yes, the financial statements are a quick and helpful way to look into the company’s financial strengths. Still, one should not ignore the competitive and qualitative aspects to drive a better comparison.

FAQs

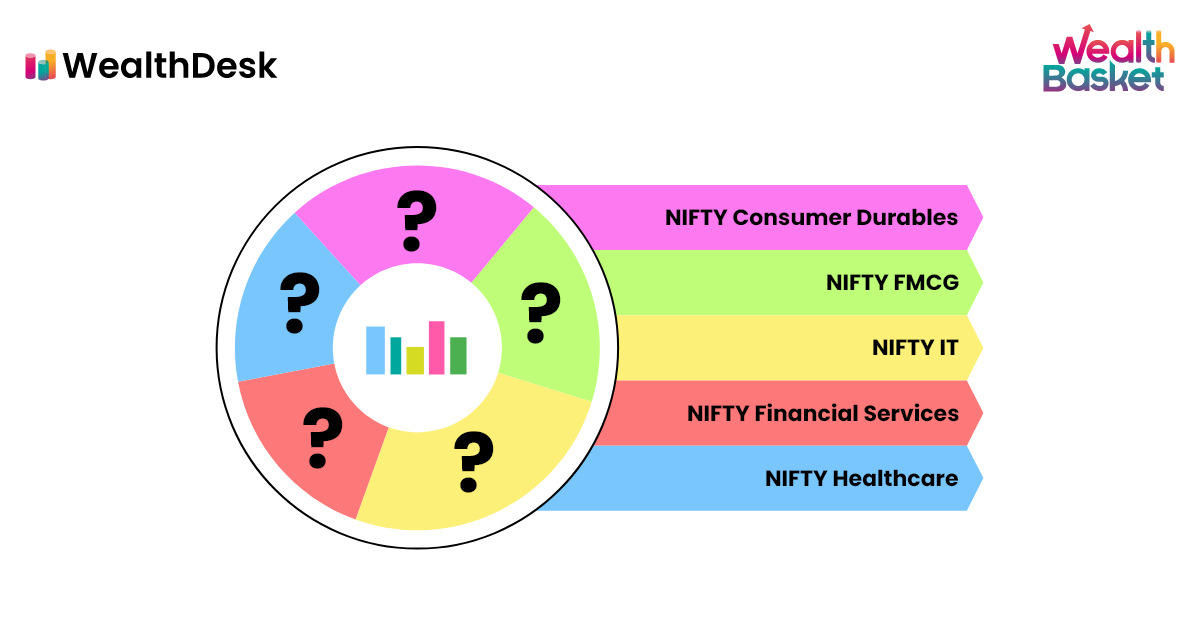

Identify the hottest sectors driving the market

upward and the top stocks inside those sectors

during an advance.

Determine which

industries are outperforming the market as a whole.

Identify the hottest sectors driving the market upward and the top stocks inside those sectors during an advance. Before choosing a sector or stock, investors should use different time frames within charts to determine a trend. Determine which industries are outperforming the market as a whole. One must analyse and compare close peers within a sector based on various ratios and parameters before making a final decision.

A reverse stock split is a financial procedure in which shares of a company’s stock are effectively merged to generate a smaller number of proportionally more valuable shares. A stock merge is another term for a reverse stock split.

When the price of a company rises with higher-than-normal volume, it signals that investors are behind the rally and that the stock will continue to rise. A dropping price trend with high volume, on the other hand, indicates a potential downward trajectory. A large trade volume might also signal a trend reversal.