Life is full of surprises, and not all of them are pleasant. Emergencies, whether they’re unexpected medical bills, car repairs, or sudden job loss, can strike at any time. That’s where an emergency fund comes into play—a financial cushion that can help you weather unexpected storms.

In this blog, we’ll break down what an emergency fund is, why it’s crucial, how to build one, and the smartest ways to use it when life throws you a curveball.

Why is an Emergency Fund Important?

Have you ever cruised on a road trip and suddenly faced

a breakdown out of nowhere? Situations like these can be

stressful, but an emergency repair kit and a little

knowledge of repairing can help you get out of the

situation instead of feeling helpless.

An

emergency fund provides you with a similar level of

assurance to the self. It serves as a safety net,

ensuring you don’t have to rely on credit cards or

loans when the unexpected occurs. An emergency fund is

your financial lifeline during tough times, helping you

maintain financial stability and avoid debt since all of

us are aware how costly it is to arrange a short term

loan during an emergency.

How Much Money Should You Have in Your Emergency Fund?

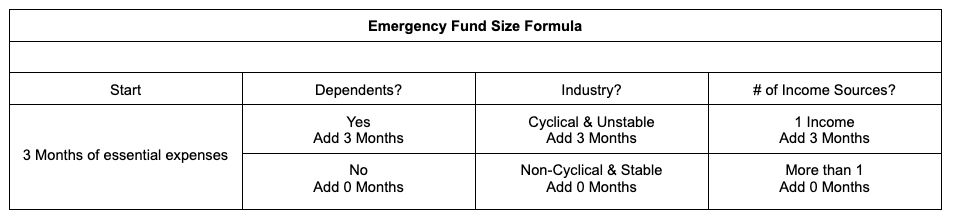

The ideal amount for your emergency fund varies from person to person. As a general guideline, you can aim to save at least three to nine months’ worth of essential expenses for emergency needs.

This amount can cover your rent or mortgage, utilities, groceries, and other necessary bills. If you have dependents, less stable income or only one source of income, consider saving closer to nine months’ worth of sustenance amount as an emergency fund. The key is to tailor your fund size to your individual circumstances.

You can refer to the following table to better understand the amount you could save up for your emergency fund in detail:

How to Build an Emergency Fund?

Set Realistic Goals

When setting goals for your emergency fund, it is important to consider your individual needs and circumstances. Some questions that you can ask yourself before you can decide on the extent of funds needed are:

Your monthly expenses: How much money do you need to cover your essential monthly expenses, such as rent, food, and transportation?

Your income: How much money do you earn each month?

Your debt: How much debt do you have, and what are the monthly payments?

Your financial goals: Do you have any other financial goals, such as saving for a down payment on a house or retirement?

Make a Budget and Track Your Spending

A budget can help you to understand where your money is going and to identify areas where you can cut back. To create a budget, start by tracking your spending for a month. Once you have a good understanding of your spending habits, you can start to set budget categories and goals.

There are many different ways to budget. One popular method is the 50/30/20 rule. This rule allocates 50% of your income to essential expenses, 30% to discretionary expenses, and 20% to savings and debt repayment.

Create a Plan to Reduce Your Expenses

Once you have a budget, you can start to look for opportunities to reduce your expenses. Some common ways to save money include:

- Eating out less

- Canceling unused subscriptions

- Finding cheaper alternatives to your favorite brands

- Shopping around for insurance and other services

- Negotiating with your service providers

- Reducing your energy consumption

- Creating alternate sources of income

Automate Your Savings

One of the best ways to ensure that you save consistently is to automate your savings. Create a separate bank account for emergency expenses. Set up a recurring transfer from your bank account to this emergency fund account. This way, you will save money without even having to think about it.

Be Patient and Consistent

Building an emergency fund takes time and discipline. Don’t get discouraged if you don’t reach your goal right away. Just keep saving consistently, and eventually you will have a financial cushion to fall back on in case of an unexpected expense.

Other key points to remember

- Keep your emergency fund in liquid funds or a savings account. This way, you can easily access the money whenever needed.

- Avoid using your emergency fund for non-emergency expenses. It is important to have a financial cushion in case of an unexpected expense, such as a job loss or medical emergency.

- Review your emergency fund regularly and make adjustments as needed. As your income and expenses change, you may need to adjust your savings goals.

How to Use Your Emergency Fund

Since emergencies are very personal and their definition can vary from person to person, our advice to you would be to make a defined list of emergency events for which you may want to use this amount. Some of the common emergencies can include but are not limited to:

- Medical emergencies or unexpected healthcare costs.

- Car repairs or replacements.

- Job loss or a sudden reduction in income.

- Home repairs or appliance replacements.

- Urgent travel expenses due to family emergencies.

How to Use Your Emergency Fund Wisely?

- Only use it for genuine emergencies, not for non-essential purchases.

- Prioritize essential expenses like housing, food, and healthcare when deciding to dip into your fund.

- Replenish your fund as soon as possible after using it.

How to Replenish Your Emergency Fund After You Use It?

- Resume regular contributions as soon as your financial situation stabilizes.

- Allocate windfalls like tax refunds or bonuses to your emergency fund.

- Consider redirecting funds from other savings goals temporarily.

Tips for Building and Maintaining an Emergency Fund

Start Small and Gradually Increase:

If you can’t save the recommended amount right away, begin with a smaller goal and increase it over time.

Keep It Liquid:

Store your emergency fund in a savings account or money market account, ensuring easy access when needed.

Avoid Non-Emergency Spending:

Resist the temptation to dip into your fund for non-urgent expenses like vacations or shopping sprees.

Regularly Review and Adjust:

Life circumstances change, so revisit your emergency fund periodically to ensure it aligns with your current needs and goals.

Checklist for your Financial Health

Conclusion

In conclusion, an emergency fund is your financial safety net in times of unexpected crises. It provides peace of mind, protects you from debt, and empowers you to handle life’s curveballs with confidence. Building and maintaining an emergency fund is a smart and responsible financial strategy that sets you on the path to financial security and peace of mind.