Who doesn’t like something at a discount? Some of the greatest investors in the world have bought stocks at deep discounts, helping themselves make a fortune, years later.

Warren Buffet goes down in history as one of the greatest investors. In fact, he is often credited for popularizing value investing, which also turned him into a billionaire. However, was this the only strategy that helped him amass wealth? Well, the answer is ‘No’.

In this article, we shall take a look at an investing strategy called cigar butt investing and understand how it works. Keep reading to find out!

What is Cigar Butt Investing?

The concept is simple: a person who does not have money and wants to smoke would probably go around picking discarded cigars on a street to enjoy a few puffs, which would come at no cost. Similarly, investors try to find companies that are temporarily beaten down but still have some value left in them.

Cigar butt investing is an investment strategy that involves looking for companies that have been beaten down by the market and are trading for less than their liquidation value.

The plan is to invest in such companies, watch them recover, and then sell them at a profit. This strategy differs from value investing, which involves seeking out undervalued, high-quality companies for long-term investments.

How Does Cigar-Butt Investing Work?

The process of cigar-butt investing involves identifying companies that are trading at a discount to their intrinsic value. This can be done by analyzing financial statements, looking for companies with low price-to-earnings ratios, or using other valuation metrics.

Once you have identified a company that is trading at a discount, you buy shares in the company and wait for the market to recognize its true value. When the market does recognize the company’s value, you sell your shares for a profit.

In other words, cigar butt investing is a form of troubled-asset investment. In this strategy, you buy low-priced stock in struggling companies that should be worth more than their current share price. You let the stock soar, then sell it for a quick profit.

How do you Identify Cigar Butt Companies?

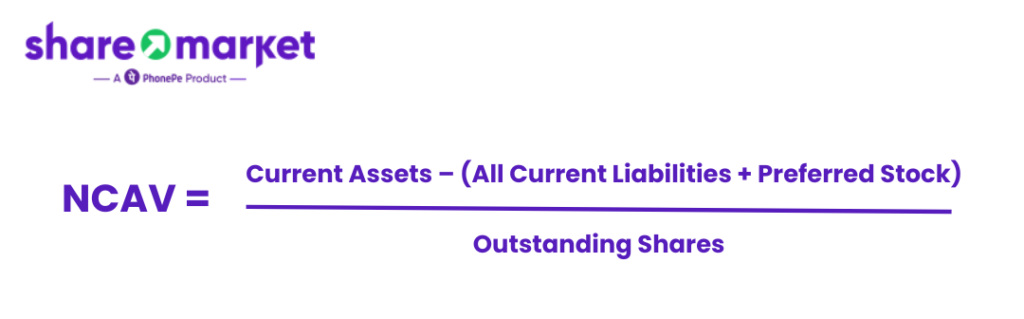

Cigar butt investments are found through what’s known as a company’s net current asset value (NCAV).

In other words, start with the total value of a company’s current assets, then subtract its debts, liabilities and everything it owes to preferred shareholders (since they get paid first). This number tells you what the company would be worth if it liquidated completely and paid off all its debts.

Divide this by the number of common shares of stock outstanding, to get how much every shareholder would receive if the company liquidated tomorrow, paid off all its debts and distributed the remainder to its shareholders. If this number is greater than the stock’s current trading price, then the company may be a cigar butt investment.

Benjamin Graham and Cigar Butt Investing

It is said that Benjamin Graham, the father of value investing proposed the “cigar-butt” approach to investing. He started with this approach during the onset of the great depression.

Companies were trading at very low prices, during the great depression. It did not matter if they were making any profit, as long as they could be bought for less than the net liquidation value, as one would get both the goodwill and the factory for nothing, like the discarded cigar.

Warren Buffett and Cigar-Butt Investing

Buffett is said to have popularized the approach in his early career. In fact, he used it to generate some of the highest returns during his career. However, there’s a reason that he has shunned this style of investing and now warns investors off of it. Interestingly, Berkshire Hathaway was a cigar butt investment.

Warren Buffett initially made his fortune using the cigar-butt investing approach. However, he has since moved away from this approach and now prefers buying and holding quality companies for the long term.

In the 1989 Berkshire Hathaway Annual Letter to shareholders, Buffett explained, “If you buy a stock at a sufficiently low price, there will usually be some hiccup in the fortunes of the business that gives you a chance to unload at a decent profit, even though the long-term performance of the business may be terrible. I call this the “cigar butt” approach to investing.”

“Cigar Butt approach to investing is where you try and find a really kind of pathetic company but it sells so cheap that you think there is one good puff left in it”.” Though the stub might be ugly and soggy”, the bargain purchase would make “the puff all free”, said Buffet.

Limitations of Cigar Butt Investing

Even though Buffet started off his investing career with this approach, unlike Graham, he gave it up. In his “ Mistakes of the First 25 Years”, he said that the cigar butt strategy was rewarding, but buying businesses with such an approach was foolish, unless you’re a liquidator, because:

There isn’t just one cockroach in the kitchen

If a kitchen has a cockroach, it is likely that it has more of them. Similarly, companies that are getting liquidated usually have more than one reason for doing so. Even if we think that one problem is solved, another comes up.

Time is a friend of a good business and an enemy of the mediocre

The cigar butt approach is dependent on a temporary spike in the share price of a company. This spike may never occur, or take too long.

Let’s assume that you buy the shares of a company at ₹ 70 each and are able to recover ₹ 100 from its sale. This situation is okay if you make a profit in a shorter period of time. However, if you recovered the money after ten years, the returns were poor.

Conclusion

Cigar butt investing involves finding companies that have been beaten down by the market and are trading for less than their liquidation value. While it can give a good source of quick revenue, it is a short-term approach to buying into generally weak firms.

This approach is dependent on a temporary spike in the price or liquidation that may never occur. Therefore, it is important to note that cigar butt investing has many risks and limitations.

FAQs

Cigar butt investing is a short-term investment strategy that involves buying the shares of struggling companies at a very low price. These companies are worth more than the price at which the shares are bought. Then the investor waits for the company’s share price to rise and then sells it to make a quick profit.

Warren Buffett popularized cigar butt investing in his early career. He used this strategy to generate the highest returns of his career. In fact, Berkshire Hathaway was a cigar butt investment. However, he shunned this approach later.

Cigar butt investing involves finding companies that have been beaten down by the market and are trading for less than their liquidation value. The idea is to invest in these companies, wait for them to recover and then sell them at a profit.

Cigar butt investing should not be confused with value investing. They are different. Value investing involves finding high-quality companies for long-term investments. However, cigar butt investing involves finding weaker businesses that are likely approaching the end of their value potential and are trading at a substantial discount to their liquidation value.