In 2010, the then Finance Minister of Brazil declared that an international ‘currency war’ was underway. His concerns about the currency war hurting the global economy were shared by the likes of Raghuram Rajan.

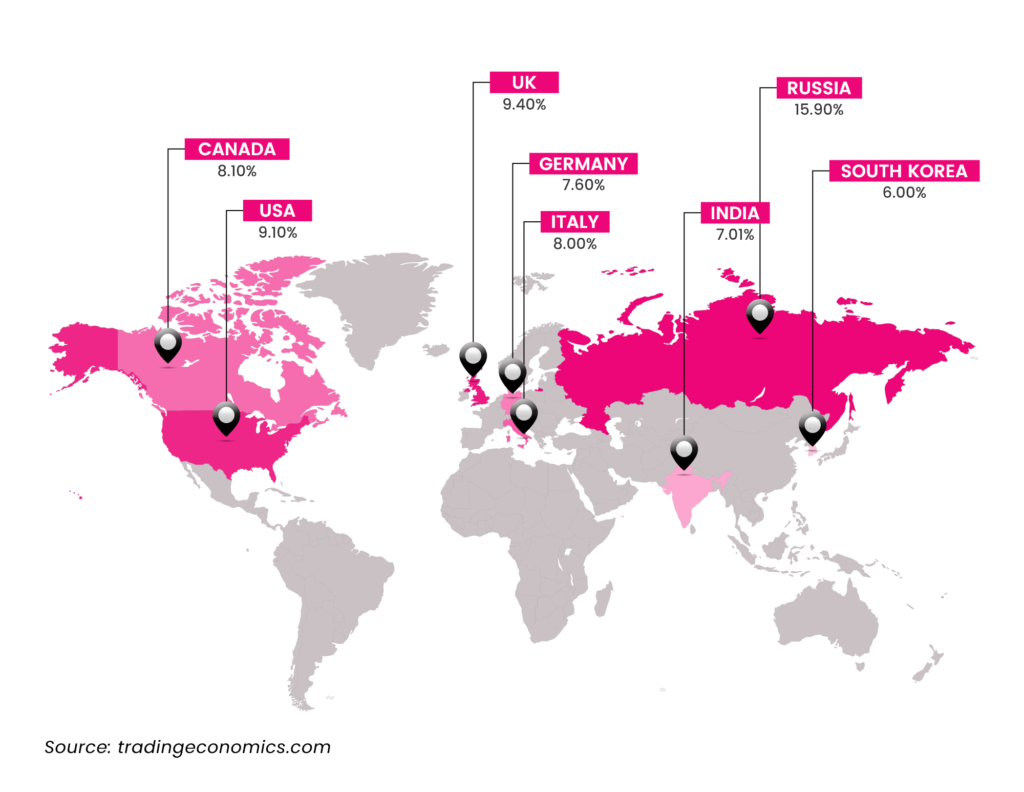

Currently, countries worldwide are trying to curb inflation by raising interest rates. This also impacts exchange rates. Thus, the question of whether we are in the middle of a currency war has been doing the rounds.

Here we explore the meaning of currency wars, their reasons and repercussions, and whether we are facing one currently.

What is a Currency War?

When a country deliberately reduces the exchange value of its currency with respect to foreign currencies, it is called devaluation.

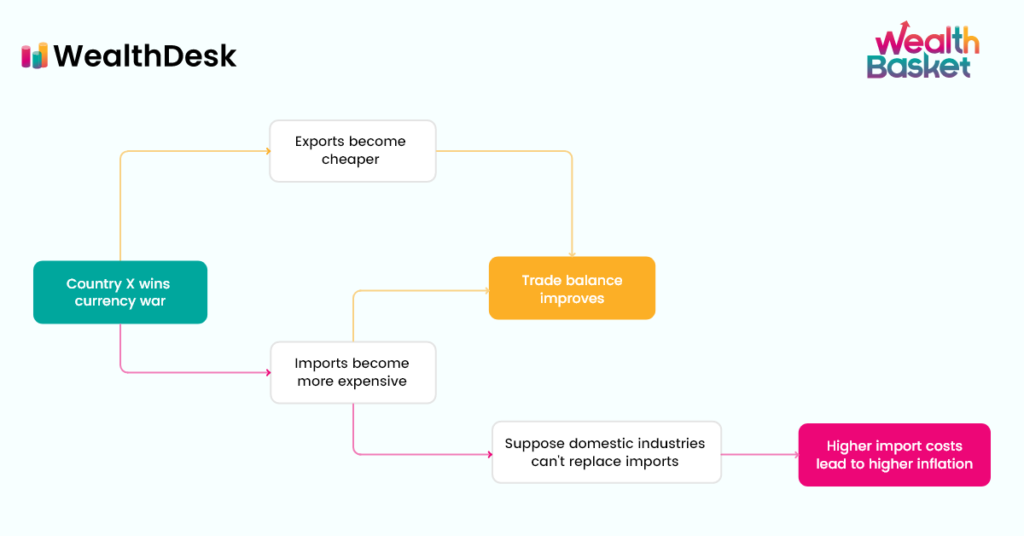

Currency wars involve countries devaluing their currencies to gain a competitive advantage over other countries. When your country’s currency is devalued, exports become cheaper, and imports become more expensive. This might boost exports and discourage imports causing their trade balance to improve.

But, if other countries also devalue their currencies, the effect on exports and imports your country would desire might not occur. Instead, you might go back to square one or end up in an even more unfavourable trade situation.

The result is a ‘tit for tat’ of currency devaluations by various countries.

What caused currency war in the past?

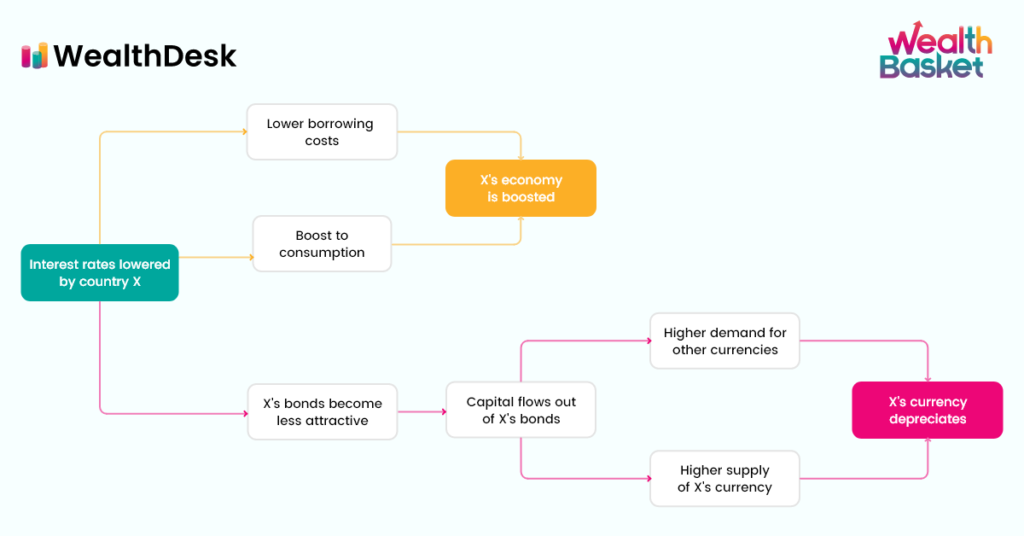

Currency wars are sparked when various countries need to lower interest rates to boost economic activity or improve the trade balance.

In 2008, the US housing bubble burst and triggered the Great Recession. Economies all around the world were affected. There was a need to stimulate economic growth by lowering interest rates. A by-product of lowering interest rates is a currency depreciating. Since this is unfavourable for other countries, they devalued their own currencies in retaliation.

Similar situations arose during the Great Depression of the 1930s and when low competitiveness (in comparison to other economies) prompted the UK to devalue the sterling in 1967.

Are we in a currency war?

The situation in 2022 is different from that of 2010. In 2022, countries want to curb inflation but also want to avoid or delay hurting domestic industries through higher borrowing costs.

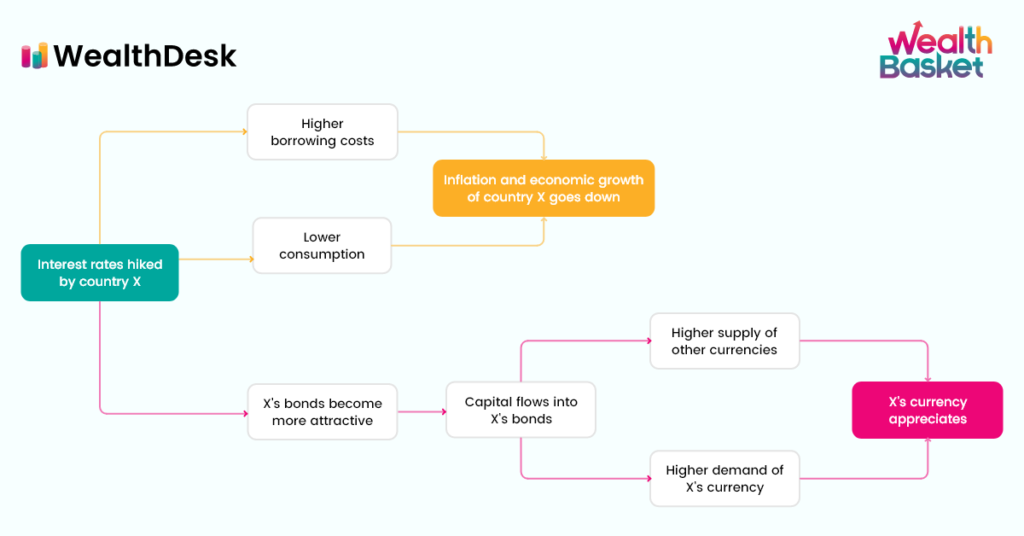

One of the measures used by central banks to curb inflation is raising interest rates, as it lowers spending. Just like lowering interest rates can depreciate a currency, hiking interest rates can appreciate a currency.

How?

Appreciation of a currency might be favourable for countries dependent on imports for key materials like crude oil, which has been quite volatile over the past few years. However, rising interest rates would hurt domestic industries. This can also have an effect on international capital flows.

Impact of currency war

Impact on economies

If a country is successful in a currency war, its exports will be cheaper, and imports will be minimised. This would improve the trade balance. If the interest rates were lowered to devalue its currency, it might have the effect of spurring economic growth. It should be noted that there is always a risk that the country would end up with high import costs. Higher import costs can lead to higher inflation.

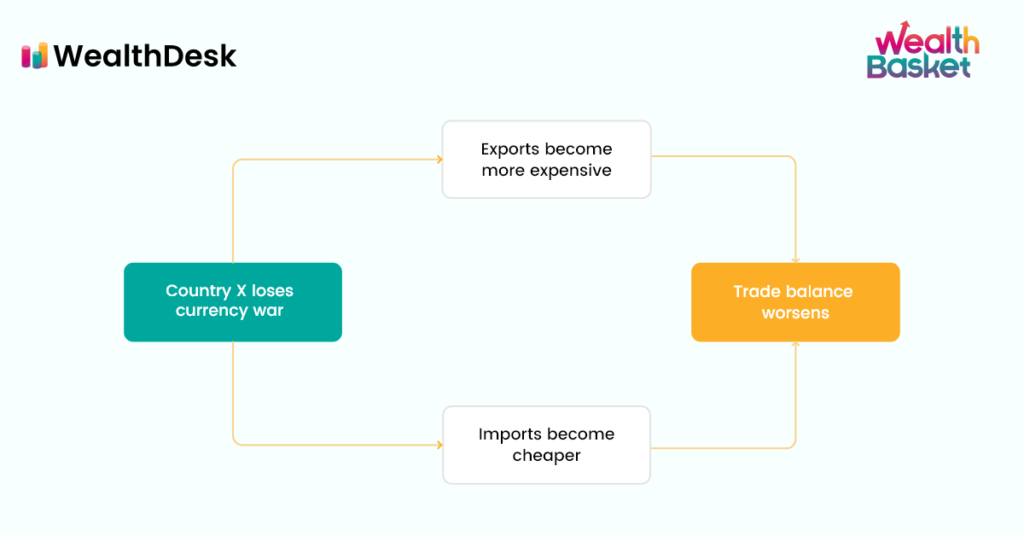

If a country loses out in a currency war, its exports will become more expensive, and imports will become cheaper. This can affect the trade balance and the domestic industries.

How do they impact investors?

When a country’s currency is devalued, the value of returns for overseas investors might drop. This expectation itself might lead overseas investors to pull out. The outflow of capital can lower asset prices.

When a country’s currency is expected to appreciate, the value of returns for overseas investors might increase. This expectation might lead to an inflow of investments from overseas investors. The inflow of capital can boost asset prices.

Final thoughts

When interest rates are hiked, the supply of a currency in the economy is reduced. By reducing the supply of a currency, inflation might be lowered. But, interest rates can also affect exchange rates and trade balances. Thus, countries might be cautious with interest rate moves to not trigger currency wars.

At WealthDesk, you can find WealthBaskets, combinations of stocks and ETFs built by SEBI registered professionals. Each WealthBasket follows a certain investment theme and strategy.

FAQs

The effect of a war on the US dollar would depend on

how destabilising the war is, i.e.:

– How

much does it affect the supply of key materials like

oil and food grains

– What is the impact

on the workforce

– Are there any

spillover effects from sanctions

Winners of currency wars will have cheaper exports and costlier imports. This would be a chance for the winners to improve their trade balance. The losers of currency wars will have expensive exports and cheaper imports. The companies from the losers of currency wars will find it difficult to compete with foreign companies.

Currency wars occur when multiple countries try to gain an advantage in international trade based on the value of their currencies. When a currency is devalued, it discourages imports as they will become costlier and might boost exports as they would be cheaper to other countries.

Safe currencies would be the currencies that are less likely to lose value than other currencies. The US dollar, the Swiss franc and the Japanese yen are considered the safest currencies. Which currency is safest at which point would depend on several factors, including political situations, trade balance, amount of volatility in capital markets, and stability of the banking systems.

Some of the reasons for the US dollar being as

strong as it is are:

– Global currency

– Can be used in international trade

–

The US Fed raised interest rates, leading to higher

demand for the US dollar to invest in the US bond

market

– The US dollar is considered to

be a safe-haven currency, i.e. it is expected to

retain value during times of market turbulence