In today’s fast-paced digital age, managing your finances can be a complex task. Keeping track of multiple financial accounts, sharing data with various institutions, and ensuring the security of your financial information can be overwhelming.

However, there’s a revolutionary solution that’s changing the way we handle our finances in India – Account Aggregators.

What is an Account Aggregator?

An Account Aggregator (AA) is a regulated entity that allows individuals to securely and digitally access and share financial information from one institution to another within the AA network.

This sharing of data requires the explicit consent of the individual, ensuring complete control over their personal financial data. Unlike traditional methods, account aggregators replace cumbersome paperwork and processes with a streamlined, mobile-based approach.

How Do Account Aggregators Work?

Account aggregators operate as intermediaries between financial institutions and consumers. They facilitate the secure transfer of financial data based on an individual’s explicit consent.

This data includes transaction history, bank statements, and more, making it easier for individuals to access credit, loans, and other financial services.

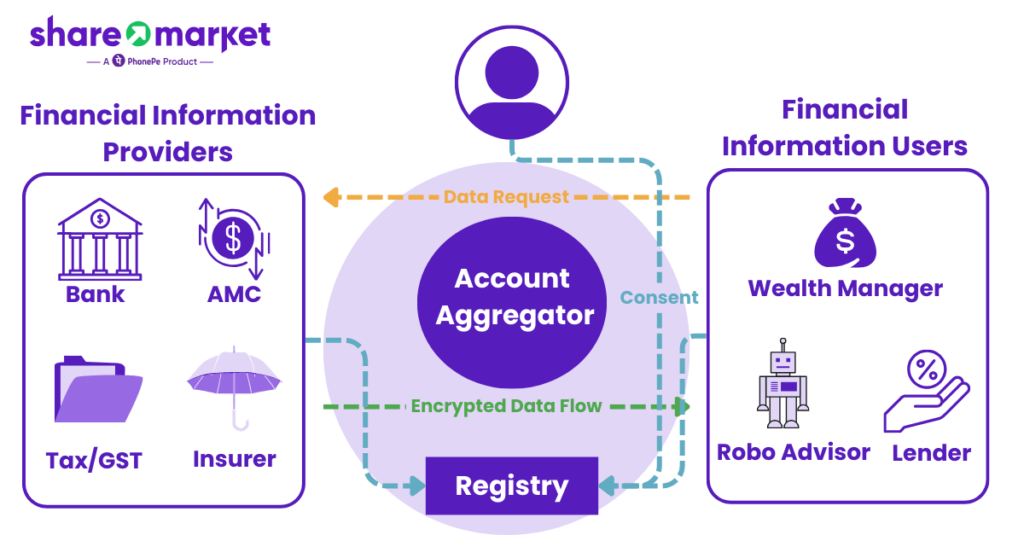

Let’s now find out the different stakeholders in this ecosystem.

Account Aggregator Ecosystem

The ecosystem comprises the following players:

Financial Information Provider (FIP):

FIPs are the institutions that hold the customer’s financial data, such as banks, non-banking financial companies (NBFCs), mutual fund depositories, insurance repositories, and pension fund repositories.

Financial Information User (FIU):

FIUs are entities that consume the data from an FIP to provide various services to the end consumer, such as lending banks and agencies that provide financial services.

Account Aggregator (AA):

AAs are intermediaries that collect data from FIPs that hold the customer’s financial data and share that with FIUs. AAs are regulated by the Reserve Bank of India (RBI).

Technology Service Provider (TSP):

TSPs collaborate with FIUs and FIPs to deliver AA products and services. TSPs develop foundation modules for the account aggregators in the ecosystem.

Certifier:

Certifiers enable verification of adherence to the RBI-prescribed Technical Standards by all AA ecosystem participants.

How to Use an Account Aggregator

Creating an Account:

Begin by registering with an AA of your choice through their app or website. You’ll receive a unique handle (similar to a username) to use during the consent process.

Linking Your Accounts:

Once registered, you can link your financial accounts to the AA and consent to share financial data with authorized FIs. This step grants control over which accounts you want to connect.

Sharing Data:

With your accounts linked, you can share specific financial data with other institutions(FIPs and FIUs). This data sharing is done through a granular, step-by-step permission process, ensuring you share only what’s necessary for a particular purpose.

Which companies provide Account aggregation services?

Companies regulated by the Reserve Bank of India (RBI) and who have the necessary license can provide AA services. They are required to implement strict security and privacy measures to protect financial data. These are a few of the companies which provide Account Aggregation services in India-

- Anumati Account Aggregation Services Private Limited

- CAMSFinServ

- Cookiejar Technologies Private Limited (FinVu)

- CRIF Connect Private Limited

- Dashboard Account Aggregation Services Private Limited (Saafe)

- FinSec AA Solutions Private Limited (OneMoney)

- NESL Asset Data Limited (NADL)

- Protean (formerly NSDL E-Governance Account Aggregator Limited) (Protean SurakshAA)

- Perfios Account Aggregation Services Pvt Ltd

- Cygnet Account Aggregation Private Limited

- Digio Internet Private Limited

- OMS Fintech Account Aggregator Private Limited

- PB Financial Account Aggregator Private Limited

Benefits of Using an Account Aggregator

Single View of Finances:

Account aggregators provide a unified view of all your financial data, eliminating the need to navigate multiple platforms.

Personalized Financial Products:

Access to your comprehensive financial data enables institutions to tailor their products and services to your specific needs.

Faster Loan Approvals:

Streamlined data sharing speeds up loan processing, reducing the time it takes to get approved for loans.

Improved Financial Literacy:

Access to your financial data empowers you with better insights into your financial health.

Security and Privacy Considerations

Account aggregators prioritize the security and privacy of your financial data in a number of ways:

- Data shared through account aggregators is encrypted from the sender to the recipient. This means that your data is protected from unauthorized access, even if it is intercepted during transmission and remains unreadable due to lack of the right encryption key with the person.

- AAs do not aggregate or store your data. This means that they do not have access to your financial data and cannot use it for any other purpose than facilitating the sharing of data between you and other financial institutions.

- You have full control and can revoke consent to share data at any time. This means that you can choose which financial accounts to link to your AA and which financial institutions you want to share your data with. You can also revoke your consent at any time.

- Account aggregators are regulated by the Reserve Bank of India (RBI). This means that they are subject to strict security and privacy requirements.

- Account aggregators are required to implement a number of security measures, such as two-factor authentication and intrusion detection systems. This helps to protect your data from unauthorized access and misuse.

Your rights as a consumer when using an account aggregator:

- Using an account aggregator is voluntary. You are not required to use an account aggregator to access your financial data or share it with other financial institutions.

- You have the right to choose your preferred AA. There are multiple AA providers in India, and you can choose the one that best suits your needs.

- You have the right to decide which accounts to link. You are not required to link all of your financial accounts to your AA. You can choose to link only the accounts that you want to share data from.

- You have the right to accept or reject consent requests. When you link a financial account to your AA, you will be asked to provide consent for the AA to share your data with other financial institutions. You have the right to accept or reject these consent requests.

- You have the right to revoke consent for data sharing at any time. Once you have granted consent to an AA to share your data with a financial institution, you can revoke that consent at any time.

- Overall, account aggregators offer a number of security and privacy features that protect your financial data. They also give you full control over your data and your rights as a consumer.

The Future of Account Aggregators

Account aggregators represent a significant step toward open banking in India. They empower consumers to access and share their financial data securely, paving the way for innovative financial services. They bridge the gap between consumers and institutions, fostering financial inclusion.

In summary, account aggregators have the potential to revolutionize the financial landscape, by putting control back into the hands of consumers, ushering in a new era of financial empowerment.

FAQs

To use an account aggregator to get a loan, you will

need to:

1. Choose an account aggregator and

create an account.

2. Link your financial

accounts to the account aggregator.

3. Grant

consent to the account aggregator to share your

financial data with the lender you are applying for

a loan from.

3. The lender will then be able to

access your financial data through the account

aggregator to assess your eligibility for a loan.

This

process is much faster and easier than the

traditional method of applying for a loan, where you

would need to manually gather and submit your

financial documents to the lender.

To use an account aggregator to

invest in stocks and mutual funds, you will need to:

1. Choose

an account aggregator and create an account.

2.

Link your bank account and investment accounts to

the account aggregator.

3. Grant consent to the

account aggregator to share your financial data with

the investment platform you are using to invest in

stocks and mutual funds.

4. The investment

platform will then be able to access your financial

data through the account aggregator to verify your

identity and assess your investment suitability.

This

process makes it easier to invest in stocks and

mutual funds, as you do not need to manually

transfer funds between your bank account and

investment account.

To use an account aggregator to file your taxes, you

will need to:

1. Choose an account aggregator

and create an account.

2. Link your bank

account and investment accounts to the account

aggregator.

3. Grant consent to the account

aggregator to share your financial data with the tax

preparation platform you are using to file your

taxes.

4. The tax preparation platform will

then be able to access your financial data through

the account aggregator to automatically populate

your tax return.

This process makes it much

faster and easier to file your taxes, as you do not

need to manually enter your financial data into your

tax return.

To use an account aggregator to get a credit report,

you will need to:

1. Choose an account

aggregator and create an account.

2. Link your

financial accounts to the account aggregator.

3.

Grant consent to the account aggregator to share

your financial data with the credit bureau you are

requesting a credit report from.

4. The credit

bureau will then be able to access your financial

data through the account aggregator to generate your

credit report.

This process makes it easier to

get a credit report, as you do not need to manually

submit a credit report request to the credit

bureau.

To use an account aggregator to track your spending,

you will need to:

1. Choose an account

aggregator and create an account.

2. Link your

financial accounts to the account aggregator.

3.

The account aggregator will then be able to

aggregate your financial data and provide you with

insights into your spending habits.

This can

help you to identify areas where you can cut back on

your spending and save more money.