All of us have dreamed of picking a stock and getting 50%, 100% or even 1,000% returns on the day we invest in it. Sadly, this might not be possible due to circuit limits beyond which a stock’s price can not move. In India, the Securities and Exchanges Board of India (SEBI) determines the upper circuits and the lower circuits.

Here we discuss what upper and lower circuits are, what could lead stock to hit these limits, and what happens when stocks or indices hit these limits.

What is the upper circuit?

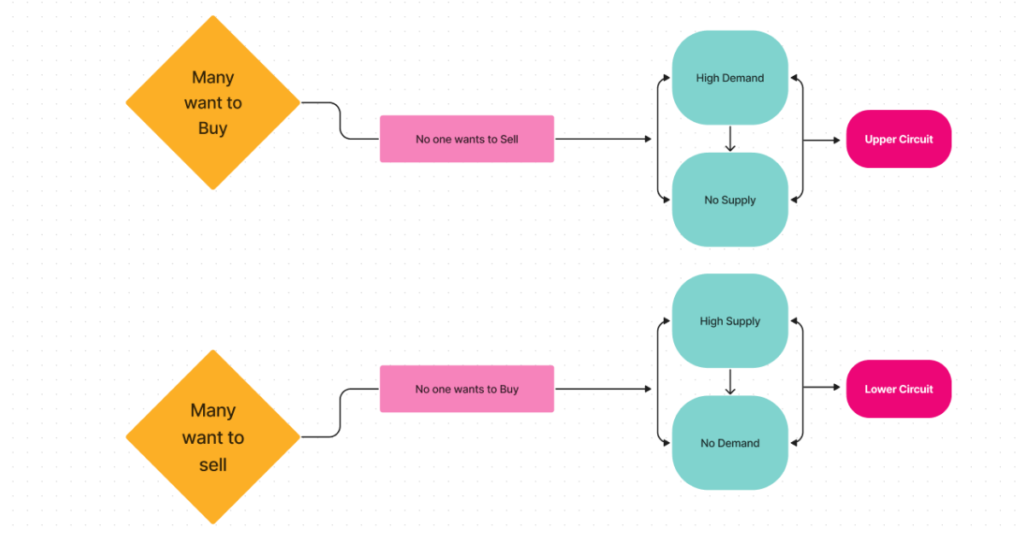

The maximum level beyond which a stock’s price or an index’s value can not rise in a day is called the upper circuit. Stocks that many want to buy but barely anyone is selling might hit the upper circuit. Upper circuits are calculated based on the previous day’s closing price.

Some stocks might have their upper circuits at a price 2% higher than their previous day’s closing price. Other stocks might have their upper circuits at prices 5%, 10%, or 20% higher than their previous day’s closing price.

A stock’s price can not rise beyond its upper circuit in a single trading session. However, the prices may drop if some people start selling.

What is the lower circuit?

The lowest level to which a stock’s price or an index’s value can fall is called the lower circuit. Stocks that many want to sell but barely anyone is buying might hit the lower circuit.

Lower circuits are also calculated based on the previous day’s closing price and it may differ from stock to stock.

For some stocks, the lower circuit might be 2% lower than the previous closing price, while the lower circuit for other stocks might be 5%, 10%, 15% or 20% lower than the previous closing price.

A stock’s price may not fall beyond its lower circuit in a single trading session, but if people start buying the stock, its price may rise.

Why do stocks hit upper or lower circuits?

To get an idea of why stocks may hit their lower circuits and upper circuits, let’s look at examples of stocks hitting the upper or lower circuit.

When a stock hits its upper circuit…

Suppose a new automobile company unexpectedly overtakes the market share of the market leader, and the demand for this stock suddenly increases.

Stockholders of such a company are unlikely to sell their stocks. But people who want to buy might bid higher prices for these stocks. With upper circuits, it is possible to prevent a stock’s price from skyrocketing in a single day and protect investors from volatility and undue speculation like the pump-and-dump scheme on Telegram uncovered in January 2022.

On 12th January 2022, SEBI alleged that a Telegram group’s administrators had made unlawful gains worth ₹2.84 Cr by buying certain stocks, then recommending them to their subscribers and then selling these shares for a neat profit.

When a stock hits its lower circuit…

Suppose news breaks that a particular company was involved in illegal business practices. The government is expected to crack down on this company. Now, the stocks of this company become unwanted. The existing stockholders will not be able to sell their shares as no one would want to buy.

When no one is buying a stock, its price might drop. The fear of investing in a stock that is already falling may lead to the stock price to keep falling. To prevent this, lower circuits are set.

Example of a stock hitting a lower circuit

Future Retail’s stock hit lower circuits every trading session from 25th April 2022 to 12th May 2022. About 50% of the stock’s price eroded in a month’s period (from 13th April to 12th May).

Factors that can lead a stock to hit circuit limits

We often hear that stock prices are determined by the forces of demand and supply. You must have realised at what levels of demand and supply which circuit will be hit.

So, in theory, any event that changes how desirable a stock is can lead a stock to hit its circuit limits. The change in desirability has to be very high for a stock to hit the upper or lower circuit. In some cases, market manipulation may also cause stocks to hit their upper or lower circuits.

Following are some events that may lead the stock to hit its upper or lower circuits:

- Earnings outperforming or underperforming expectations

- Political uncertainty

- Geopolitical pressures

- Changes in investor confidence due to sharp falls or rises in foreign stock markets

- Change in interest rates

- Fiscal expansion or consolidation

- Changes in trade scenario (trade agreements, economic zones, tariffs, etc.)

- Competitors outperforming or underperforming

What are market-wide circuit breakers?

In India, a coordinated halt in all equity and equity derivative markets occurs when market-wide circuit breakers are triggered. On both NSE and BSE, circuit breakers halt trading activities at 3 stages of their index’s movement.

After each halt, NSE reopens with a pre-open call auction session, and BSE reopens with a pre-opening session.

On 13th March 2020, Nifty 50 fell by 10% in early trade and both NSE and BSE had to be halted for 45 minutes.

Market-wide Circuit Breaker On NSE

| Change in BSE Sensex or the Nifty 50(Positive or Negative) | TRIGGER TIME | MARKET HALT DURATION | PRE-OPEN CALL AUCTION SESSION POST MARKET HALT |

| 10% | Before 1:00 PM | 45 Minutes | 15 Minutes |

| At or after 1:00 PM upto 2.30 PM | 15 Minutes | 15 Minutes | |

| At or after 2.30 PM | No halt | Not Applicable | |

| 15% | Before 1 PM | 1 hour 45 minutes | 15 Minutes |

| At or after 1:00 PM before 2:00 PM | 45 Minutes | 15 Minutes | |

| On or after 2:00 PM | Remainder of the day | Not Applicable | |

| 20% | Any time during market hours | Remainder of the day | Not Applicable |

Market-wide Circuit Breaker On BSE

| Change in BSE Sensex or the Nifty 50(Positive or Negative) | TRIGGER TIME | MARKET HALT DURATION | Pre Opening Session duration post each halt |

| 10% | Before 1 PM | 45 Minutes | 15 Minutes |

| At or After 1 PM to 2.30 PM | 15 Minutes | 15 Minutes | |

| At or after 2.30 PM | No Halt | Not Applicable | |

| 15% | Before 1 PM | 1 Hour 45 minutes | 15 Minutes |

| At or after 1 PM before 2 PM | 45 Minutes | 15 Minutes | |

| On or after 2 PM | Remainder of the day | Not Applicable | |

| 20% | Any time of the day | Remainder of the day | Not Applicable |

Final Thoughts

Circuit limits are set to protect investors from undue speculation and volatility. Ideally, only when there is a change in the stock’s desirability, its price may hit the lower circuit and upper circuit. But, in some cases, market manipulators may try to influence the demand and supply for a stock. Investors should be careful not to make trades solely based on stocks or indices hitting their upper or lower circuits.

Discover stocks that suit certain filter criteria and dive into details to check their WealthBaskets.

At WealthDesk, you can find combinations of stocks and ETFs called WealthBaskets. WealthBaskets are managed by SEBI registered professionals. All stocks and ETFs inside a WealthBasket are transferred to the subscriber’s Demat account.

FAQs

When a stock’s price is at its upper circuit, there are many buyers and no sellers. If you want to sell, you can as there will be an abundance of buyers at the upper circuit.

Due to the lack of sellers, it is difficult to buy a stock when its price hits the upper circuit. Buyers may have to wait until the stock price falls or try to buy at the upper circuit price.

In India, the duration of a halt depends on the

level of change in the index’s value and the

time the index hits that value. The details of

market-wide circuit breakers are mentioned earlier

in this article.

For stocks, there is no

definite time for the circuit to end.

The lower and upper circuits are the lower and upper limits to a stock’s price or an index’s value. In India, the Securities and Exchanges Board of India (SEBI) sets the circuit filters.