This post looks at various costs associated with investment portfolios and their multiple components. We will discuss different types of assets and their expenses, the calculation of expense ratios, and the impact of these costs on investment decisions.

What are the costs of investing in securities and funds?

What is the cost of investing in equities

Equity stocks are securities through which investors can hold ownership in publicly-listed companies. Equity stocks expose investors to price risks.

Investing in stock markets will attract brokerage charges. Brokerage charges are a well-known stock investment fee incurred by investors. Additionally, they may incur taxes and other charges.

| Charges | Amount |

| Brokerage | Depends on the broker |

| Security Transaction Tax (STT) | 0.1% on buy & sell |

| Transaction charges | ⇒ NSE= 0.00345%⇒ BSE= 0.00345% |

| GST | 18% on (brokerage + transaction charges) |

| SEBI Charges | ₹10 / crore |

| Stamp charges | 0.015% or ₹1500 / crore on buy-side |

How much does it cost to invest in mutual funds?

Mutual funds comprise a pool of money collected from various investors. The pool of money is used to invest in securities like stocks, bonds, money market instruments, and other assets. They are a popular financial vehicle that allows investing without needing Demat accounts. Depending on the research scale, the management costs can be very high. Mutual funds also have entry and exit costs in some cases.

Transactional Charges in Mutual Funds

Investments below ₹10,000 – No charges

Investments above ₹10,000 – ₹100

What is the cost of investing in Exchange-Traded Funds (ETFs)

Exchange-traded funds (ETFs) are investment funds traded on the exchange. They have been described as tradeable variations of index mutual funds; however, ETFs that don’t replicate indices exist. ETFs can track a particular sector, segment, or market. In addition, they may follow a specific investment strategy. Index ETFs are known for low management costs. Transaction costs are applicable at purchase and sale. They trigger taxable events only on sale. It is crucial to see if it is actively or passively managed when investing in ETFs. The expense ratio of an ETF will differ according to this classification and the costs incurred by the fund manager if it is actively managed.

ETF Transaction Costs

| Charges | Amount |

| Average Brokerage | 0.01% of the turnover value |

| Security Transaction Tax (STT) | 0.1% on buy & sell |

| Transaction charges | ⇒ NSE= 0.00345%⇒ BSE= 0.00345% |

| GST | 18% on (brokerage + transaction charges) |

| SEBI Charges | ₹10 / crore |

| Stamp charges | 0.015% or ₹1500 / crore on buy-side |

What is the cost of investing in Real Estate – REITs

Real Estate Investment Trusts (REIT) are a relatively new asset in Indian markets, with the first IPO of a REIT happening in 2019. REITs are companies that own or finance real estate properties. They own four types of assets: private equity, private debt, public equity and public debt. They are actively managed funds.

REITs can be private, publicly traded and non-traded public REITs. They have a high maintenance fee of up to 15% globally.

Publicly traded REITs have trading costs like those of equity:

| Charges | Amount |

| Average Brokerage | Varies depending on the brokerage firm |

| Security Transaction Tax (STT) | 0.1% on buy & sell |

| Transaction charges | ⇒ NSE= 0.00345%⇒ BSE= 0.00345% |

| GST | 18% on (brokerage + transaction charges) |

| SEBI Charges | ₹10 / crore |

| Stamp charges | 0.015% or ₹1500 / crore on buy-side |

What is the cost of investing in Corporate Bonds

Corporate bonds are debt securities issued by companies. People who are buying the corporate bonds are lending to the issuing company. The maturity of corporate bonds is at least one year. Besides direct investments, investors can get exposure to corporate bonds through mutual funds and ETFs. Corporate bonds are also traded in the secondary market. However, in the secondary market, prices are decided by the number of interest instalments still due before the bond’s maturity date. In this case, the investor may receive less than the face value of the bond.

What is the cost of investing in Government Securities

Government Securities are debt securities issued by the government. Investors are effectively lending money to the government. These bonds are seen as the least risky securities as there is no credit default risk, meaning that they are loans that come with a sovereign guarantee of payback. However, they are not free of price risk. This would mean that offloading these securities might lose investor money in case the price of the security has gone down in the secondary market. Investing in government securities has become possible for Indian retail investors with the rollout of Retail Direct Schemes.

No fees are charged for opening and maintaining the ‘Retail Direct Gilt account’ with RBI. No fee will be charged by the aggregator for submitting bids in the primary auctions. Fee for payment gateway etc., as applicable, will be borne by the registered investor.

What is the cost of investing in Commodities (Gold, Oil, Metals)

By commodities, we refer to metals like gold, silver, copper and other items like cotton, oil and pepper. Contracts for raw materials are traded on the commodity market. Trading in commodities will incur brokerage charges.

| Commodity futures | Commodity options | |

| Brokerage | Depends on the broker | |

| STT/CTT | 0.01% on sell side (Non-Agri) | 0.05% on sell-side |

| Transaction charges | Group AExchange txn charge: 0.0026%Group B:Exchange txn charge:CASTORSEED – 0.0005%KAPAS – 0.0026%PEPPER – 0.00005%RBDPMOLEIN – 0.001% | Exchange txn charge: 0.05% |

| GST | 18% on (brokerage + transaction charges) | 18% on (brokerage + transaction charges) |

| SEBI charges | Agri:₹1 / croreNon-Agri:₹10 / crore | ₹10 / crore |

| Stamp charges | 0.002% or ₹200 / crore on buy-side | 0.003% or ₹300 / crore on buy-side |

What are transactions charges in stock market?

Looking at your broker’s website can tell you the exact costs involved in trading each security. However, it is impossible to make valuable inferences about the impact of the expenses on investment decisions through such a detailed view. So instead, we suggest looking at the average transaction costs.

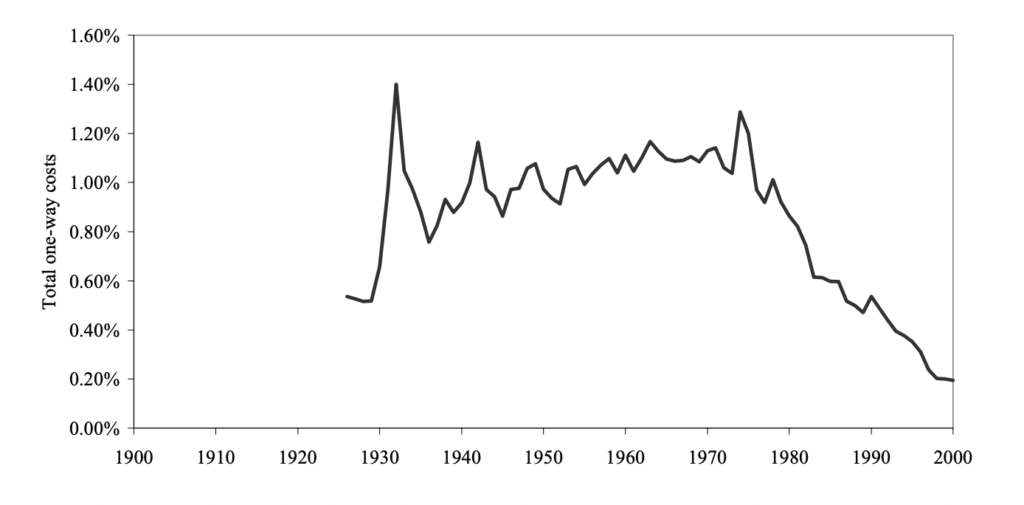

Observing the average transaction costs, we can see a gradual decline in costs. Over the years, we have witnessed commission charges go down as new technologies and protocols were developed and incorporated into exchanges. As a result, information technology developments have connected sellers and buyers worldwide. Thus, IT has made the market a more robust place, allowing for smoother transactions, at a faster pace, across vast distances and decreasing costs.

Average one-way transaction costs (half-spread+NYSE commission)

A fall in transaction costs shall lead to an increase in trading. Lower trading costs open up multiple possibilities for traders. Trades that were previously given up due to high transaction costs would become easier on the wallet.

While the effect of lower trading costs is remarkable, it is admittedly not the only factor influencing the increase in trading volumes. Another contributing factor is the increased access to information for traders that allows for faster trades.

What is the Cost of Having a Fund Manager Handle Your Portfolio?

Keeping all these costs in mind and working out a well-diversified portfolio might seem like a full-time job at times, and it is.

So far, we have discussed the different cost considerations for various assets and the transaction costs incurred by investors. Now, let’s understand how these costs impact portfolio management.

Different asset classes involve different costs. These differences lead to complications in the cost analysis. The complexity of cost analysis would depend on the amount of diversification.

This is one of the reasons why diversification can be tricky and may overload an investor. Deciding to shift to another asset can be tricky because of the various costs. Thus, to sidestep these complexities, one needs to be wary of over-diversification.

Taking care of all these tasks might be difficult for individuals holding different jobs. And this is just the cost analysis. Various other tasks that comprise market research and analysis need to be taken care of. Unless an investor gets returns above the market return, it would be meaningless to take on such tasks.

If an investor decides to take external help, these cost analyses would be taken over by the fund manager. Additionally, some funds may provide advisory services for the curation of portfolios. So, fund management services will charge for the research conducted, cost-to-return analysis, expenses incurred and curation of a portfolio. These charges are often stated as an expense ratio.

When comparing the cost of fund management services, it might be essential to consider the number of assets covered.

What is an Expense Ratio?

The expense ratio is calculated by dividing the expenses incurred in running a fund by the assets under management. We mean the total market value of investments managed by a particular fund manager by assets under management. Total expenses would include the asset-specific costs covered earlier and the transaction costs.

We can interpret the expense ratio as the cost incurred per rupee of investment. It measures the amount of investor money used for administrative, research, and transaction costs.

When it comes to choosing funds, the expense ratio happens to be the 2nd most followed figure. When analysed along with the return ratio, it gives a fair picture of the cost-to-benefit outlook of investing in a fund.

For example, if a total expense of ₹2 lakhs was incurred by a fund managing total investments of about ₹2 crores, the expense ratio would be = ₹2 lakhs / ₹2 crores =1%

Conclusion

We saw how different types of investment costs could affect your portfolio. In addition to the direct effect of reducing the value of investments, various fees can make portfolio management very complicated.

On WealthDesk, you can find WealthBaskets for various investment strategies like growth investing, momentum investing, etc., and different investment objectives, managed by SEBI registered professionals.

Check out our website for the various WealthBaskets.

What are WealthBaskets?

A WealthBasket is a collection of equity stocks and ETFs. Each WealthBasket has a specific investment idea behind it. SEBI-registered investment professionals make these WealthBaskets. Some attractive features of investing in WealthBaskets:

- All underlying equity stocks and ETFs are on your Demat account

- More clarity and transparency in investing

- Invest without a lock-in

- Apply regular rebalancing updates in your WealthBaskets

- Earn dividends directly in your account

FAQs

In our blog, we have discussed how fees can reduce the value of investments. Consequently, we also see that the diversification of a portfolio becomes problematic as it requires additional cost analysis.

Depending on the type of security, investors incur brokerage fees and taxes. In addition, management costs are also incurred if the investment is indirect, i. e., the investment is made through a trust or a fund.

Investors stand to get tax efficiency, flexibility, convenience and peace of mind by investing through managed portfolios. Instead of handling all investment decisions themselves, investors can tap into the experience of professionals whose primary focus will be on managing the portfolio.