Shareholders and stakeholders – these terms may sound similar, but they differ vastly in reality. If you are also confused about these two terms, exploring this article may help.

This article discusses who are shareholders, the types of shareholders, the role of shareholders, who are stakeholders, types of stakeholders, the role of stakeholders, and the differences between shareholders and stakeholders.

Who Are Shareholders?

Shareholders are individuals or institutions holding at least one share in a company. As shares represent ownership, shareholders are said to have partial ownership of the issuing company, proportional to the number of shares they hold.

Types Of Shareholders

There are two types of shareholders based on the type of shares owned.

1. Common shareholders

- Shareholders holding common stock are called common shareholders.

- Being a common shareholder, you can get a right to vote on certain company matters.

- If you own common stock, you may generate returns in two ways: dividend and capital appreciation. A dividend is a part of a company’s earnings that may be distributed to reward shareholders. Capital appreciation means an increase in stock price compared to your purchase price.

- In the case of liquidation, you would get paid the remaining share of assets after debtors and preference shareholders are paid out.

2. Preference shareholders

- Those shareholders who own preferred stock are called preference shareholders.

- Being a preferred shareholder, you do not hold the voting rights in the issuing company.

- You may get a fixed dividend as a reward for holding preference shares.

- You would get a preference, over common shareholders, in the event of dividend payout and liquidation.

Understanding The Role Of The Shareholders

- Shareholders provide required funds to the company.

- Common shareholders play a crucial role in electing the company directors and making some vital business policies and decisions using their voting powers.

- The remuneration payable to the company directors has to be approved by the shareholders.

- Shareholders’ approval is also necessary when deciding on dividend payouts.

Who Are Stakeholders?

Stakeholders can be individuals or institutions connected with the company – who can affect or get affected by the company’s actions.

For instance, if you buy a company product, you contribute to the company’s revenue. Plus, some business decisions such as changes in the product price or the introduction of a new product may affect you as a customer. Therefore, you are a stakeholder of that company.

Types Of Stakeholders

Mainly there are two types of stakeholders.

Internal stakeholders

- Internal stakeholders are individuals or institutions directly impacted by the company’s action and its success or failure.

- A company’s internal stakeholders may include owners, shareholders, managers, employees, etc.

External stakeholders

- External stakeholders are individuals or institutions who are not directly connected with the company yet are somehow affected by its actions and success or failure.

- A company’s external stakeholders may include government, customers, creditors, suppliers, etc.

Understanding The Role Of The Stakeholders

- As shareholders are also stakeholders, they play an essential role in vital corporate decisions using their voting powers.

- Managers, employees, and company executives contribute to the company’s performance and help it achieve its goal.

- Customers affect the profitability of the business by their buying behaviour. Suppliers provide necessary raw materials, and creditors provide required funds to the company.

Shareholders Vs Stakeholders

Here are the differences between shareholders and stakeholders.

| No. | Shareholders | Stakeholders |

| 1 | All shareholders are partial owners of the company. | All the stakeholders may not be the owners of the company. |

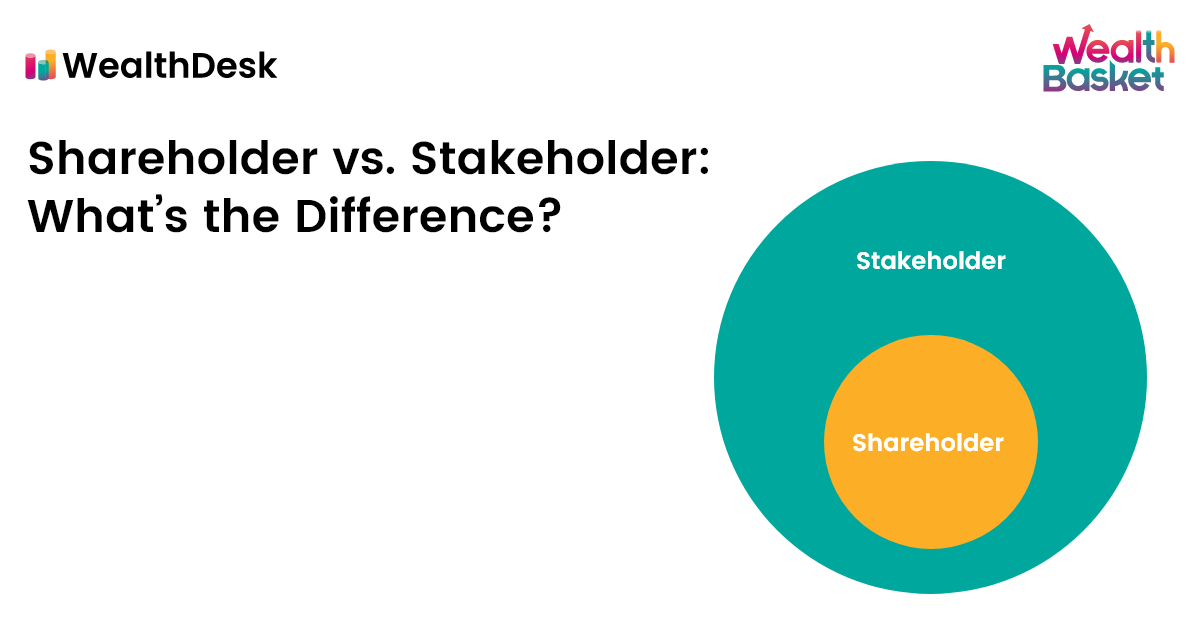

| 2 | Each shareholder is a stakeholder. | Not each stakeholder is necessarily a shareholder. |

| 3 | The main focus of shareholders may be the stock performance and return on their investments. | Different stakeholders would have different areas they may be focusing on. For eg. shareholders would focus on profits, creditors would focus on repayment capability, etc. |

| 4 | The company may distribute its profit among shareholders through dividends. | All the stakeholders may not get a profit part or even monetary benefits. |

Also Read: Difference Between Discount Brokers And Full-Service Brokers In India

Special Considerations

Companies may consider all stakeholders’ interests, over only shareholders’ interests, because of the growing importance of Corporate Social Responsibility (CSR). Corporate social responsibility considers the general public as the stakeholders of a company.

For instance, a company may have two choices while making business decisions: reduce costs and increase profits or reduce their carbon footprints (at relatively higher costs) to promote a healthy environment. Here, the company may choose the second option and prefer the interest of stakeholders (instead of solely shareholders) as a part of their corporate social responsibility.

Final Thoughts

Shareholders and stakeholders are two different terms. Shareholders are those who own shares, while stakeholders include all parties who affect the business anyway. Therefore, shareholders are also stakeholders. Companies need to make decisions considering the interests of all stakeholders.

We, at WealthDesk, help you have a smooth investment journey by enabling you to invest in WealthBaskets, which are the combinations of equities and ETFs that reflect an idea, theme, or strategy. SEBI registered professionals curate and monitor these WealthBaskets.

FAQs

Shareholders are partial owners (proportional to their stake) of the company. If the company has 1,000 outstanding shares, and you hold 200 shares, you own 20% of that company.

Stakeholders are all the individuals or institutions that can affect or get affected by the company’s actions. For example, shareholders, customers, employees, creditors, suppliers, any agency company works with, etc.,

As shareholders are interested in the company’s performance and are impacted by its actions, they are considered the company’s stakeholders.

Shareholders provide funds to the company. Plus, common shareholders play a crucial role in electing the company directors and making some vital business policies and decisions using their voting powers.

Shareholders are those stakeholders who have ownership as well as capital interest in the company. As the company’s operations and performance affect shareholders’ actions, they are important to other stakeholders.