We all dream of doubling our money, and for that, we use multiple investment strategies and opt for expert advisories. There is no assured solution that guarantees the doubling of your money. However, there are ways to predict the time frame your investment can double. One such way is the Rule of 72.

This article highlights the concept of Rule of 72 in finance, its formula, how you can use it, and whether it gives accurate results.

What Is The Rule Of 72 In Finance?

The Rule of 72 is a mathematical formula used to estimate the approximate time your investment would take to double in value at a specific annual compounded rate of return. Alternatively, the Rule of 72 also helps to estimate the annual compounded rate of return required to double your investment in a particular time frame.

Rule Of 72 Formula

The formula for Rule of 72 is as below.

- Doubling period

To calculate the approximate time your investment would take to double in value, you need to divide 72 by the expected annual compounded rate of return.

Doubling period (in years) = 72 / expected annual compounded rate of return.

Note: You need to consider the ‘whole number’ of the rate of return and not a decimal number. For instance, if the expected rate of return is 8%, you need to divide 72 by 8, not 0.08.

- The required rate of return

To arrive at the required rate of return needed to double your investment in a set time, you need to divide 72 by the number of years you plan to hold your investment.

Required rate of return (in %) = 72 / number of years

The result is a compounding rate of return you require to double your investment in the specified number of years.

Also Read: All You Need To Know About Price-To-Earnings (P/E) Ratio

Rule Of 72 Example

- Harshit has invested ₹3,00,000 in an automobile manufacturing company, expecting he would get a 9.5% compounded rate of return every year. He wants to know when his investment would get doubled, and here is how he can calculate the approximate doubling period using the Rule of 72.

Doubling period = 72 / 9.5 = 7.58 Years

Harshit’s investment would take approximately seven and a half years to double in value.

- Ruchi has an investable income of ₹5,00,000, and she is aiming for it to be ₹10,00,000 in seven years. She wants to know the annual compounded rate of return required to reach her targeted portfolio size in seven years and here is how Rule of 72 can help her figure it out quickly.

Required rate of return = 72 / 7 = 10.29%

If Ruchi gets a compounded rate of return of 10.29% every year, she can reach her targeted portfolio size in approximately seven years.

How Can You Use Rule Of 72?

-

Investment Planning:

You can use Rule of 72 for your investment planning. For instance, you invest ₹1,00,000 today, assuming you will get a 10% return every year. Plus, let’s assume your investment horizon is 21 years. With this amount and yearly fixed rate of return, your investment would nearly double in 7.2 years.

It means your ₹1,00,000 would become approximately ₹2,00,000 in the first seven years. Then, in the next seven years, ₹2,00,000 would become nearly ₹4,00,000. And, at the end of your investment horizon, your investment would reach approximately ₹8,00,000 (double ₹4,00,000).

This way, you can roughly calculate how much investment amount you will have at the end of your investment horizon. However, in case of any minor variation in the compounding interest rate, the period your money will double can change.

You can use Rule of 72 even if you get monthly or quarterly returns, provided your returns compound annually. For example, if you get 2% returns every month, it will take 36 months (72/2) or three years for your investment to double.

-

Interest on the borrowed amount:

The Rule of 72 can also help you roughly predict the time frame in which interest on your borrowed amount can double the amount you owe. For instance, you took a loan of ₹5,00,000 at 9% fixed compound interest per annum. Therefore, according to Rule 72, your loan would reach approximately ₹10,00,000 in eight years (72/9).

Also Read: How To Track Your Investment Portfolio?

Is The Rule Of 72 Accurate?

Here are some conditions in which Rule of 72 usually works.

- The fixed interest rate/rate of return compounds annually.

- The rate of return is low, typically between 6-10%.

- Investors make a one-time investment and the income generated from the investment is reinvested for compounding returns.

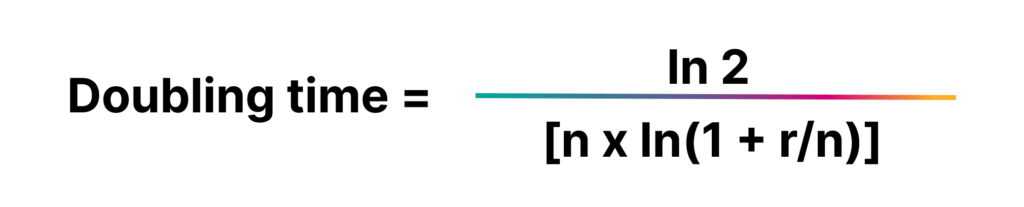

If these conditions are satisfied, the Rule of 72 can quickly give you near to the exact number. Instead, if you want to calculate the accurate doubling period, you can use the doubling time formula.

Where ln =Natural log

r

= Annual rate of return

n =

Compounding frequency per year

Final Thoughts

The Rule of 72 is a quick way to estimate the time your investment would take to double at a given annual compounding rate of return. Though it doesn’t provide reliable results for the simple interest rate, the rule does not consider the risk element. Therefore, you should use this rule cautiously.

At WealthDesk, we help you make your investment journey easy yet rewarding by offering ready-made WealthBaskets. WealthBaskets are the combination of stocks and ETFs and reflect an investment idea, strategy, or theme. SEBI registered professionals design these WealthBaskets.

FAQs

The Rule of 72 is important to quickly calculate the approximate number of years in which your investment can double at a specific annual rate of return. It can help you roughly predict the years your portfolio would take to reach your target.

No investment guarantees that your invested money will double in five years. However, if your investment offers a fixed annual compounded rate of return of 14.4%, your invested amount can double in approximately five years.

The main difference is that Rule of 72 considers simple compounding interest, whereas Rule of 69 considers continuous compounding interest. Additionally, the accuracy of Rule of 72 decreases with higher interest rates. However, you can use Rule of 69 for any interest rate.

Luca Pacioli, an Italian mathematician, mentioned Rule of 72 in his book Summa de arithmetica, geometria, proportioni et proportionalita (Summary of Arithmetic, Geometry, Proportions, and Proportionality).

Rule of 70 and Rule of 72 help calculate the approximate time your investment would take to double in value.