In a quest to grow wealth and beat inflation, Indian investors often turn to equity investments. However, most people don’t realise that there are actually two ways in which you can invest in equities: Public equity and Private equity. These two paths offer different levels of risk and reward.

This blog aims to inform you about these two categories and explain the pros and cons of investing in them in the context of Indian markets.

What is Public Equity?

Public equity constitutes investments in shares of publicly traded companies. These companies have their shares listed on renowned stock exchanges like the National Stock Exchange of India (NSE) or the Bombay Stock Exchange (BSE).

Investing in public equity provides investors with a fair degree of liquidity that allows them to buy and sell shares with relative ease. Moreover, publicly traded companies are obligated to regularly disclose their financial information regularly, giving investors transparent access to risks and potential rewards that they may face.

How to Invest in Public Equity?

There are two primary ways in which you can invest in public equities:

Direct Investing:

Investors can directly purchase shares of a stock through a stockbroker-like share.market. This approach offers greater control over individual investments but demands more in-depth knowledge and expertise from investors.

Indirect Investing:

For those not inclined to delve into individual stock research, investing in public equity through WealthBaskets, Mutual funds or Exchange-traded funds (ETFs) provides a more convenient alternative.

What are the Pros of investing in Public Equity

Liquidity:

Public equity investments are relatively liquid, enabling swift buy and sell transactions.

Transparency:

Publicly traded companies regularly disclose financial information, facilitating informed investment decisions.

Diversification:

Public equity markets offer a diverse array of investment opportunities, supporting portfolio diversification.

What are the Cons of investing in Public Equity

Volatility:

Public equity markets can be volatile, resulting in fluctuating stock prices.

Information Asymmetry:

Company insiders may possess information advantages over individual investors, providing them with an unfair advantage, which sometimes leads to front-running any positive or negative development.

Regulatory Risk:

Publicly traded companies must comply with various regulations, potentially impacting costs and flexibility.

What is Private Equity?

Private equity investments involve acquiring equity stakes in privately held companies that are not listed on stock exchanges. These investments typically target sophisticated investors who meet specific net worth criteria.

Private equity investments tend to be illiquid, meaning that investors cannot easily buy or sell their stakes. Privately held companies are also not obliged to disclose financial information on a regular basis like publicly listed companies, making risk assessment more challenging.

How to Invest in Private Equity

In India, private equity investments are generally executed through private equity funds. These funds are managed by professional investment managers who raise capital from institutional investors and high-net-worth individuals.

Another way to invest in private equity is by buying unlisted shares of these companies through grey market dealers and platforms. But it is a risky venture as frauds are very common in these transactions.

Private equity funds allocate capital to a range of privately held companies, including startups, growth firms, and turnaround enterprises. Private equity investments typically adopt a long-term investment horizon, aiming to generate returns through capital appreciation and dividends.

What are the Pros of investing in Private Equity

Potential for Higher Returns:

Private equity investments often target higher returns compared to public equity.

Lower Valuations:

Private equity funds generally invest in companies at a growing stage or when they are in need of funds, hence are likely to get shares at a cheaper valuations to invest at.

Confidentiality:

Private company investments offer a level of privacy that is not available with publicly traded stocks. Financial details and investment terms are often kept confidential.

Access to Niche Industries:

Private equity allows investors to access specialised or niche industries that may not have publicly traded counterparts. This can provide exposure to unique opportunities and market segments.

Access to High-Growth Companies:

Private equity funds can invest in high-growth companies not yet publicly traded.

What are the Cons of investing in Private Equity

Illiquidity:

Private equity investments are typically illiquid, posing challenges in buying or selling stakes.

Lack of Transparency:

Privately held companies are not mandated to regularly disclose financial information like publicly listed companies which are bound by regulations to disclose financial performance in every quarter, thus complicating risk assessment.

Risk of Business Failure:

Private companies, especially startups and early-stage ventures, have a higher risk of failure compared to established public companies. Many startups do not survive, and investors may lose their entire investment if the company goes out of business.

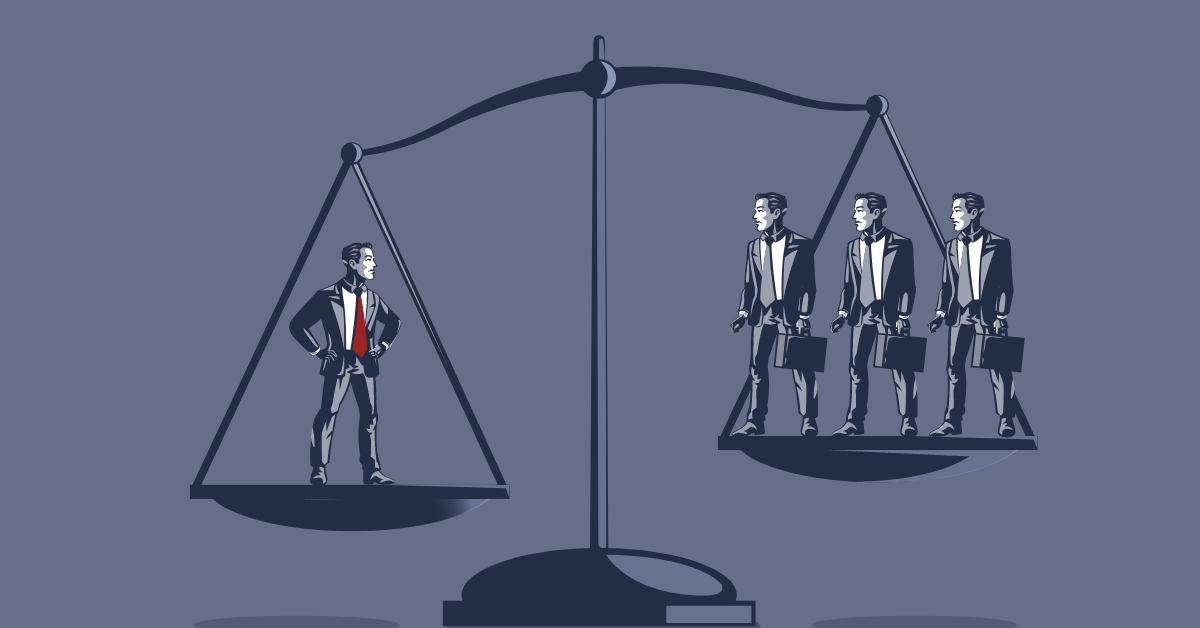

Which is Better: Public Equity or Private Equity?

The choice between public equity and private equity depends on individual investment goals and risk taking ability.

Public equity is a suitable option for those seeking liquidity, transparency, and diversification. On the other hand, private equity investments are ideal for investors willing to embrace illiquidity, a lack of transparency, and manager risk in pursuit of higher potential returns.

| Characteristic | Public Equity | Private Equity |

| Liquidity | Relatively liquid | Illiquid |

| Transparency | Publicly traded companies regularly disclose financial information as per regulations. | Privately held companies are not required to disclose financial information regularly as they are not regulated by exchanges. |

| Diversification | Public equity markets offer a diverse array of investment opportunities | Private equity funds typically invest in a limited number of companies |

| Volatility | Public equity markets can be volatile | Private equity investments are typically less volatile than public equity investments |

| Information asymmetry | Company insiders may possess information advantages over individual investors | Privately held companies are less likely to have information advantages over investors. |

| Regulatory risk | Publicly traded companies must comply with various regulations, therefore posing less risk. | Privately held companies are not subject to the same level of regulation as public companies, therefore being more risky. |

Conclusion

In conclusion both public equity and private equity stand as distinct choices, each offering its unique set of advantages and drawbacks. Public equity investments bring liquidity and transparency but may yield relatively lower returns. In contrast, private equity investments, while potentially more profitable, come with the challenges of illiquidity and limited transparency.

The optimal investment type depends on individual financial objectives and risk tolerance. If uncertainty clouds your decision, it’s wise to consult a financial advisor who can provide guidance based on your specific circumstances.

FAQs

Public equity is investing in publicly traded companies, whose shares are listed on a stock exchange. Private equity is investing in privately held companies, whose shares are not listed on a stock exchange.

The answer depends on your individual investment goals and risk tolerance. Public equity investments are more liquid and transparent, but they also have lower potential returns. Private equity investments are less liquid and transparent, but they also have the potential for higher returns.

There are two main ways to invest in public

equity:

Direct investing: You can buy shares of

stock directly from a stockbroker.

Indirect

investing: You can invest in public equity through

mutual funds or exchange-traded funds (ETFs).

Private equity investments are typically made through private equity funds. Private equity funds are managed by professional investment managers who raise money from institutional investors and high-net-worth individuals.