Anyone who follows the stock market dreads the term “bear market.” Not only are they inevitable, but it’s even difficult to predict how long they might impact the market. Smart investors are those who survive in these times and manage to generate wealth. Before exploring these winning strategies, let us first understand what a bear market is and why it scares investors.

What is a Bear Market?

A Bear Market is, in effect, a situation when stock market indices fall more than 20% from a previous high. As per the economists, the bear market should occur from time to time, allowing people to stay honest and not speculate. This is the natural way to regulate the imbalances that arise between consumer demands, corporate earnings, and combined legislative and regulatory changes in the market.

When the paws of the bear market get stronger, it becomes difficult to predict when the market will bottom out. You might miss the opportunity to buy on a dip if the stock market has made a U-shape recovery. If you buy too quickly, your portfolio might show red with falling stock prices. A 75%+ correction, seen during 2000-02 and 50%+ in 2007-09, made the investors fearful of the stock market. Investors who tried to time this bear market made more losses than the gains accumulated in a bull run.

source: https://www.investopedia.com/articles/investing/070115/4-ways-survive-and-prosper-bear-market.asp

Rather than timing the market during the lean phase, one should invest smartly to create long-term wealth and avoid losses.

Here are some of the bear market strategies investors must follow to generate wealth:

-

Buy at low prices: If you invest in a

rising market, each purchase will happen at a higher

price, and thus, the incremental returns will be

lowered. Once the market corrects, you can buy the

same stock or asset at a much lower price, yielding

higher returns when the next bull run starts.

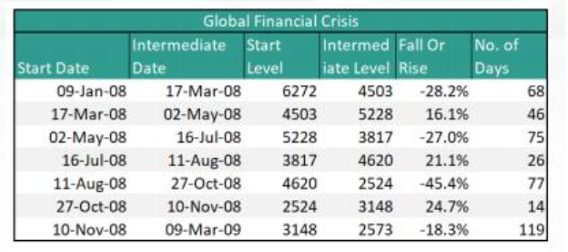

- Make Staggered investment: In the bear stock market, the opportunity to invest is continuous. Looking to buy stocks when the market has bottomed out isn’t an effective strategy. The below chart and table represent the market for the year 2008.

The benchmark index of the equity market had fallen by 40% from a year high by mid-July 2008. Investors who thought the market had bottomed out made lump sum investments in equity. This approach wouldn’t have been an appropriate one, as the table shows the journey of the index.

From July 2008, the market fell further, bottoming out in October 2008, and recovery started by March 2009 only. Investors, who made a lump sum investment in July 2008 for a quick return, would have seen their investment falling in the red by year-end. Thus, rather than timing the market, smart investors should befriend the bear of the stock market. They should invest in value bear stocks in a staggered approach and reap benefits when the market recovers.

- Never sell stocks in panic: Sharp correction causes fear among investors. They feel the market might not reach the highs again and sell all their value stocks to save losses. But selling value stocks at the onset of the bear stock market isn’t a great idea.

Even though the bear market started in 2008, the market recovered by mid of 2009 and reached new highs by 2011. Smart investors who did not panic in the bear run and even increased their investment in value bearish stocks during these times generated a significant amount of wealth eventually.

- Go for a long-term approach: Investors tend to make knee-jerk reactions to market movements in a bear market. Most investors underperform in the stock market over the long run as they quickly move in and out of the stock positions for a quick gain. While they might make short-term gains, they aren’t able to create wealth in the long term. Thus, smart investors shouldn’t look for short-term gain but keep making a regular investment in the nation’s sound companies even during the bear run. These value investments will deliver solid returns and help to create enormous wealth in the 10-20 year horizon.

If you want to invest in the stock market but are unsure from where to start. Wealthdesk offers a portfolio of equities known as WealthBaskets. These low-cost baskets help you to diversify your portfolio for long-term and short-term goals. WealthBaskets are curated by SEBI registered professionals following thorough research, with each basket reflecting an investment strategy, theme or idea. It is suitable for all kinds of investors- whether new to equity or seasoned ones. Explore our various offerings and choose the one that best suits your needs.

Though the main goal of investment is to ‘buy low and sell high,’ investors usually follow the opposite behavior:

- They panic and sell their investments during the bear market.

- Buy overpriced stocks during the bull run.

- They look for short-term gains rather than long-term growth.

This is what differentiates a regular investor from a smart one. Smart investors understand that bear markets are an opportunity to generate wealth long term. They patiently invest in good quality stocks during the bear run and keep an eye on the growth of these companies in the longer term.

FAQs

Long-term wealth creation refers to investing in assets that can help to generate massive income/returns over the horizon of 10-20 years.

Whether it’s a bear or bull market, both provide the best opportunity to make money. There are specific techniques for each market that should be used appropriately to generate wealth over time.

Investors should never sell stocks due to fear of the bear stock market. They should hold their investment for a longer horizon and only sell stocks when it’s not aligned with their goals.