The prospect of earning passive income through dividends is certainly attractive. When companies’ earnings are announced, we often find ourselves questioning which are the good dividend-paying stocks in India or what some high dividend shares in India might be. Some might wonder even what the top dividend yield stocks are in India.

If you are trying to shortlist the highest dividend-paying companies, you may find this article useful. Here, we discuss some points to consider when choosing stocks to earn dividends.

Some points to consider when choosing stocks to earn dividends

Check Sector Trends

Shortlisting stocks can be much easier if you start by looking at the best performing sectors and the companies in those sectors that consistently pay dividends. In addition to knowing the historically best performing sectors, you should know which sectors are expected to grow and stay profitable over the next few years.

After shortlisting a few sectors, you can sort the companies by their dividend yields (percentage of share price paid out in dividends each year).

Dividend Yield

The dividend yield is the percentage of share price paid out in dividends each year.

What are high dividend yield stocks?

Higher the dividend yield, the higher the dividend return on investment. Typically high dividend yield stocks in India tend to be in utilities and commodities trading sectors.

High dividend yield growth stocks are tough to find and might require you to tolerate price fluctuations. If you prefer comparatively lower price fluctuations, you could look for high dividend yield large-cap stocks. Large-cap stocks are generally thought of as companies that have reached their growth potential. So, they may not experience wild changes in valuations.

Consistent increase in dividend yields is a good sign

Instead of focusing on consistent dividend-paying stocks in India, you could look for stocks that have shown a consistent increase in dividend yield over the years. It is important to have a long-term focus during this research, as falling prices might affect the dividend yield more than the actual dividends in the short term.

After recognising such stocks, you could set up a SIP (Systematic Investment Plan) and possibly earn growing dividends. If you commit to reinvesting your dividends, you could also gain from compounding benefits.

Long Term Profitability Matters

Dividends are distributions of profits by companies to their shareholders. So, it is important to shortlist firms expected to have good long term profits. Ideally, you would want to make long term investments in stocks that will consistently pay dividends.

Companies with good fundamentals, sound management, and a nurturing environment (supportive government policies, healthy supplementary industries, etc.) will have better long-term profitability.

Domestically, investors may be able to find profitable stocks for long term investment. India is a developing country, and as such, the businesses grow faster than the ones in developed countries.

Discover stocks that suit certain filter criteria and dive into details to check their WealthBaskets.

Some useful measures of earnings and profitability:

Earnings Per Share Ratio (EPS)

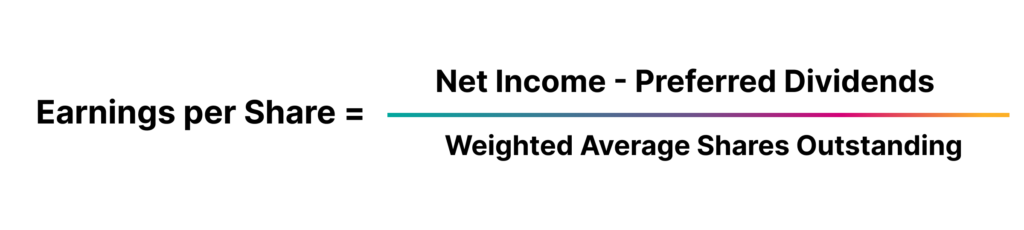

The earnings per share ratio is measured by dividing a company’s net income by the number of outstanding shares. The expected earnings per share ratio is called the forward earnings per share ratio (forward EPS) and is calculated based on the expected net income of the company.

To understand what a good earnings per share ratio is, you need to know the industry average of earnings per share ratio.

You can calculate the earnings per share ratio for a stock with the following formula.

But, since EPS ratios for all companies are readily available, you may not need to use this formula.

Price to earnings ratio (P/E Ratio)

The price to earnings ratio is calculated by dividing the current share price by its earnings per share ratio (EPS).

What is the P/E ratio?

P/E ratio can be described as a company’s market capitalisation divided by its earnings. This ratio gives you a sense of whether the company is valued correctly or not.

To understand, what a good P/E ratio for buying into a company would be, you need to know the industry average. A high P/E ratio suggests that the company is overvalued and vice versa.

Look For Low Debt Stocks

Just looking at how profitable a stock is may not be enough. You could expand your search to stocks with a high ROE (Return On Equity) and low debt. In India, information about the debt to equity ratios and ROE is readily available in company filings such as annual reports, quarterly results etc.

Low debt companies are desirable as they tend to have lower interest payments. If a company gets most of its funds through equity and a smaller amount from debt, i. e. if it has a low debt to equity ratio, the chance of interest payments affecting dividends is lower.

Check Company History

Over this article, we have mentioned the significance of EPS, P/E, debt to equity ratio and ROE. In addition to this, you should also check the sales and profit figures. By looking at the historical performance and not just recent figures, you can understand how the company grew over the years.

Historical financial performance analysis will tell you how well the company has managed its debt and created revenues.

You could also look at the stock price trends to avoid foreseeable capital losses. Even though you are selecting dividend stocks, the historical performance of stock prices can not be overlooked.

Final Thoughts

Dividends are directly affected by a company’s profitability. So, investors must evaluate the business using measures such as debt to equity ratio, P/E ratio, ROE, in addition to dividend yields. Also, you might want to check the historical performance instead of just recent figures to understand the business’s growth trajectory.

Shortlisting stocks on your own can be a hassle sometimes. At the same time, it is expensive to get professionally made portfolios. WealthBaskets were created to connect SEBI-registered professionals with retail investors from all walks of life. Each WealthBasket is a professionally curated portfolio with a specific idea and investment strategy.

FAQs

Dividends are distributions of earnings of companies. So, you need to look for companies that will stay profitable and have a history of consistently paying dividends.

Dividends could be paid on a monthly, quarterly or annual basis. Some companies might choose to reinvest profits and not pay dividends. Ultimately, it depends on the company’s board of directors’ decision.

You might be able to earn some part of your income from dividends, but being entirely dependent on them might be a bad idea. You should look to diversify across asset classes (stocks, bonds, etc.) to earn income from independent sources.

Earnings per share (EPS) is a measure of how profitable a company is. EPS is calculated by dividing the company’s profit by the number of outstanding shares.

Price to earnings ratio (P/E) is the ratio of the current share prices to its EPS. It tells you the amount of investment required to earn ₹1 of profits.