Finkasturi Nivesh Private Limited (FinKasturi) is a SEBI Registered Investment Advisor (SEBI Registration No: INA000014128) based out of Mumbai. It provides research-based advisory solutions on various asset classes like Equity, Fixed Income, Mutual Funds, Exchange Trades Funds (ETFs) etc. Our process-driven approach in research provides a prudent solution to the client within the risk parameters while following all regulatory and compliance requirements. Since its inception, FinKasturi has helped many clients in their journey towards achieving their financial goals over the last two years.

Dr.Nirakar Pradhan, CFA, the architect of the portfolio, has more than 35 years of experience in investments and finance. He has been in the roles of Chief Investment Officer, Head of Treasury, and Head of Investment Control during his career spanning multiple geographies such as India, Germany, and France, working with leading companies like State Bank of India, Generali Investments, Paris and Future Generali Life Insurance, Mumbai. With a track record of top quartile portfolio performance, Nirakar strives to replicate superior risk-adjusted returns for clients through FinKasturi WealthBasket.

About FinKasturi WealthBasket

FinKasturi WealthBasket consists of carefully selected 20 stocks, christened as Kasturi Equity Opportunity Portfolio (KEOP), with a potential to provide a superior risk-adjusted return over the medium to long term. Since we choose stocks based on investment thesis playing out over the medium to long term, we recommend clients to stay invested for at least 3 years. The minimum investment amount for FinKasturi WealthBasket is Rs 5 lakh, and an advisory fee is 2.0% per annum on average Asset under Advisory (AuA).

Past Performance

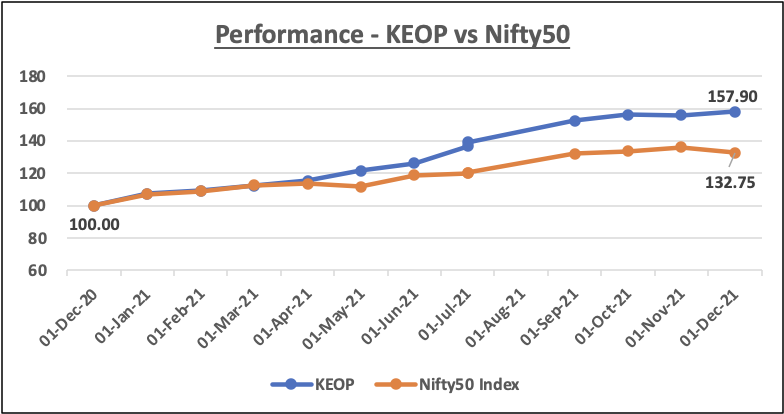

Since its inception on 1 Dec 2020, KEOP has generated more than 20% alpha (excess return) compared to Nifty50 Index in one year while maintaining a portfolio Beta of less than 0.75. Among a few successful stocks in our portfolio over last one year, IT companies Tata Elxsi and L&T Infotech stand out as they have been the beneficiary of accelerated global shift towards digital post-Covid. Among others, stocks like Dr Lal Pathlabs (leading diagnostics company which is the beneficiary of increased medical testing), Jubilant Foodworks (largest QSR chain in India getting benefit of higher percentage of home delivery) and Dixon Technology (poster boy for PLI theme in India), to name a few, have generated alpha for the portfolio.

Below graph shows the performance of KEOP over Nifty50 Index over last one year.

FinKasturi WealthBasket: Investment Thesis

FinKasturi WealthBasket is a growth-oriented portfolio with 20 stocks selected based on past financial performance and corporate governance. 70% of the portfolio (14 stocks) is picked from the output of a quantitative model, which considers the consistency of financial performance over the past five years, while balance 30% of the portfolio (6 stocks) are selected based on subjective parameters like turn around stories, beneficiaries of policy changes, structural levers driving growth etc. Even though the portfolio’s generation of excess return (alpha) is important, special attention is given to risk control parameters (standard deviation, portfolio beta, etc.) to minimize the volatility. The portfolio’s objective is safety, liquidity and sustainable risk-adjusted return in that order. The differentiating feature of the portfolio is that we strive to maintain low volatility (Beta less than 0.75) while at the same time targeting to generate a return higher than the benchmark.

A few of the financial parameters used for shortlisting the portfolio stocks:

Minimum Market Capitalization – To avoid unexplained volatility, get adequate liquidity and research coverage

Minimum Average Return Ratio (RoCE/RoE) over the past few years – The firm should consistently generate higher returns from business compared to its cost of capital.

Positive Free Cash Flow Generation – Most of the years firm must generate positive free cash flow.

Minimum Asset Turnover Ratio – Company must be generating adequate revenue on its investment in Assets (indicates the efficiency of deployment of assets)

Comfortable Leverage Situation – Leverage must not exceed a certain level of debt-to-equity ratio to keep borrowing rate and interest outgo under control.

Minimum Operating Margin – Company should have a minimum operating margin level in its business so that in case of a downturn / competitive scenario, it must be able to take some adverse impact on margins.

Minimum Growth Rate in Revenue and Profits – The firm must be generating a minimum growth rate in revenue and operating profit over the last few years.

Market Cap commensurate with Cash Flow – The price to Cash flow ratio should be below a threshold level.

Outlook on Indian markets and economy

The Indian economy has continued to be one of the growth leaders globally over the past few years. Despite many speed bumps like demonetization, GST implementation, and the most recent impact of Covid-19, India has clocked a real GDP growth between 5% and 10% consistently, which very few countries have achieved. Moreover, this pace of growth of high single digits is likely to continue for at least another few years as many growth levers are in place such as policy reforms, favorable demographics, rising middle-class population, long road of infrastructure investments ahead etc.

Robust economic growth is likely to translate into earnings upcycle, and the portfolio’s returns are sustained in the equity markets. Sectors linked to domestic consumption and capital investments are likely to benefit as a higher income profile will lead to consumption growth while CAPEX recovery is around the corner. While volatility is an inherent part of the equity market, investors should stay invested for the long term to reap the benefit of a robust performance by equity markets in years to come.

Also, a few domestic structural factors are acting as tailwinds for Indian equity markets: 1) increasing focus by savers on financial assets like equity compared to physical assets like gold & real estate as indicated by nearly Rs 11,000 crore SIP inflow into equity mutual funds every month; 2) Government focus on digitalization of economy and transaction leading to more capital flowing into the formal economy; 3) Increasing participation by retail investors in the equity market as the number of Demat accounts has more than doubled to 7.7 crores in last 3 years.

How FinKasturi WealthBasket will help Indian investors get access to significant financial instruments

Indian economy is currently a multi-year growth story. We believe the equity market is best positioned to take advantage of this growth story. Equity is likely to be the best asset class in return generation over the next decade. Thus, FinKasturi WealthBasket, a portfolio of hand-picked 20 multi-cap stocks, is an endeavor towards generating top quartile risk-adjusted returns for clients and thus, making their wealth-building journey a memorable experience.

www.finkasturi.wealthdesk.in