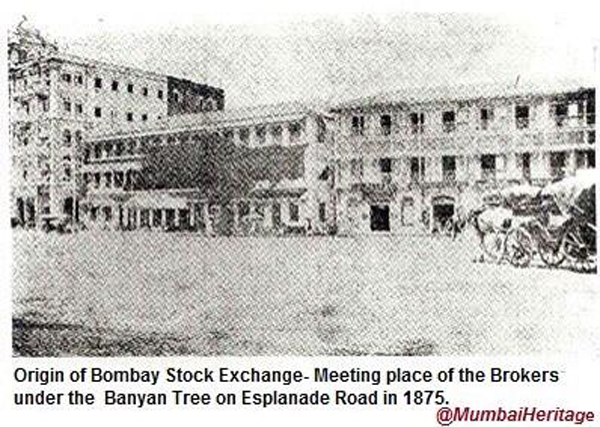

While independent India is 75 years young, our equity markets’ origin dates back to the second half of the 19th century which started with a bunch of stockbrokers trading securities under a banyan tree.

From the humble beginnings of trading under the

shade of a tree to being the fifth largest in terms of

market capitalisation across the world, the Indian

equity odyssey has been a delight to watch.

This

piece reveals the highlights of this journey that every

investor must know.

While loan securities trading began when East India Company entered India in the early 1800s, stock exchanges informally popped up much later. Until 1872, 22 stock brokers operated opposite the Town Hall of Bombay, which was later shifted to its current home in Dalal Street in 1874 as more brokers joined.

Finally, in 1875 the informal group of brokers called Native Share and Stockbrokers Association organized themselves as the Bombay Stock Exchange (BSE).

After BSE set shop, a huge range of regional exchanges flourished over the next couple of decades in Ahmedabad, Madras, Calcutta and Hyderabad.

| Year | Regional Stock Exchanges |

| 1894 | Ahmedabad Stock Exchange |

| 1908 | The Calcutta Stock Exchange |

| 1920 | The Madras Stock Exchange |

| 1944 | Hyderabad Stock Exchange |

Things sped up post our independence in 1947. The formalisation of the stock market embarked on its journey after the introduction of the Securities Contracts Act in 1956. This also became the year when BSE became the first exchange to be given permanent recognition under the act.

All the efforts to boost the equity markets were further complemented by the setting up of Unit Trust of India in 1963 which laid the foundation for the Mutual Fund industry in our country, currently accounting for ₹37.75 Lakh Crore of AUM.

A decade later, the cult of equity investors rose with Reliance’s IPO in 1977. Becoming the first Indian company to be listed on the stock exchange, its issue was oversubscribed by seven times and still remains a darling of investors in the markets being the largest company in terms of market capitalization. (₹17.5 Lakh Crore)

All this while the BSE finally shifted to its current home, the Phiroze Jeejeebhoy Tower in 1980, where the famous 1,000 kg bronze Big Bull would be installed 28 years hence.

In 1986 BSE launched India’s first benchmark index called SENSEX which has since returned 17.2% including dividends, showcasing the wealth generation that happened over one’s lifetime.

1992 was the year of many changes when the then Finance Minister, Manmohan Singh, opened the gate to foreign institutional investors and introduced the LPG policy. Piggybacking on the huge wave of new opportunities coming up, Harshad Mehta became a household name for the classic rags to riches story, only to find himself behind the bars for the biggest securities scam India had ever seen.

Owing to these developments, the Securities

Exchange Board of India was given statutory status in

1992, which had been operating as a non-statutory body

for 4 years before this.

In 1994, NSE set up shop to compete with the monopoly of BSE in trading volumes and breed healthy competition after which in 1995 BSE introduced an electronic trading system known as BSE On-line Trading (BOLT) replacing the open outcry floor system.

10 years after India’s first market-wide index, NSE came up with NIFTY 50 in 1996 and setting the stage for India’s first index derivative contract to be traded in 2000.

2008 was a bad year for global markets as major indices were cut in half after the Global Financial Crisis turmoil, including SENSEX.

In 2017 NSE IFSC started trading at GIFT City making it easier for Indian investors to diversify their portfolios across geographies with relative ease.

2022 will be remembered as the year Indian markets eventually start being recognized as mature markets, since this is when we finally entered the top 5 countries by market capitalization and witnessed India’s biggest IPO of 21,000 crores, listing LIC at 6 lac crore valuation.

150 years have been a wild ride with booms and busts. While a lot has changed over the years, one thing remains constant, Indian equities treading higher and higher making Indian investors wealthier as each decade passes!