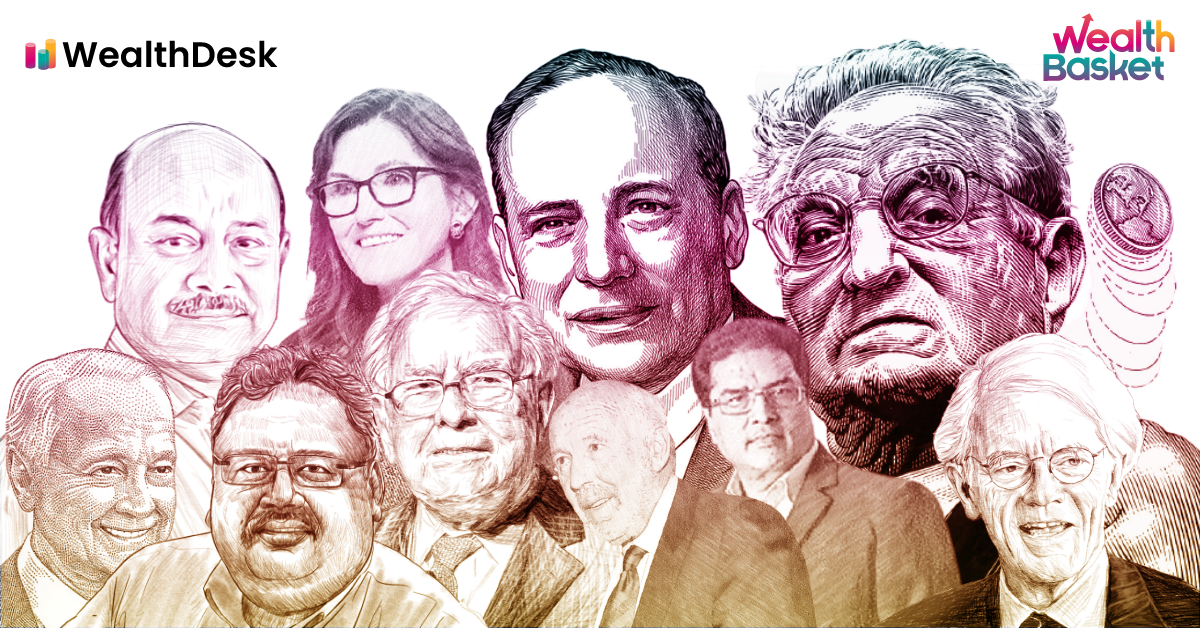

In the stock market, various routes to wealth creation exist. You can take the value investing route or the growth investing route. You may keep it simple or invest in emerging technologies that might change how the world works. For every investing style, there is a pioneer you can learn from. This article looks at some of the most influential investors of various investing styles and their teachings.

Warren Buffett

Warren Buffett, a.k.a. the Oracle of Omaha, is probably the most well-known investor. The 92-year-old first bought a stock at age 11 and is the owner and CEO of Berkshire Hathaway. This American multinational conglomerate owns shares of various companies, including Apple, Bank of America, Citigroup and HP.

One can describe Warren Buffett’s investing style as value investing. This investing strategy involves buying undervalued stocks to make profits when they are valued correctly later by the market.

Some of the lessons we can learn from Warren Buffet are:

- Invest in what you understand

- Read extensively for new investment ideas

- Diversification is protection against ignorance

- Don’t follow the herd

- Take a long-term approach to equity investments

Rakesh Jhunjhunwala

Rakesh Jhunjhunwala, a.k.a. the Big Bull of India, was a celebrated Indian investor, trader and chartered accountant. He began investing in college in 1985 with ₹5,000, which grew to ₹11,000 cr by September 2018. He ran a stock trading firm called RARE Enterprises. He invested in various companies, including Titan, Aurobindo Pharma, NCC and Fortis Healthcare.

Rakesh Jhunjhunwala believed in basing investment decisions on fundamentals rather than market noise or short-sightedness. His stock picking strategy can be called ‘buy right and sit tight.’

Some of the lessons we can learn from Rakesh Jhunjhunwala are:

- Market is above individuals

- Don’t flock to companies that are in the limelight

- A sure way to make a loss in stock markets is to mix emotions with investing

- Stock tips are hazardous to financial health

- Never invest at unreasonable valuations or bhav bhagwaan che!

George Soros

George Soros, a former hedge fund manager, is widely regarded as one of the most successful investors. Quantum Fund, a fund managed by Soros, achieved an average annual return of 30% from 1970 to 2000. George Soros famously shorted the British pound in 1992, making a profit of $1 billion, for which he became known as ‘the man who broke the Bank of England’.

George Soros’ understanding of economic trends on regional and global levels is considered unparalleled. When market inefficiencies like the Asian financial crisis or the UK crisis of 1992 occurred, Soros exploited them using huge, highly leveraged bets.

Some of the lessons we can learn from George Soros are:

- Look globally for unique opportunities

- Look for economic mistakes and exploit them

- Balance realism and hopefulness

- Use feedback loops to your advantage

Radhakishan Damani

Radhakishan Damani, a.k.a. India’s retail king, is the founder of DMart and the mentor of Rakesh Jhunjhunwala. Damani is known for keeping a low profile and simplicity, nicknamed ‘Mr White-And-White’. Despite being the largest individual shareholder in HDFC Bank in 1995, Damani exited the market in 2000 to set up his retail business.

One can describe Damani’s investing strategy as focusing on buying cheap stocks that have a high potential to generate profits in the long run.

Some of the lessons we can learn from Radhakishan Damani are:

- Keep an eye on the long term

- No frills, keep things basic

- Ignore the herd

- Take small steps to make it big

Peter Lynch

Peter Lynch is considered the most successful fund manager of all time. Between 1977 and 1990, he managed the Magellan Fund at Fidelity Investments, which averaged a 29.2% annual return, more than double the S&P 500 stock market index return.

Peter Lynch was a proponent of growth investing and believed in picking stocks after thorough research. He is famous for popularising GARP – growth at a reasonable price. This investment strategy combines the principles of growth and value investing.

Some of the lessons we can learn from Peter Lynch are:

- Know the business you are investing in and understand your motive for owning it

- Let your winners run

- Enter early – but not too early

- To win in the long run, you might need to accept periodic losses

- You can not kiss all the girls – Everyone misses their fair share of multibaggers

Also Read: Biggest Scams In The History Of The Indian Stock Market

Benjamin Graham

Benjamin Graham, the author of the bible of value investing, ‘Intelligent Investor’, was influential in paving the way for in-depth fundamental valuation. He taught Warren Buffet at Columbia University. In the 1920s and 1930s, when the stock market was considered to move widely on speculation, Graham was responsible for introducing the notions of intrinsic value and margin of safety.

The formula devised by Benjamin Graham for arriving at the intrinsic value of a stock originally was:

Intrinsic value = EPS × (8.5 + 2g)

Where:

V = intrinsic value

EPS = trailing 12-month earnings-per-share (EPS)

8.5 = P/E ratio of a zero-growth stock

g = long-term growth rate of the company

Some of the lessons we can learn from Benjamin Graham are:

- Concentrate on the actual performance of companies rather than paying attention to changing market sentiments

- Invest, don’t gamble

- Take a long-term approach

- Do your homework

Cathie Wood

Cathie Wood, a.k.a. the ‘Money Tree’, is the founder of ARK Invest, a company focusing on investing in emerging and disruptive technologies and thematic investing. Although Cathie Wood has more than 40 years of investing experience, she rose to fame only in 2020 when her ARK Innovation Fund returned almost 150%.

Cathie Wood follows thematic investing, meaning that she tries to identify technology that could change the world. Her stock picks are often companies involved in artificial intelligence, blockchain technology, genomics and 3D printing.

Some of the lessons we can learn from Cathie Wood are:

- Investing in innovative technologies

- Diversify into liquid stocks during a bull market

- Pursue electric vehicle investments

- Watch for opportunities in biotech

- Monitor disruption in artificial intelligence

Jim Simons

Jim Simons, a.k.a. the ‘Quant King’, is famous for incorporating quantitative analysis into investment strategies. Simons earned a PhD in mathematics from the University of California, Berkeley, in 1961 and is considered a very successful mathematician and professor. However, in 1978, he left it all behind to found a hedge fund named Monemetrics, a move he would not regret as his net worth now stands at $29 billion.

Jim Simons founded Renaissance Technologies, a renowned quantitative investment management company, and built a team of mathematicians, statisticians and physicists. Medallion Fund, the flagship fund of Renaissance Technologies, clocked annualised returns of 66% from 1988 to 2018.

Some lessons we can learn from Jim Simons are:

- Develop a system based on historical data

- Keep collecting data and gradually optimise your system

- Once you have a system or a model, stick to it

- You can’t simulate how gut feelings will play out, but models are different

John Templeton

John Templeton, the man that Money magazine recognised as arguably the greatest global stock picker of the century, introduced the idea of international investing in the US. He was among the first to invest in Japan when it was still an emerging market in the 1960s.

John Templeton invested globally and practised contrarian value investing. Contrarian investing involves going against the prevailing market trends on purpose and is based on the belief that herd mentality among investors can create exploitable opportunities.

Some lessons we can learn from John Templeton are:

- Invest to maximise returns after accounting for taxes and inflation

- Don’t trade or speculate

- Be flexible and open-minded about the types of investments

- Look for bargains among quality stocks

- Diversify – There’s safety in numbers

Raamdeo Agrawal

Raamdeo Agrawal co-founded Motilal Oswal Financial Services in 1987 with Motilal Oswal. He started his investing journey with ₹1 cr in 1990. He oversaw various crashes and corrections triggered by the 1992 Scam, the Dot Com bubble bursting, and the US housing crisis. Despite the setbacks, his capital grew close to ₹2,200 cr.

Raamdeo Agrawal believes in investing in quality businesses and puts a lot of emphasis on the quality of management of a company. He also believes investors should learn the art of valuing a business rather than just monitoring price movements.

Some lessons we can learn from Raamdeo Agrawal are:

- Focus on quality, growth and longevity at a reasonable price

- Only good businesses compound in the long term

- Quality of management can make or break the quality of a company

- Everybody looks at the price; the real advantage is in understanding the value of a business

Final Thoughts

Since the investing styles of the investors mentioned above are different, their teachings may sometimes contradict each other. Instead of trying to figure out which teachings are the absolute best, you might benefit by following the teachings of investors whose investing style makes intuitive sense to you.

More importantly, it is crucial for us to understand that even these investors have been students of the market and that market is the ultimate teacher. Respecting and learning from the market can take one places in the world of investing!

Want to invest with the help of experts? At WealthDesk, you can find WealthBaskets, collections of stocks and ETFs built by SEBI registered professionals. Each WealthBasket follows a certain investment strategy or a theme, ranging from thematic investments in electric vehicles to growth and value investing.