In Abrahamic religions, fallen angels are angels who were expelled from heaven. The term describes the angels cast out of heaven for they have sinned.

FAANG, as an acronym, became famous in 2017, and since then, the entire world has been following these tech giants’ incredible stock run. These stocks gained immensely post-Covid lockdown.

However, reality kicked in for most investors, and lately, the stocks have been on a significant downward trajectory.

These angels, which once resided in heaven, are now falling, but for what sins?

To better understand their sins, we must open our history books to the chapter on the 1960s and 1970s bull run in the US and the Nifty Fifty.

Well, this Nifty Fifty isn’t what you are thinking about. It was an informal designation for a group of roughly fifty large-cap stocks on the NYSE that were widely regarded as solid buy-and-hold growth stocks or “Blue-chip” stocks.

Because of their immense popularity and historical growth, they became stock market darlings, causing many innocent investors to flock in these names for perceived safety and high returns.

This resulted in a positive feedback loop for these stocks, causing prices to rise even further as more investors poured in, eventually causing the bull market of the early 1970s.

But sanity does prevail in the end. People started realising that “growth stocks” can only grow to a certain extent. This sudden but obvious realisation became a reason for the beginning of their fall.

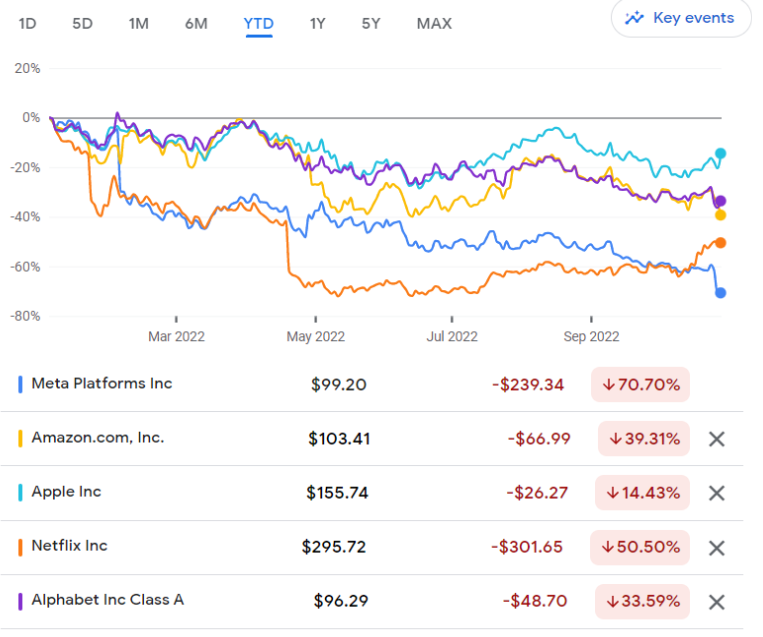

Something similar can be seen happening today. FAANG

stocks, which are closely tracked by the markets and

have high investor participation, are facing some

troubles.

Tech companies that had experienced

more than a decade of consistent growth are now

signalling cutbacks. With future growth outlook meagre,

valuation multiples for these companies have started

contracting.

This phenomenon, coupled with

hawkish commentary from Fed, is giving no breathing room

to investors, causing a further downward spiral.

Will

FAANG be the Nifty Fifty of the next generation? Or is

this just a temporary hiccup for truly exceptional

companies?

Only time will tell. But one thing that remains evident is the great fear in the mind of investors towards tech companies, both abroad and in India, which reminds an investor of Warren Buffett’s quote

“Be Fearful When Others Are Greedy and Greedy When Others Are Fearful”

Time to be greedy or fearful – decide for yourself!