Indian stock markets are at an all-time high, and economic reforms by the government are making way for ample opportunities for all. Add to this the power and drive of the youth – one of the highest in the world – and India is the fastest-growing emerging market. The July 2021 World Economic Outlook estimates India’s GDP to grow 9.5% in 2021 and 8.5% in 2022.

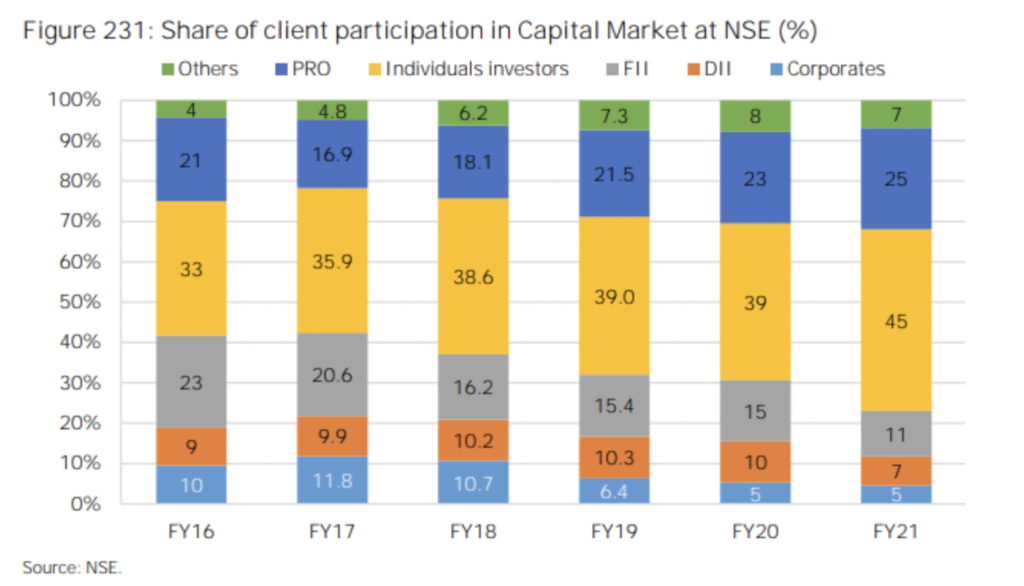

The last couple of years have seen a noticeable increase in the number of investors in the Indian market. With more and more youngsters joining the bandwagon, exchange-traded funds (ETFs) in India are emerging as a popular investment choice among retail investors. It is reflected in AMFI data that shows ETF assets under management surged by 73% year-over-year to INR 3.21 lakh crore in June 2021.

What Exactly Are ETFs?

Exchange-traded funds (ETFs) are mutual funds that are tradable on the stock exchange. An ETF invests in a basket of securities, such as stocks, bonds, and commodities, and gives the investor the benefit of price fluctuation of the underlying asset.

ETF investment makes for an interesting incentive. Think of them as a clever combo-pack of mutual funds and equity stocks, taking the merits of both (mutual funds: diversification; stocks: the ability to liquidate). ETFs offer unique attractive features to all kinds of investors, from beginners to experts.

8 Benefits of Investing in ETFs

- ETFs are passively managed

Investing in ETFs does not require an investor to be an expert in market movements. A little homework and research on what kind of ETF you would like to invest in are enough. Once bought, your investments will automatically follow the particular index your ETF replicates. The portfolio manager ensures the ETF resembles the benchmark index as closely as possible.

- ETFs are economical

Since these are passively managed funds, ETFs are cost-effective compared to actively managed funds. With no “hidden costs” involved, the expense ratio of ETFs is lower than even index funds. The money in ETFs largely goes towards investing rather than being paid to an active fund manager to monitor the market and adjust your investments accordingly.

- ETFs offer more for less

Perhaps the biggest attraction of ETFs is that you can buy a basket of equity stocks or bonds in a single transaction at affordable rates. Buying each of the underlying stocks would have cost considerably more. However, one ETF can give you exposure to several stocks for the cost of a single transaction.

- ETFs offer diversification

You may invest in ETFs for diversification needs. An ETF is a basket of varied bonds or stocks listed on a particular index. Therefore, investing in ETFs gives the investor the advantage of diversification in any segment of their choice. These can be asset or sector-specific, such as pharma ETFs, PSU Banks ETFs, or even gold, bond, and currency ETFs. Again, thanks to their easy liquidity, investors can explore several segments and further diversify their portfolios.

- ETFs are flexible

One of the most defining advantages of ETFs over mutual funds is they can be bought or sold on an exchange. You can buy or sell ETFs on any business day during market hours. The flexibility and freedom to trade can help investors reap profits and control their investments.

- ETFs offer ease of liquidity

Liquidating ETFs is easy by being tradeable on exchanges and with no specific lock-in period involved. Like equity stocks, the money from ETF withdrawals takes T + 2 days to process. The ease of liquidity especially helps investors who wish to enter the equity market but are still unsure how to go about it. For such people, investing or “parking” the money in ETFs offers a chance to learn the ropes of the market. They can sell their ETFs anytime during trading hours and use the money for other investments, sometimes making a profit on them in the bargain.

- ETFs are more tax-efficient

Compared to other mutual funds, ETFs are more tax-efficient due to their equity-like trading feature. High redemption in other mutual funds leads to capital gains, and, in turn, a capital gains tax is levied. However, ETFs can be bought and sold on the market like equity stocks. Therefore, equity-oriented taxation rules apply to them, optimizing the investor’s actual gains.

- ETFs help hedge risks

If you are into futures and options, you can short sell ETF derivative contracts. Further, you can use hedging and covered options strategies with an ETF as an underlying.

Summarising the above points, ETFs are cost-effective ways to invest in stocks, gold, and commodities.

Is ETF Investment Good for Beginners?

Whether ETF investment is suitable for beginners depends on how you invest in ETFs. They are a good investment if you adopt a passive investment strategy and stay invested long-term. Therefore, they are a good investment choice for beginners. They allow you to get exposure to a basket of top stocks for a minimal cost. In India, ETFs are particularly popular in alternate asset classes, such as gold ETFs, and complex investing strategies, including momentum investing ETFs.

Momentum investing ETFs also have a benchmark index. Still, portfolio managers have the bandwidth to deviate from the index to grab market-time trades or change sector allocations if needed. According to Hartford Funds, active management has outperformed passive management in 19 out of 27 corrections over the past 35 years.

How to Invest In ETF in India?

The process of investing in ETFs in India is the same as equity. You need to open a Demat account to buy an ETF on the exchange and get the delivery in T + 2 days. There are many investing strategies you can adopt.

You can invest a lump sum when the market is down or start an ETF SIP.

- A SIP in ETF will keep you disciplined and bring the rupee-cost averaging benefit to your diversified portfolio. SIPs work well for volatile gold prices. A gold ETF SIP can help reduce your overall cost.

- You can invest in a particular sector, index in India, or get exposure to international markets or alternate asset classes.

Just knowing how to invest in ETF stocks is not enough. ETF investing does have risks, So you need to allocate your assets per your risk profile. An 85% allocation in an equity ETF is considered aggressive. In comparison, a 30% allocation in a debt or gold ETF is considered moderate.

Should You Invest In ETFs?

If you’re wondering whether you should invest in ETFs, you can refer to the list of top ETFs in India and invest according to your risk profile. Nippon India ETF Nifty BeES, Motilal Oswal NASDAQ 100 ETF, and Nippon India ETF Gold BEES were some of the best ETFs to invest in India in 2021.

Discover stocks that suit certain filter criteria and dive into details to check their WealthBaskets.

Conclusion

As India emerges as a force to reckon with globally, ETFs are slowly gaining acceptance among investors. The rising popularity of ETF Investment might pave the way for more types of ETFs. However, before jumping into investing, have a proper financial plan and specific goals.

Check out the WealthDesk ETF portfolios called WealthBaskets curated by the top Indian financial institutions and progress in this journey toward financial independence and wealth creation.

FAQs

ETFs are a cost-effective way of investing in a portfolio of securities. You don’t need to be an expert in investing. The ETF takes care of rebalancing and reinvesting for you. Plus, you can trade the ETF on the stock exchange anytime during trading hours.

Exchange-traded funds (ETFs) are a good investment for both small and large investors if you are looking to invest for the long term and achieve market returns. However, if you are looking to beat the market, ETFs are not appropriate.

ETFs are a good option for beginners as they allow you to invest in some of the best stocks for a small amount. You don’t need expertise in stock investing because the ETF takes care of stock picking, rebalancing, and reinvesting. Moreover, it is a cost-efficient and flexible way to have a well-diversified portfolio.

• Open a share trading or Demat account with a

broker to trade and hold the ETFs

• Select the

ETFs you want to buy. You can also set an ETF SIP

for a disciplined investment

• Place your

trade, and let the ETF do the rest

While ETFs are good tools for diversifying your portfolio, you should also consider direct investments in equities or government securities. ETFs are funds and so your money will be spread across various assets. Diversification works to lower risks but it also lowers returns. So, if you want higher returns, you may need to look for investments that have a better return.